The February employment report was solid – not a blockbuster report, but definitely solid. And three of the last four employment reports have been solid as well, with payroll growth about 200k per month. This will undoubtedly raise some chatter that the Federal Reserve’s large scale asset purchase program will be tapered back soon than later. I suspect such talk would be premature. While the labor market currently has some momentum, we have seen such momentum fade in the past. Moreover, we are still deep in the labor market hole, so to speak. The Fed has time to see this play out, and, even if labor markets continue to improve at this pace, will most likely take that time, delaying any reduction of the pace of asset purchases until late this year.

Headline job gains totaled 236k for February:

December was revised up, but January was revised down. The three-month average is 191k, while the twelve-month average is a more modest 164k, declining slowly over the year. Note that during the last two years we have seen momentum on either side of the start of the year fade by spring or summer. The Fed knows this as well, and thus will tend to question the resiliency of these numbers. This is especially the case as the fiscal contraction is just beginning to work its way through the economy. Note that government employment continues to be an overall drag on the numbers:

The sequester may aggravate this trend in the near term. Calculated Risk is optimistic that layoffs at the state and local levels are mostly over; my conversations with municipalities in Oregon tend to be somewhat more pessimistic. Even though revenues are stabilizing in some cases, costs continue to rise, squeezing budgets. Anecdotal and regional evidence, so use with caution.

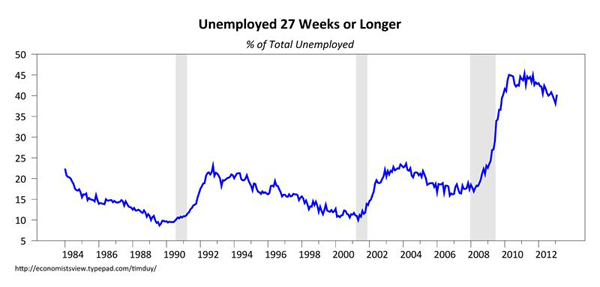

The unemployment rate edged down to 7.7%; at this rate of decline, we will be into next year before we see 6.5%. And that’s not a trigger for Fed action on interest rates – as long as inflation remains contained, 6.5% early next year suggests a rate hike in late 2014 or early 2015, consistent with current expectations. Why the delay after hitting 6.5%? Again, I think it reflects the depth of the hole. Progress on some indicators remains woefully slow:

See also Robin Harding’s cheat-sheet on Federal Reserve Vice Chair Janet Yellen’s last speech.

Hawkish monetary policymakers might try to gain some traction on wage gains:

Here again, the depth of the hole matters. Wage growth has considerable room to climb before it becomes a worrisome inflation indicator. And note that the all employees figure is not showing the same gains:

I would expect that the intensity of public comments by Federal Reserve policymakers increases as the year progresses. The hawks will almost certainly get increasingly nervous, and like to be heard. This will probably continue to show up in the minutes. But the doves, and currently dovish-leaning center, recognize the importance of clear communications, and thus will feel compelled to respond even more vociferously than in the past. In my opinion, this is not a great overall strategy, but unless Federal Reserve Chairman Ben Bernanke wants to exert more direct control over communications to get everyone on the same talking points, it is what we have.

Bottom Line: A solid report, but we need a longer stream of solid reports before Fed chatter turns decisively toward tighter policy.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply