Oh boy, amidst the good earnings of Intel (NASDAQ:INTC) and Google (NASDAQ:GOOG) we have a downer of a story on real estate. Foreclosures have hit an all-time high in Q3 of almost 1M homes. In Nevada, 1 out of 23 homes was in foreclosure last quarter. Mish reports that foreclosures could top 3.5M homes this year, 50% higher than last year. Mish was a bundle of joy today, also reporting that rents have fallen for the first time in 17 years, and that new FHA rules make condos utterly worthless.

Oh boy, amidst the good earnings of Intel (NASDAQ:INTC) and Google (NASDAQ:GOOG) we have a downer of a story on real estate. Foreclosures have hit an all-time high in Q3 of almost 1M homes. In Nevada, 1 out of 23 homes was in foreclosure last quarter. Mish reports that foreclosures could top 3.5M homes this year, 50% higher than last year. Mish was a bundle of joy today, also reporting that rents have fallen for the first time in 17 years, and that new FHA rules make condos utterly worthless.

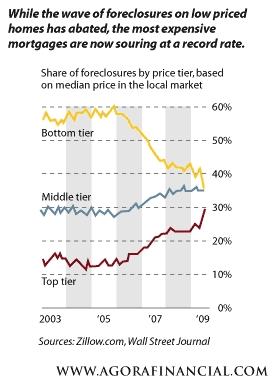

Worse, real estate woes have run through subprime and are now increasing in prime housing. Prime loans are now 58% of foreclosures, and the chart shows that 65% of foreclosures are in the mid and upper tiers of prices. Video commentary here.

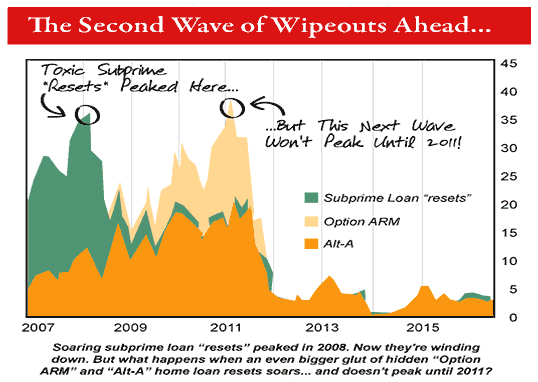

OptionARMs are starting to bite. The 5 Min. Forecast reports that 46% of optionARMs are past due, even though only 12% have reset rates.

What to make of this? I have commented on this previously, including here and in a much more in depth post here. The next wave down is coming – see second chart. OptionARMs, HELOCs (home equity lines of credit) and commercial REITS are about to go through the same wringer that subprime did last year.

That doesn’t mean real estate couldn’t be played. My comments from the in depth post still stand:

Seems like the only two sensible options (besides staying out) are: buy in places which avoided the egregious loans, like Palo Alto; or buy apartment buildings near distressed areas to pick up all those folks who are about to be kicked out of their homes.

Also, one bright spot globally is the land of Oz. Sydney real estate is still bouyant, pulled up by Chinese stockpiling. Of course, that could change if (when?) the China Bubble bursts.

I would avoid China however – check out this Special Project: The China Files analysis of a growing bubble in Chinese real estate, sent around by John Mauldin today. Bottom line: China 2010 = Japan 1989.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply