Gold (NYSE:GLD) is getting absolutely taken to the woodshed this morning, down more than 4% after breaking macro support. Silver (NYSE:SLV) is down even bigger, so far more than 5% lower. While the magnitude of today’s sell-off is taking some people by surprise, there were clues that GLD was weakening and levels to exit the trade if you were long or potentially enter short of that is part of your arsenal.

This morning as we came in and GLD looked set for a sharply lower open, I sent out a note to my list and posted a chart on Stocktwits outlining the scenario in GLD. Over the last few months, there have ostensibly been many reasons for the precious metal to rally off macro support, but the demand simply hasn’t been there.

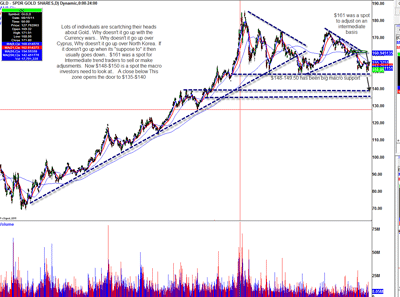

Before:

(click to enlarge)

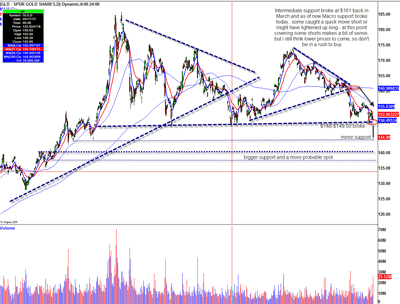

After:

(click to enlarge)

Here is what I wrote this morning:

A close here or lower than that $135-$140 happens a lot sooner than anyone would have thought

Lots of people have been scratching their heads about the action in Gold (GLD).

Some thought it would go up based on currency wars.

Some thought it would go up based on events in Europe and Cyprus.

Some thought it would go up based on the potential events in North Korea.

Some thought it would go up since our printing presses are working here and we could have inflation down the road.

When something doesn’t act well when it’s “supposed to,” that means it could probably go lower. Back in March, GLD broke below its symmetrical triangle around $161. That was an area to make adjustments.

Today if you are a “macro participant” in GLD, you need to watch $148-149.50 a close below this area opens the door for a move down to the $135-140 area.

Now, with today’s waterfall down in GLD, it looks like that $135-140 area could be hit sooner rather than later. You could have some Gold funds start to come under intense pressure with today’s sharp sell-off, which could cause even more panic selling.

Disclosure: No position in GLD

Leave a Reply