The CIA has some new 2011/2012 numbers for the world’s economy. These numbers are as “good” as the countries who post the individual data, so it’s safe to be suspect. That said, I found them interesting.

There’s 7B of us. I love the CIA’s precise estimate.

Only 47% of the population is in the workforce. 28% of the population is under 14 years of age, 8% is older than 65.

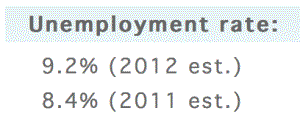

Of the 3.3 potential workers, fully 9.2% are unemployed.

I was surprised to see that the global unemployment rate had risen in 2012 by .8%. That’s a big change, It comes to an additional 26m people. Overall, some 300m people are looking for work. The numbers are big, the direction is bad. There is a case to be made about political stability with this many people not working.

The estimate for the USA is that 13m people are now unemployed. The US share of world unemployment is 4.3%, while US population is 4.4%. In other words, the US is right in the middle of the pack on unemployment. Not bad for the leading industrial economy……..

2012 was a so-so year for global growth, down YoY and down significantly from 2010.

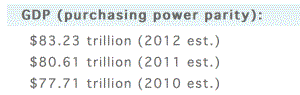

The CIA measures total GDP, it came to a whopping $83T in 2012. The US share is 19%.

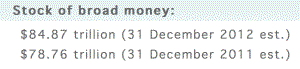

Global GDP rose $2.2T in 2012. How did that happen? Easy, more debt, money and inflation. The stock of money rose $6.1T, about 3Xs the increase in GDP. Given this, why is gold falling?

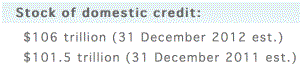

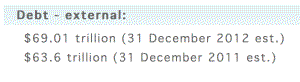

Where did all the new money come from? Debt, of course. Domestic and cross border debt marched ever higher:

Domestic debt rose by $5.1T, while cross bordered indebtedness rose $5.4T. Total debt is up by $10.5T while GDP rose only $2.2T. From this I conclude that it takes $1 of debt to produce a measly 20 cents of growth. Who was it that said that debt was an efficient stimulus for growth? There is no evidence of that in the CIA numbers.

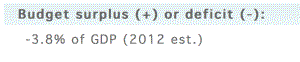

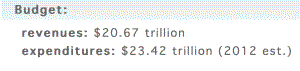

The world is running a budget deficit. The government deficits increased by 3.8% (Vs. GDP of 3.3%) and by $2.7T (Vs. $2.2T of real growth). On balance, for each $1 increase in government debt, GDP rose by 80 cents.

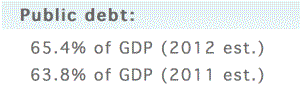

Total government debt as a share of GDP is now at 65%.

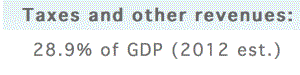

The large deficits are happening even though global tax rates are high. There is not much blood to be had from the taxpayer’s stone:

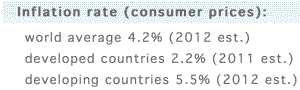

Inflation was tame in 2012. With all that money sloshing around, one would think that the inflation numbers have to be headed higher.

The CIA data for 2012 is a mixed bag. There is no crisis at the moment, but there are troubling signs:

– Unemployment is dangerously high, social problems will be the result.

-Global growth is occurring as a result of every higher debt loads and a rapidly expanding money supply. Total debt is rising much faster than economic output. Every year we get more leveraged. The “efficiency” of debt is waning.

-Inflation is not a big issue today, but there is every reason to believe that this can’t be sustained.

Leave a Reply