A “cure rate” is a measurement of those who fall behind in their payments and then catch back up. Take a look at the numbers, they are staggering.

Fitch: Delinquency Cure Rates Worsening for U.S. Prime RMBS

NEW YORK, Aug 24, 2009 (BUSINESS WIRE) — While the number of U.S. prime RMBS loans rolling into a delinquency status has recently slowed, this improvement is being overwhelmed by the dramatic decrease in delinquency cure rates that has occurred since 2006, according to Fitch Ratings. An increasing number of borrowers who are ‘underwater’ on their mortgages appear to be driving this trend, as Fitch has also observed.

Delinquency cure rates refer to the percentage of delinquent loans returning to a current payment status each month. Cure rates have declined from an average of 45% during 2000-2006 to the currently level of 6.6%. It is important not only to observe total roll rates, but delinquency cure rates as well, according to Managing Director Roelof Slump.

‘Recent stability of loans becoming delinquent do not take into account the drastic decrease in delinquency cure rates experienced in the prime sector since the peak of the housing market,’ said Slump. ‘While prime has shown the most precipitous decline, rates have dropped in other sectors as well.’

In addition to prime cure rates dropping to 6.6%, Alt-A cure rates have dropped to 4.3%, from an average of 30.2%, and subprime is down to 5.3% from an average of 19.4%. ‘Whereas prime had previously been distinct for its relatively high level of delinquency recoveries, by this measure prime is no longer significantly outperforming other sectors,’ said Slump.

The general deterioration in home prices appears to be a key driver in the worsening cure rate behavior. Due to home price declines, loans that have recently become delinquent have an effective loan to value ratio that is on average approximately 23% higher than those loans that are current on their payments, and are typically over 100%. Since home price declines have been relatively more severe in certain areas such as California and Florida, these areas tend to have a higher degree of representation in the non-current category. While California and Florida represent 49% of the remaining outstanding balance of currently performing prime loans, these states make up 62% of the non-current category and are under-represented in the ‘cured loan’ category as well. Furthermore, up to 25% of loans counted as cures are modified loans, which have been shown to have an increased propensity to re-default.

Recent data shows prime current-to-delinquency rates at 89% of the December 2008 levels, though new rolls-to-delinquency are still elevated when compared to historical standards. Recently observed three-month average roll rates of 1.1% are nearly twice the level seen from the 2000 through current averages for prime. Additionally, the gross roll rates do not reveal some additional important information relating to prime loan performance.

Other stresses may also be playing a part in the worsening cure rates. Although current credit score information is not generally available for all borrowers, some significant differences are noted between the original credit profiles of the current and delinquent prime loans. On average, current prime loans had credit scores at origination that are seen to be 25 points higher than the delinquent loans. Also, the loans that are current have shown a higher percentage of full income documentation than those that have recently become delinquent. ‘As income and employment stress has spread, weaker prime borrowers become more likely to become delinquent in their loan payments and are less likely to become current again,’ said Slump.

Regardless of aggregate roll-to-delinquent behavior, it will be difficult to argue that the market has stabilized or that performance has improved, until there is a concurrent increase in cure rates. This is especially true in the prime sector, which remains performing many times worse than historic averages. Prime 60+ delinquencies have more than tripled in the past year, from $9.5 billion to $28 billion total, or roughly $1.6 billion a month. (emphasis added)

While we had a temporary decrease in the number of foreclosures, we learned that the reason behind it is that the courts are so overwhelmed with them that they simply cannot process them quickly enough!

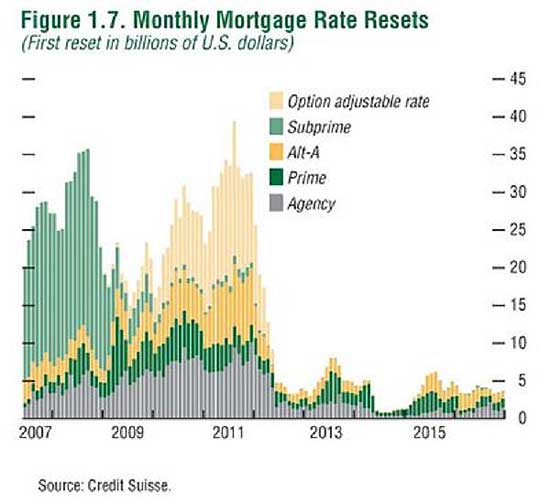

We know that we are on the leading edge of the option arm reset bubble…

…and now Fitch is reporting that cure rates are plunging.

A 6.6% cure rate means that only 1 in 15 people who fall behind in their payments will catch back up. That is a disaster that’s FAR, FAR beyond the “models” that are built to track such things and which economists and quants build their programs around. That would make this a “black swan,” would it not? Certainly the mortgage backed securities based upon faulty models will be wrong. The institutions who have loaded up on those securities have far less valuable “assets” than they report, and those who have sold or purchased credit default swaps against those institutions are working with a reality that is far outside of their models.

This is what happens as those on the MARGINS run out of operating cash. The margins at first don’t seem to affect the larger masses, but then as the bubble begins to contract, prices and comparables begin to sink and the next thing you know the “prime” borrowers are underwater on their “assets” too. That is what happens during deflation as asset prices fall.

The same process is also happening in Commercial Real Estate, only some would say worse. The next phase of the crisis will be much more painful than the first because people and businesses have been pounded by the first wave – they have been holding on HOPING for recovery. Their cash depleted, they will not weather the second wave as they simply run out of cash and the ability to get more.

Had the government let the small waves wash away the misallocation, then the big waves would not have been required. Get ready, there’s a big wave coming…

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

The decrease in delinquency cure rates is just one of the clear signs that the economy has not recovered yet. Hopefully, things will be better by 2011 so we can see some changes in the the financial arena.