Many economists think that the US Federal Reserve’s loose monetary stance in the 2000s fuelled the US housing bubble. Is the Fed thus responsible for the Global Crisis? This column discusses evidence suggesting that monetary policy was, in fact, not to blame. Rather, it was the absence of an effective regulatory function that created the mess we’re in now. It is not fair to blame the Great Recession only on the Fed’s monetary-policy stance nor is the Fed now breeding the next US financial crisis.

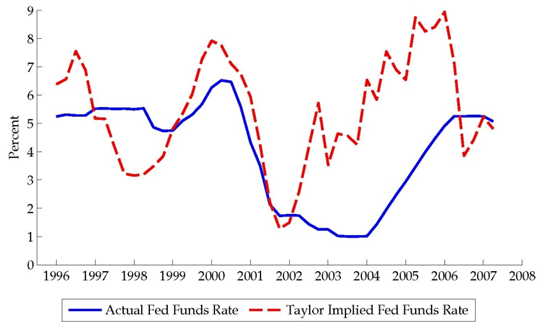

According to many economists, monetary policy played a central role in exacerbating the severity of the global financial crisis of 2007-09. For example, Taylor (2007) pointed out that, during the 2002-06 period, the US federal funds rate was well below what a standard ‘Taylor rule’ (a tool routinely used by economists to summarise past central bank behaviour) would have predicted (Figure 1). Indeed, the interest rate implied by the Taylor rule (dashed line) was well above the actual federal funds rate (solid line) as of the second quarter of 2002. Taylor also showed that such a counterfactually higher policy rate could have reduced the rapid growth of the housing-market bubble, further arguing that this deviation from typical Federal Reserve (Fed) behaviour of the past had been a major determinant of the likelihood and severity of the 2007-09 crisis.

Figure 1. A counterfactual path for the US policy rate

A theoretical model of the interaction between monetary and regulatory policies

In a recent paper (Cesa-Bianchi and Rebucci 2013), we develop a simple model of consumption-based asset pricing and collateralised borrowing with monopolistic banking and real-interest-rate rigidities that speaks to the interaction between macroeconomic and financial stability. In this model, the presence of both a real and a financial friction give rise to a traditional macroeconomic stabilisation role for policy as well as a more novel financial-stability objective.

The macroeconomic-stabilisation objective arises from the presence of monopolistic competition in the banking sector and real-interest-rate rigidities in a New-Keynesian fashion. Due to monopolistic power, banks apply a markup on lending rates; moreover, when banks cannot fully adjust their lending rates in response to macroeconomic shocks, the economy displays distortions typical of models with staggered price setting, generating equilibrium allocations that are not Pareto efficient (Hannan and Berger 1991, Kwapil and Scharler 2010, Gerali et al. 2010).

The financial-stability objective stems from the fact that the model endogenously generates financial crisis and embeds systemic risk. When access to credit is subject to an occasionally binding collateral constraint, a pecuniary externality arises (see Benigno et al. 2012, 2013; Bianchi 2011; Bianchi and Mendoza 2011; Jeanne and Korinek 2010). Atomistic agents do not internalise the effect of their individual consumption decisions on the relative price that enters the collateral constraint, thus consuming and borrowing more or less than what is desirable from the point of the economy as a whole.

Our model shows that a policy authority that obeys the same financial constraints faced by private economic agents may not be able to achieve an efficient allocation when hit by negative shocks if it has only one instrument (in the case of our simple model, the policy interest rate). In our model, in response to negative shocks, the authority faces a trade-off between macroeconomic and financial stability because the two objectives require interventions in opposite directions on the policy rate. On the one hand, the policymaker would like to lower interest rates to accommodate the negative shock. On the other hand, she would like to raise them so as to contain the excessive borrowing generated by the externality associated with the collateral constraint. In this case, it may not be optimal for the central bank to lower interest rates as much as needed to restore equilibrium following a negative shock. This means that, as Taylor (2007) noted, the Fed might have fuelled excessive borrowing during the 2002-06 period while trying to fight the deflation scare after the bursting of the dot-com bubble.

The results of our analysis are completely different if we assume that the policymaker has two separate policy instruments (for example, a tax on debt and the policy interest rate).1 In this case, the policymaker can achieve an efficient allocation with two independent policy actions, regardless of whether the shock is positive or negative. In this case, once the excessive borrowing generated by the externality is addressed with a tax on debt or other regulatory instruments, it is optimal for the central bank to lower interest rates as much as needed to restore equilibrium following a negative shock.2

This has important implications regarding the role played by US monetary policy for the stability of the financial system in the run-up to the global financial crisis. In particular, our analysis shows that Taylor’s argument – i.e., that higher interest rates would have reduced both the probability and the severity of the crisis — is valid only with the auxiliary assumption that the policy authority had just one instrument at its disposal, namely the policy rate, to address both macroeconomic and financial distortions in the economy. In the US, institutional responsibility for financial stability is shared among a multiplicity of agencies (i.e. Office of the Comptroller of the Currency, Federal Reserve, Office of Thrift Supervision, Federal Deposit Insurance Corporation). According to our analysis, therefore, it was fully appropriate for the Fed to focus squarely on the macroeconomic stability objective of fighting the risk of deflation during the period 2002-06.

Did loose monetary policy or lax regulation contribute to the financial crisis?

Although monetary policy was unusually loose in the run-up to the crisis, according to our model this was appropriate given the shared institutional responsibilities for financial stability. But what did other regulators of the US financial system do to contain the housing boom and mortgage lending excesses between 2002 and 2007?

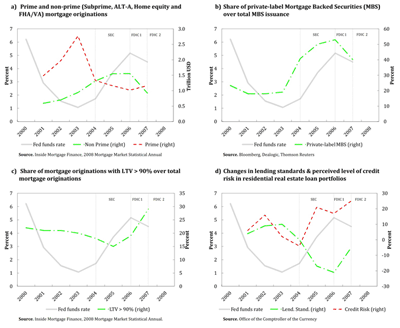

Figure 2 provides a picture of the evolution of the policy rate, the US mortgage market, and regulatory policies on the mortgage market from 2000 to 2007. Broadly speaking, this evidence shows that, after the Fed started to tighten its monetary-policy stance and the prime segment of the mortgage market promptly turned around, the subprime segment of the mortgage market continued to boom, with increased perceived risk of loans portfolios and declining lending standards. Despite this evidence, the first regulatory action to rein in those financial excesses was undertaken only in late 2006, after almost two years of steady increases in the federal funds rate.

Figure 2. Monetary policy, regulatory policy, and the mortgage market before the financial crisis

(click to enlarge)

As a matter of fact, the share of non-prime mortgage over total mortgage originations went from about 20% in 2001 to more than 50% in 2006 (Panel a), experiencing the largest increase in 2004, while the Fed was already tightening its monetary policy stance. A similar pattern emerges in issuance of mortgage-backed securities (MBS), whose share sharply increased in the 2003-06 period (Panel b). Moreover, the share of high-LTV ratio mortgages in the US spiked in 2005 (Panel c), two years after the beginning of monetary-policy tightening. Finally, while the level of perceived risk increased sharply starting in 2004, banks began to ease their lending standards in 2003 and did so even more in the 2004-05 period (Panel d).3

Despite this evidence, US regulators did not take action until late 2006, almost two years after the Fed had started to tighten. On the contrary, for instance, the SEC proposed in 2004 a system of voluntary regulation under the Consolidated Supervised Entities program, allowing investment banks to hold less capital in reserve and increase leverage that might have contributed to fuelling the demand for mortgage-backed securities (the vertical line in our charts labelled SEC). When regulators finally decided to act, it was too late: in fact, it was not until September 2006 that regulators agreed on new guidelines (the vertical line labelled FDIC 1) aimed at tightening ‘non-traditional’ mortgage-lending practices. Even if it this measure may have served as a signal that regulatory policy was changing direction, it should be noted the new underwriting criteria did not apply to subprime loans, whose standards were discussed in a subsequent regulatory measure introduced in June 2007 (the vertical line labeled FDIC 2). By that time, more than 30 subprime lenders had already gone bankrupt and many more followed suit.

In the context of our model and according to this evidence, regulatory rather than monetary-policy failures are largely to blame for the occurrence and the severity of the Great Recession. Only by assuming that the Fed was the sole institutional guardian of financial stability, or at least the main one, is it possible to contend that monetary policy is to blame for the 2007-09 financial crisis and the ensuing Great Recession.

Are we heading for another financial crisis?

The Fed is currently fighting an unemployment scare with extraordinary quantitative measures and a commitment to keep interest rates low for an extended period of time. It is therefore natural to ask whether the same mix of loose monetary and regulatory policies is fuelling the next financial crisis. Indeed, the current situation displays many similarities with the aftermath of the bursting of the dot-com bubble. As in 2001, in 2008 the US economy experienced a large negative shock, and the Fed reacted by easing monetary policy very aggressively. Interest rates today are even lower than in the 2002-2004 period and have been low for a much longer period of time. So is monetary policy fuelling the next financial crisis, as some fear? In an institutional context like that of the US, in which the regulatory and monetary-policy functions are assigned to different agencies that rely on different instruments, our model suggests that monetary policy is appropriately targeting macroeconomic stability.

But is regulatory policy asleep at the wheel? The Housing and Economic Recovery Act of 2008, primarily designed to address the subprime mortgage crisis, includes a variety of initiatives such as the reform of government-sponsored enterprises, the regulation and modernisation of the Federal Housing Administration, the enhancement of consumer protection, and the reduction of fraud through the imposition of minimum standards for mortgage-loan originators.4

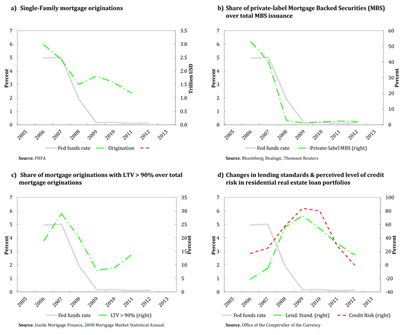

Figure 3 provides a picture of the behaviour of monetary policy and the mortgage market as in Figure 2, but for the period after the financial crisis, from 2006 to 2012. Mortgage originations have steadily decreased since 2006 (Panel a). Moreover, and differently from the 2003-06 period, the share of private-label Mortgage Backed Securities (MBS) over total MBS issuance has decreased to almost zero (Panel b). This is important because it implies that virtually all MBS are issued by well-regulated institutions as opposed to largely unregulated non-depository institutions. The share of high-LTV ratio mortgages is slowly picking up from the very low levels achieved in 2009 (Panel c), but it is still well below the levels of 2007. Finally, the risk perceived by banks involved in residential lending is decreasing, while lending standards are easing from overly tight levels to more normal levels (Panel d). This evidence therefore shows that, despite historically low interest rates, current data are not sending alarming red signals regarding these markets.

Figure 3. Monetary policy, regulatory policy, and the mortgage market after the global financial crisis

(click to enlarge)

References

•Benigno, G, H Chen, C Otrok, A Rebucci, and E R Young (2012), “Optimal Policy for Macro-Financial Stability,” CEPR Discussion Papers, 9223, CEPR Discussion Papers.

•Benigno, G, H Chen, C Otrok, A Rebucci, and E R Young (2013), “Financial crisis and macro-prudential policies“, Journal of International Economics, 89(2), 453-470.

•Bianchi, J (2011), “Overborrowing and systemic externalities in the business cycle”, The American Economic Review, 101(7), 3400–3426.

•Bianchi, J and EG Mendoza (2011), “Overborrowing, financial crises and macro-prudential policy?”, IMF Working Papers, 11/24, International Monetary Fund.

•Cesa-Bianchi and Rebucci (2013). “Does Easing Monetary Policy Increase Financial Instability?“, IDB Working Paper Series, No. IDB-WP-387, Inter-American Development Bank.

•Claessens and Valencia (2013), “The interaction between monetary and macroprudential policies“, VoxEU.org, 14 March 2013.

•Gerali, A, S Neri, L Sessa, and F M Signoretti (2010), “Credit and banking in a DSGE model of the Eurozone”, Journal of Money, Credit and Banking, 42(1), 107–141.

•Hannan, T H and A N Berger (1991), “The rigidity of prices: Evidence from the banking industry”, The American Economic Review, 81(4), 938–45.

•Jeanne, O and A Korinek (2010), “Managing credit booms and busts: A pigouvian taxation approach”, NBER Working Papers, No. 16377, National Bureau of Economic Research, Inc.

•Kwapil, C and J Scharler (2010), “Interest rate pass-through, monetary policy rules and macroeconomic stability”, Journal of International Money and Finance, 29, 236-251.

•Taylor, J B (2007), “Housing and monetary policy”, Proceedings Fed Bank of Kansas City, 463–476.

__________

1 Note that this is equivalent to the case in which there are two separate and independent policy authorities, such as a central bank with the objective of price stability and a financial regulator with the objective of financial stability (see also Claessens and Valencia, 2013).

2 Note that, while in this simple three-period model the tax on debt is prudential in the sense that it is applied before knowing whether a financial crisis has materialised or not, Benigno et al. (2013) show that the optimal policy intervention need not be prudential when there is a sufficient number of instruments (such as a tax on debt and a tax on consumption in their model).

3 Net percentage calculated by subtracting the percent of banks tightening from the percent of banks easing. Negative values, therefore, indicate easing.

4 The Act also established a new independent federal agency, the Federal Housing Finance Agency (FHFA), by merging the Federal Housing Finance Board (FHFB) and Office of Federal Housing Enterprise Oversight (OFHEO).

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply