A lot of ink has been spilled over the past three years fretting about the fragility of the economy. But the reality is largely the opposite. The economy has proved to be very resilient. We have weathered external demand shocks, external financial crises, and even fiscal contraction, and all the while economic activity continued to grind higher. Looking back, it seems that the biggest risk the economy faced was the Fed’s start/stop approach to quantitative easing. That problem appears solved with open-ended QE linked to economic guideposts.

At the risk of sounding overly optimistic, I am going to go out on a limb: The recovery is here to stay. Not “stay” as in “permanent.” I am not predicting the end of the business cycle. But “stay” until some point after the Federal Reserve begins to raise interest rates, which I don’t expect until 2015. This doesn’t mean you need to be happy about the pace of growth. But it does mean that a US recession in the next three years should be pretty far down on your list of concerns.

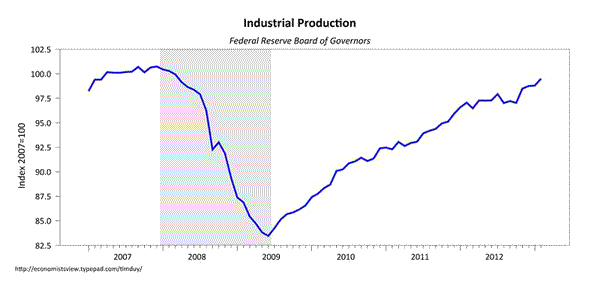

Consider a handful of recent data. Last year’s slowdown in manufacturing activity has proved temporary:

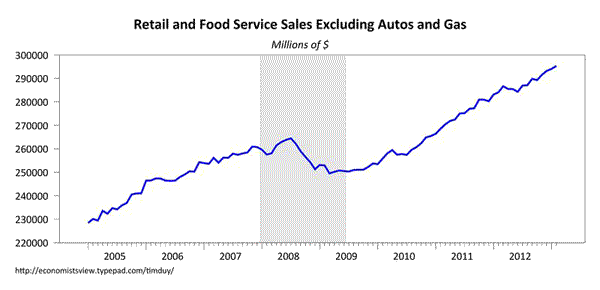

Remember, this was the data that ECRI claimed was a smoking gun in their hypothesis that the US economy slipped into recession in the middle of last year. Retail sales continued to gain in February despite the end of the payroll tax break:

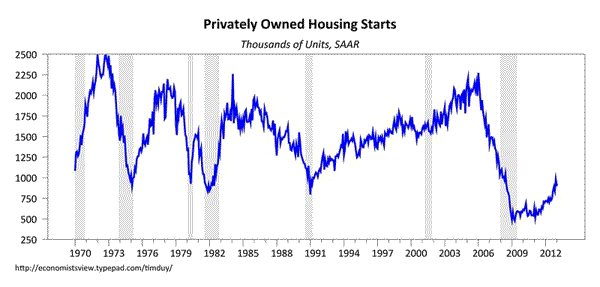

Sure, you might complain about weak consumer confidence, but I think it best to pay more attention to what household do. The housing market is unambiguously improving, which by itself should ease any recession concerns:

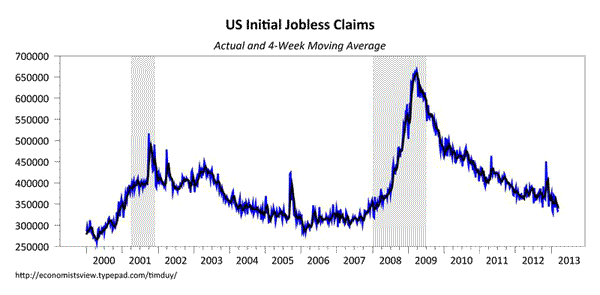

Note recent reports that the housing market is catching even producers off-guard, constraining supply. Expect them to gear up over the year, setting the stage for a stronger activity in 2014. With the issues of jobs in mind, note that jobless claims continue to grind lower:

Still too high, but moving in the right direction; I expect claims will fall to 300k by then end of this year or early next year.

I anticipate monetary policy will remain on hold for much of this year before the Federal Reserve turns to the issue of tapering off the pace of asset purchases. Even then, rates will not increase until 2015; inflation is simply too low and unemployment too high to justify a policy shift before that time. Interestingly, I am believe the biggest risk to my expectations is that the economy accelerates faster than expected, prompting the Federal Reserve to raise rates in late 2014.

To be sure, I think that fiscal policy will weigh on growth in the first part of 2013. And I think that the European crisis is far from solved (note today’s PMI release, not to mention Cyprus). And maybe China will slow further, undermining exports. But as far as the implications for the US economy, I tend to see these events as bumps in the road. They might cause air pockets for equity markets, but are of second or third order importance in the evolution of US activity.

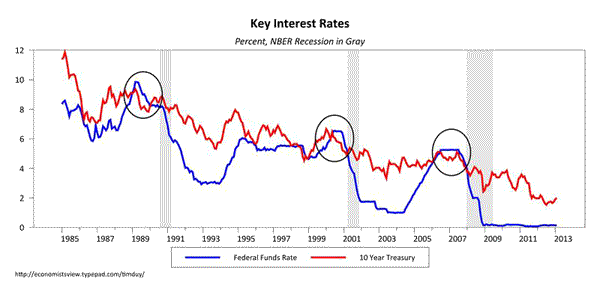

Indeed, it seems to me that betting on a recession when the Fed is not tightening is clearly betting against history. Moreover, historically the Fed has inverted the yield curve prior to a recession:

And yes, I realize this seems to imply that the US economy cannot have a recession because the yield curve is upward sloping – which of course it has to be when short rates are constrained by the lower bound. But that still doesn’t resolve the issue that recessions tend to occur only after a period of tighter policy. As long as the Fed is able and willing to ease in the face of negative shocks – and they have seemed to be willing to do so and have found a solution to the zero bound problem in quantitative easing – I would expect that monetary policy would largely offset most problems that comes down the pipeline.

Case is point is the Asian Financial Crisis. I remember predictions of US recession due to the trade shock, but that never occurred. The Fed eased into the crisis, mitigating its impact. The recession only occurred after the Fed revered course and tightened sufficiently to invert the yield curve. Arguably last summer’s European shock was the same. The Fed met fire with fire, and recession fears faded.

Could I imagine a shock the Federal Reserve could not offset sufficiently? Something that just came on too strong, too fast? Sure – I suspect a US debt default would be such a shock. But I also put very low probability on such an occurrence. As a general rule, the US economy is a like a large ship. It may run into headwinds that slows its progress and I can argue it needs more coals in its furnace, but it doesn’t turn on a dime. Pretty much best just to stay out of its way until the Federal Reserve decides it turn the rudder.

Mostly now I concern myself with the pace of growth (still disappointing) and the eventual policy reversal. Similar to Ryan Avent here, I am not convinced that the Fed will be successful in pulling the economy off the zero bound:

If recovery proceeds as the Fed anticipates, its interest-rate target will remain at near zero until at least 2015. Perhaps more worrying, the FOMC’s best guess at the appropriate, long-run value of the fed funds rate is about 4%. That is strikingly low. In each of the past three recessions the Fed has responded by cutting the fed funds rate more than 4 percentage points. A fed funds rate at that level virtually guarantees that the next downturn will result in a relapse into ZLB territory. Unless the Fed suddenly becomes much more comfortable with unconventional policy, the unemployment rate will rise more than it otherwise would and recovery will be weaker as a result. And that’s assuming that growth over the next few years actually is robust enough to allow the Fed to get rates back to 4%, which is not at all guaranteed.

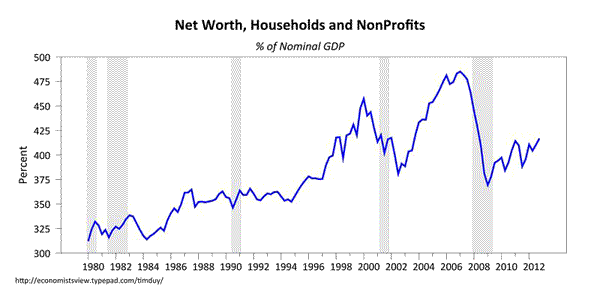

My second concern is to what extent this expansion, like the last two, will be dependent on asset valuations. What will this chart look like in two years?

Caution: Pure speculation follows. If this recovery is built on an asset bubble (and I am starting to entertain a possibility that I had previously discounted, that it could be a joint equity/housing bubble), then I suspect we will learn after the Fed tightens policy that we are not off the zero bound. If so, I further suspect the next recovery will require the Fed to deliver a pure-helicopter drop of money.

Bottom Line: The US economy is less fragile than commonly believed; it has endured a series of shocks over the last three years without major incident. I am claiming neither that equity prices won’t stumble, nor that we should be happy with the pace of activity. But I do think that a recession is unlikely before the Federal Reserve begins raising interest rates – something not likely to happen for two years. While long-run predictions are dangerous, for the sake of argument add up to another two years for tighter policy to reverberate through the economy and you are looking at sometime around 2016/2017 when the next recession hits. That’s the timeframe I am currently thinking about.

Leave a Reply