Apple’s brutal downdraft continues, now down over $20 on the day as we post.

What’s the problem? Lack of lines for the iPhone5 in China? Maybe today’s catalyst.

We think, however, the market is coming to the conclusion the company has a scale problem. That is, it is just too darn large.

We posted earlier in the week about the relative size of Apple’s earnings. In the last four quarters, for example, Apple’s earnings totaled $41.7 billion, which was 21 percent more than the combined earnings of Microsoft, eBay, Google, Yahoo, Facebook, and Amazon!

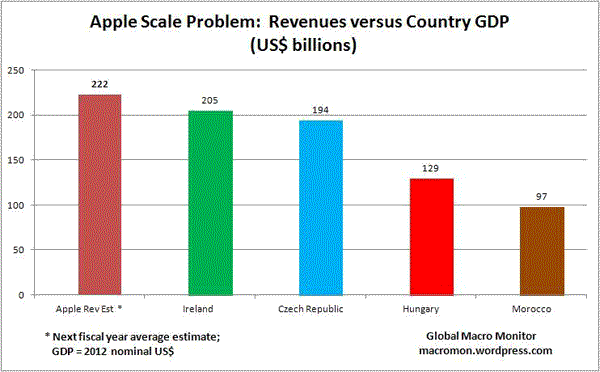

For even more perspective take a look at the chart below. Apple’s average revenue estimate for next fiscal year is $222 billion, which, would rank as the 47th largest GDP out of the 186 countries monitored by the IMF.

Thus, with relatively little reoccurring revenue, Apple has to wake up on the first day of every fiscal year and generate annual sales of iPhones, iPads, and iMacs equivalent to Ireland’s GDP or a combined Hungary and Morocco. That’s a big nut.

This is a problem probably very few companies experience.

Is growth still possible? No doubt. And if any company can do it, it’s Apple. But the growth rate is starting to run up against a hard wall of the law of large numbers, or, at least, the perception that it is. Maybe this why the stock looked so cheap in terms of its PE during the last few years of extraordinary growth.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply