Yesterday’s post brought a flood of responses, with suggested trades/themes ranging from micro security selection to the classic macro big picture trade. Suffice to say that there was no consensus on either product or direction…it should make for an interesting sprint into the end of the year.

Meanwhile, in real time, asset markets continued to bewilder Macro Man. The German ifo survey printed another new cyclical high and exceeded expectations……so naturally the euro got clubbed and Bunds went bid.

Then, a few hours later, headline durable goods orders blew away expectations, as did new home sales. Equities yawned and Treasuries maintained their relentless march higher. Macro Man seems to adopt the bewildered look of Have I Got News For You’s Paul Merton with distressing regularity.

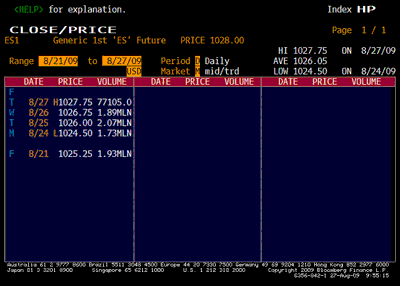

He knows it’s August, but trying to connect the dots in this market is like squeezing blood from a stone. China finally announced some measures to curb some of the more bubblicious aspects of its stimulus program….and A shares yawned. Meanwhile, Spoos seem to be super-glued to 1025 this week. If today’s GDP and claims data can’t rouse equities from their lethargy, it would appear that the rest of the week might be more profitably spent on the golf course (at least, it would if Macro Man’s rehabbing knee permitted him to play.)

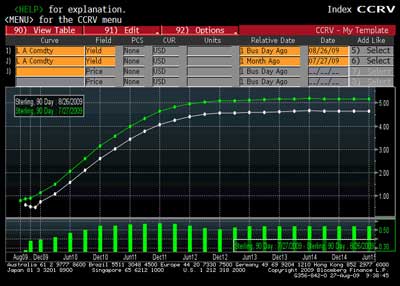

One market where punters see a bit more opportunity is in UK fixed income, specifically the short sterling strip. It was little more than a month ago that Macro Man mused about playing an early reversion to a tightening bias from the BOE. This month’s expansion of QE put paid to that; fortunately, Macro Man hadn’t deployed any capital towards the view.

Market focus is now swirling towards the possibility that the BOE reduces the rate it pays on deposits, possibly towards a punitive negative rate. This, the thinking goes, would spur more lending towards the real economy…or at least the interbank market. Whether that actually happens is up for debate.

In any event, the strip has shifted dramatically over the past month, with front Sep trading nearly 10 bps through the current LIBOR fix.

While a lot of juice has surely been squeezed out of the trade, the market has evidently seized on a deposit rate reduction as one of the few attractive opportunities as the summer winds down. Yesterday saw extraordinary volume in the short sterling options market…..some 375,000 contracts traded (compared to just over 50,000 in the Euirbor market.)

While some of the front-end stuff offers decent value, there was a lot of focus on the June 2010 contract, with punters buying call spreads nearly 100 ticks out of the money (i.e., closer to an implied rate of zero than they are to the current rate implied by L Z0.)

Maybe these trades will be epic winners…though they are low enough delta that it will take a long time to find out. But given the uptick in things like US housing and Merve the Swerve’s propensity for swift U-turns, Macro Man can’t help but think that some of these trades are trying to squeeze blood from a stone.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply