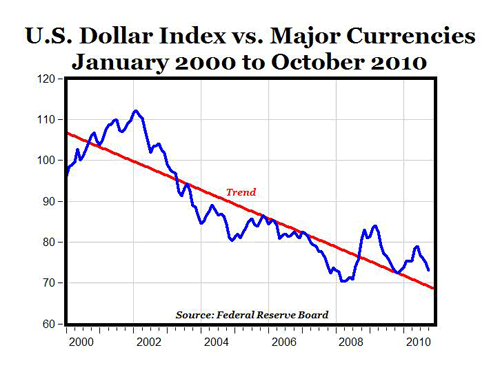

The trade-weighted U.S. dollar index has depreciated by almost 40% over the last ten years vs. the world’s major currencies (see chart above). Does that make the U.S. a currency manipulator? Here’s a little editing fun of this article:

“China The United States flatly denies that its currency manipulation undervalues the renminbi (yuan) dollar by 40 percent and has become one of the foremost impediments to fair and equitable global trade, experts say.

“That undervaluation of the renminbi dollar acts as a subsidy for Chinese American exports, artificially making them as much as 40 percent cheaper when sold in outside the U.S. Conversely, it acts as a tax of as much as 40 percent on Americanforeign-made goods sold in China the United States,” according to a recent article on The Hill’s Congress Blog.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

One way to look at the fed’s policy is simply that after years of asking China to allow the RMB to seek its natural valuation through market mechanisms (which prodding the Chinese openly detested), the US decided that instead of chiding to no effect it would take unilateral action to get the desired effect. This might not be true — it might be that the U.S. would have had the same monetary policy regardless of the RMB peg — but I doubt it.