Banks, given trillions stolen from the taxpayer, are using their ill-gotten fiat to speculate in markets using quant computers and insider information, neither of which the taxpayer has access. Nor do they have access to national level politicians, their contributions simply are not as large. Thus, the banks hoard their trillions while cutting off lines of credit to the very taxpayers who bailed them out. What lines are not cut are charged 30% or more, rates that the Godfather could only dream of.

The consumer knows that credit is tighter than it was before. I’ve been saying all along that total money and credit are contracting, that the world of derivatives and leverage is contracting despite our government’s best efforts to flood the system with money. While it’s difficult to see the overall shape of the shadow banking world, clues can be found when digging. Again, I point to the OCC reports showing that JPM notional derivatives have shrunk by some $10 TRILLION in the past two years despite acquisitions. The OCC reports overall growth in derivatives, but that is only because investment banks, speculators like Goldman Sachs, applied for and were granted status as a commercial bank (to gain access to taxpayer money).

So, we have the money supply increasing, government debt skyrocketing, but that is more than offset by the shadow banking system and falling overall private credit. Today I’m going to show you the real dollars behind the collapse in consumer credit along with how that is affecting the securitization of that credit, this being but one small piece of the derivatives and credit (debt) world.

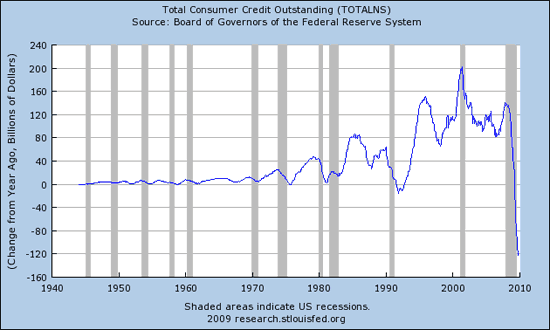

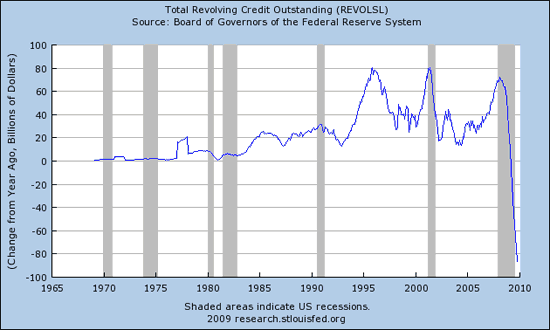

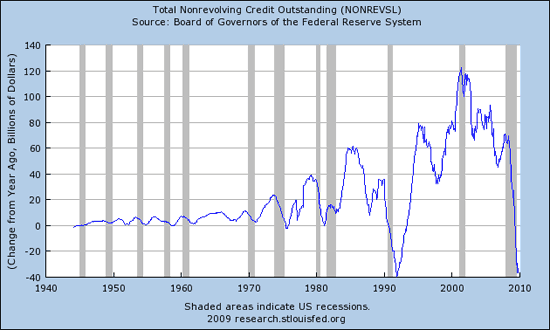

Yesterday, a $14.8 billion contraction in consumer credit was reported for the month of September. That translates into a contraction at an annual rate of 7.3% for the month, 6.1% in the third quarter, which follows a 6.6% contraction in the second quarter. Revolving credit decreased at an annual rate of 10 percent, and nonrevolving credit decreased at an annual rate of 3.8 percent.

It would seem that never ending growth has ended. Keep in mind that the consumer and their spending represents 70% or more of this nation’s economy.

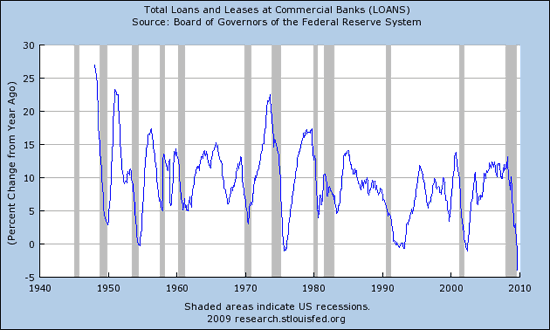

Let’s start our tour of the charts by showing that the contraction is not just in consumer credit. Below is the latest chart from the St. Louis Fed showing Total Loans and Leases at Commercial Banks percent change from a year ago:

Now, let’s look at consumer credit and its components. Below is a chart showing Total Consumer credit expressed in billions of dollars change from one year ago:

There are two types of consumer credit, revolving (credit cards, lines of credit, etc.), and nonrevolving. Below is the chart of Total Revolving Credit Outstanding, again expressed in billions of dollars change from last year:

Next is the Total Nonrevolving Credit Outstanding expressed in billions change from a year ago:

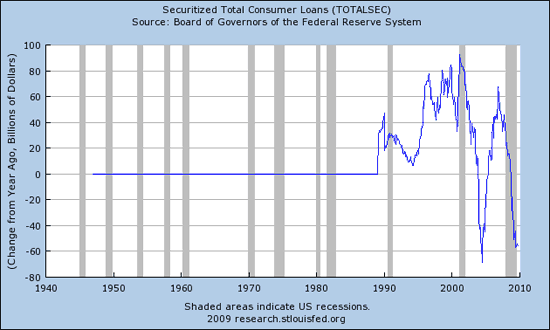

The Fed actually reports Securitized Total Consumer Loans, but I would contend that their data does NOT capture nearly all of it, nor does it capture all the derivatives based around it, credit default swaps and the like. Still, you can see that the securitization process is no longer creating never ending growth in this category. Of course the “securitization” of debt process did not exist prior to about 1990:

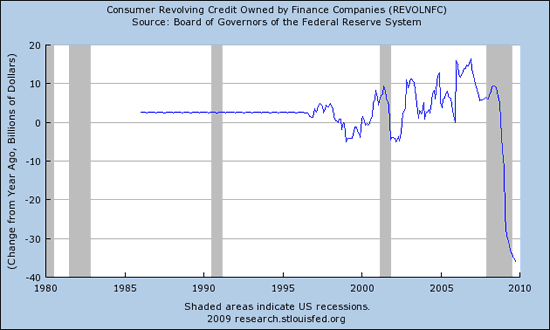

The Fed further breaks down who holds consumer debt. Below is a chart of Consumer Revolving Credit Owned by Finance Companies:

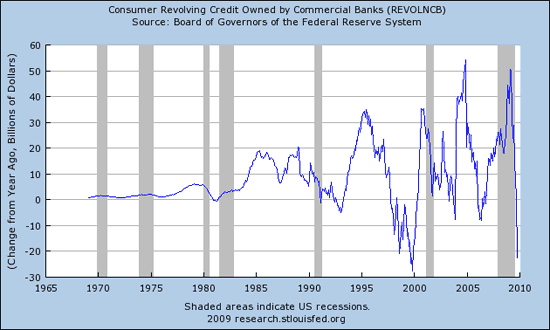

Consumer Revolving Credit Owned by Commercial Banks:

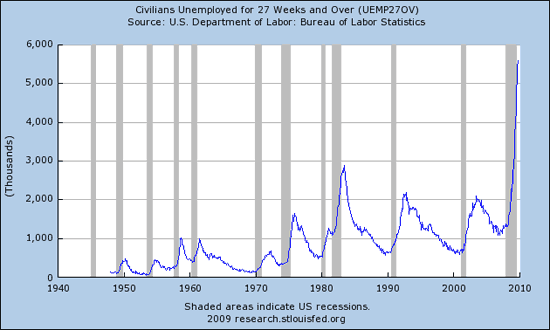

Of course, as credit contracts, businesses do poorly, and they lay people off. Below is the updated chart of those who have been unemployed for 27 weeks or longer:

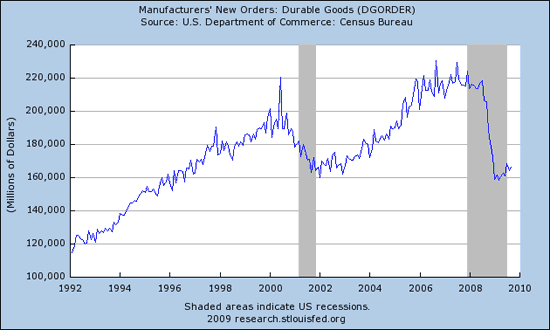

Unemployed people and people without credit do not order things, as this chart showing Durable goods orders attests:

Good luck with the “recession is over” call, welcome to the second Great Depression, what I now label the Great Deception. Keep in mind when you see trumped up GDP growth figures that even during the Great Depression of the ‘30s that GDP was positive off and on for years while the people suffered. Today we may not have soup lines extending for blocks, instead they collect unemployment, food stamps, buy their cars with the help of government money, and buy their houses on the backs of taxpayers too. The person next to you in the checkout line may look solvent, but they may be shopping with your money.

Those thinking that real recovery is here or is imminent had best keep their eye on consumer credit. They are confusing speculation and false accounting with growth. That will become more and more evident given time. The myth that more debt can cure a debt problem, that incomes can support never ending credit growth is simply a dream true only in the minds of central bankers and their minions…

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

“because investment banks, speculators like Goldman Sachs, applied for and were granted status as a commercial bank (to gain access to taxpayer money).”

Correction; should be “bank holding companies”

My feeling is that the banks have orders not to loan money until February or March as the election cycle heats up. By the time November 2010 comes, credit will be more available and the impression that economy is healed will be in effect. ~And more democrats will be re-elected.

Or that the banking system knows that credit default swaps were the first shoe to fall and interest rate swaps are next.

“If you want an Armageddon scenario, look no further than this. The cataclysm scenario that nobody is contemplated, simply because it is simply so improbable (where have we seen this before?), is what would happen when there is a black swan event at the core of the fiat monetary system: be it a failed US auction, or a parabolic move in the price of gold. At that point, watch for $1.2 quadrillion in interest rate bets to politely (or not) line up in front of the single file exit door of the burning theater. This begs the question: who has “sold” this incomprehensible amount of IR protection, and has bet the ranch, city, country, and basically all of capitalism, that a black swan in the IR arena will never happen? If you want to find your next AIG, find the answer to this question. Which is why, if one is dead set on banning CDS, one should also ban IR swaps, and virtually all derivative products, as all these asset classes reinforce one another. But the problem is that all derivatives do, when one gets down to it, is provide a monetary equivalent for the global lack of assets, as the globalized economy has gotten far too big for its own good. Fiat banking hard at work.”

http://www.zerohedge.com/article/reading-between-lines-david-einhorns-attack-cds

“There will be a reckoning”

I wrote a blog just a few days ago suggesting we refer to this economic crisis not as another Great Depression, or recession but “The Great Collapse”

http://www.u4prez.com//Blogs/ericgurr/The-Great-Collapse.html

I’m no supporter of big Keynesian interventions, but it has occured to me that one aspect of credit contraction involves clearing private consumer balance sheets. Leaving out the matter of deadbeat banks, as the government spends for the consumer, the economy can hover for a while as consumers repair their debt positions.

Interested in hearing from someone with hard data and analysis of this facet of our current credit environment. Is the magnitude of consumer debt clearing material or sustainable? On balance, is the economy better off bottoming with shredded banks and healthy consumer debt levels or the other way around?

Facts;

65% of all American jobs are the results of small buisness and entrepreneurs.

Small buisness access to credit has beeb completly choked of as Banksters are encouraged by the Fed to play the stockmarket instead with the TARP & “stimulus” money extorted from congresss.

No one without “proof of income” can get mortgage credit thus precluding all small buisness owners from ever getting a home thus creating a massive disincentive to take entrepreneurial risk.

Opinion;

The Bankster Oligarchy and the government that they have captured have declared a Jihad on small buisness, capital formation and 65% of Americas workers.