The Left Blogosphere is jumping all over a comment which Larry Summers made yesterday. Here’s the comment:

The example I always like to use is Kennedy Airport is going to be repaired. It is going to be repaired at some point. Potholes in roads are going to be filled. The question is whether we’re going to fill them now, when we can borrow to fill them at zero in real terms, and when construction unemployment is near double digits, or whether we’re going to do that years from now, when there will no longer be any multiplier benefits to those expenditures and when the deficit problem will be a more serious problem.

Now I’m certain that the good professor was speaking allegorically and realizes full well that Kennedy Airport and potholes in roads are problems for local authorities rather than the Federal government so let’s not belabor that point. Also let’s elide that cryptic reference to a deficit problem that “will be a more serious problem,” even though it suggests that he doesn’t seem particularly sanguine about turning around our deficit problem. So let’s focus in on the lengths to which some have taken his suggestion. Ezra Klein, for instance, suggests we’re missing the opportunity of a lifetime.

So the thing we’d typically worry about with high deficits? It’s not happening. It’s not close to happening. Interest rates aren’t high. They’re ridiculously, comically, insanely low. But in the coming years, they’ll rise again. So that’s one reason we should do infrastructure now rather than later: If we do it later, it will cost us more, as interest rates will have risen. We’ll have missed the big sale.

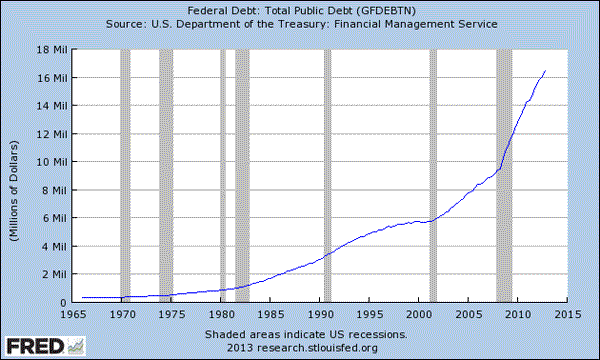

That thing he’s saying we don’t have to worry about is higher interest rates which usually accompany deficits and he’s right. They’re low now and will stay that way until the Fed decides to change the game. The problem is that our government doesn’t tend to borrow money when rates are low and pay off the loans when they go back up, it just keeps on paying interest and borrowing money. Here’s what our debt has done since 1965.

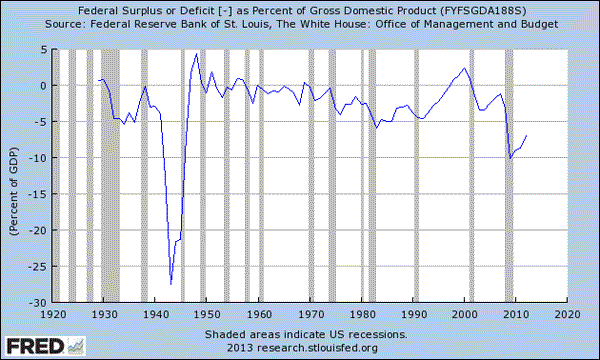

Here’s a different view. It’s a graph of surpluses and deficits as a percentage of GDP since 1930.

Notice how many times we’ve paid off those old loans? Yeah me neither. We kind of just keep on borrowing. Sure there were a few golden years in the 1990s but we put that bit of fiscal responsibility behind us very quickly.

The point is that absent some sort of mystical reversal of our propensity to run deficits to infinity we are going to be paying interest on any money we borrow at a cost substantially higher than current market rates forever. If I am not mistaken it is a matter of religion with the Left that deficits and the debt don’t matter so long as the growth of GDP plus inflation outpaces the growth of debt, is it not. Actual debt reduction is not on anyone’s radar.

Subscribing to the belief that we should borrow and spend now because money is so cheap is kind of like signing up for one of those Best Buy deals. You know, the ones where it’s interest free if you pay off your purchase in the first 9 months, but of course you don’t and it ends up costing you an arm and a leg.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply