If an embargo is successful in preventing Iran from selling a significant amount of oil on the world market, what would replace it?

On Friday the White House released the following statement:

there currently appears to be sufficient supply of non-Iranian oil to permit foreign countries to significantly reduce their import of Iranian oil, taking into account current estimates of demand, increased production by some countries, private inventories of crude oil and petroleum products, and available strategic petroleum reserves and in fact, many purchasers of Iranian crude oil have already reduced their purchases or announced they are in productive discussions with alternative suppliers.

That the President or anybody else is counting on the world demand for petroleum curve to shift left in 2012 seems doubtful. And which are the countries from which increased production is anticipated? Libyan production averaged only 500,000 barrels/day in 2011, and if things go well could soon be producing a million barrels more than that daily. In the mean time, disruptions in Sudan, Syria, and Yemen have taken out a separate 640,000 barrels/day. The best hope is perhaps Saudi Arabia, which presumably has been making private statements to U.S. officials similar to this public statement from Saudi Oil Minister Ali Naimi last Wednesday:

Saudi Arabia’s current capacity is 12.5m barrels per day, way beyond current levels demanded, and a reliable buffer against any temporary loss of production. Saudi Arabia has invested a great deal to sustain its capacity, and it will use spare production capacity to supply the oil market with any additional required volumes.

Where have we heard something like that before? Maybe this statement from June 2004 rings some bells:

Oil Minister Ali al-Naimi, in Beirut ahead of the OPEC meeting, said Riyadh was “fully ready” to increase its oil production in an effort to trim soaring prices to the cartel’s target range of $22-28 a barrel.

Or perhaps this one from August 2004:

Making good on a pledge made in May, Saudi Arabia announced Wednesday it is prepared to increase oil output by up to 1.3 million barrels per day — 14 percent — to cope with world demand. ….[Adel al-Jubair, foreign affairs advisor to Saudi Crown Prince Abdullah] said the Saudis had informed all of their customers within the last week of the kingdom’s intention to make additional crude oil available to the international market.

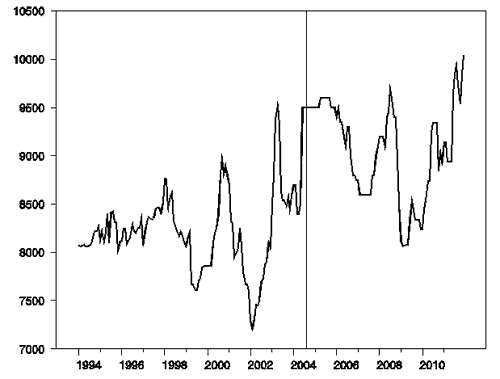

Just for fun, here’s a graph of actual Saudi production in the years following those statements, with the date of the second quote above noted by a vertical line.

Saudi Arabian crude oil production, monthly, in thousands of barrels per day, Jan 1994 to Dec 2011. Includes lease condensates but excludes natural gas plant liquids and refinery processing gain. Vertical line at August 2004. Data source: EIA.

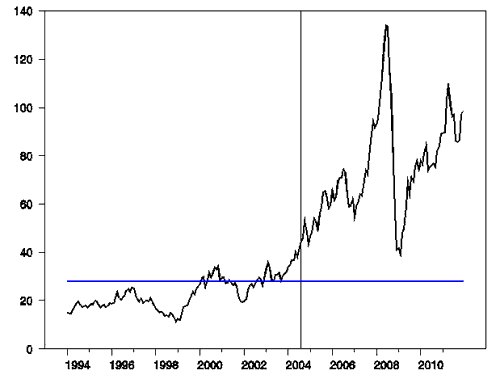

And in case you’ve been hiding in a hole for the last few years, here is what actually happened to the price of oil after those words. To help your imagination, I’ve also drawn a horizontal line at $28, the upper end of the price range referred to.

Price of West Texas Intermediate, dollars per barrel, monthly, Jan 1994 to Dec 2011. Vertical line at August 2004 and horizontal line at $28/barrel. Data source: FRED.

Moving along through the President’s list of alternatives in the first quote above, what about a release from strategic stockpiles? This may well happen, but it’s obviously only a temporary stopgap. I’m therefore inferring that Plan A is the embargo successfully shuts down Iranian exports, the world gets by for a short while on releases of strategic reserves, the Iranians cry “uncle” within a few months, and President Obama enjoys a great diplomatic success.

I guess my only question is, what does Plan B look like?

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply