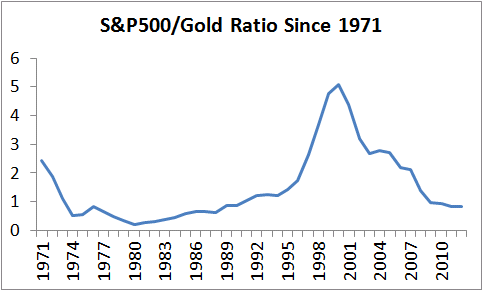

If Gold and the stock market are both geometric brownian motion, what are the odds of this pattern? It looks like there’s a clear trend from when the US closed the gold window in 1971 to 1981 when the monetarist experiment ended, to the end of the internet bubble, then to today.

Gold peaked in 1980, and basically is at a peak again, but it’s interesting that this ratio seems stationary. I bet no one thought that was true in 1980, or even 2001.

Facts are important things, and it’s not obvious what they are. Over my life I’ve seen papers argue gold has a positive, negative, and zero expected return, reflecting what has happened over the past 10 years.

Update: Eddy Elfenbein has a theory that seems pretty interesting…basically, when the real interest rate is low, gold is relatively attractive and generates good returns as investors pile in.

Leave a Reply