Macro Man is still shaking his head over Friday’s crazy equity squeeze (as well, it must be conceded, to clear the lingering after effects of a day spent watching cricket and quaffing Pimm’s on Saturday.) Why oh why can’t the US release housing data at 8.30 NY time, rather than 10 am after equity options have already expired?

Still, Macro Man can’t complain too much. His back-book SPX hedges managed to reap a windfall gain, courtesy of the absurd settlement price procedure of the CBOE listed index options.

While it’s tempting to write today about the apparent break-out in stocks, and wonder whether it’s a low-volume sucker’s rally or a straight shot to 1100, Macro Man has other things on his mind today. Specifically, bond yields and why they aren’t higher.

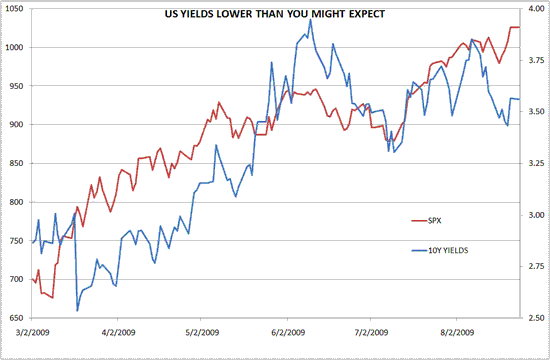

After all, since the onset of the crisis a couple of years ago, there’s been a pretty strong positive correlation between stock prices and bond yields. To be sure, the relationship is not and cannot be a linear one ad infinitum, as you’re comparing a trending series (equity prices) with a mean-reverting one (bond yields.)

But still, on shorter-term horizons, one can characterize bond yields as trending, which renders a side-by-side comparison somewhat more apt. And what we can see is that bond yields are closer to their three-month lows than their three month highs, despite the fact that the S&P is now at its highest level in ten months.

The bid for bonds seems all the more perverse given that we have another glut of supply this week in the US. Oh sure, the auction sizes are not quite as big as feared in some quarters, which may have given a temporary fillip to bond prices. But the amount of supply is still bloody enormous in absolute terms. And the pattern of the last several months is that dealers either demand a tasty concession (i.e., drive prices lower) ahead of the auction….or they get steamrollered after.

So far there’s been no concession to speak of really…..so judge for yourself what may happen after the auctions. Perhaps dealers are holding out hope that the foreign CB bid will be back throughout the week after they finally showed their hand a couple of weeks ago.

One mitigating factor for the valuation of Treasuries has been the ongoing decline of LIBOR, where the key 3m setting fell more than a basis point per day in the second half of last week.

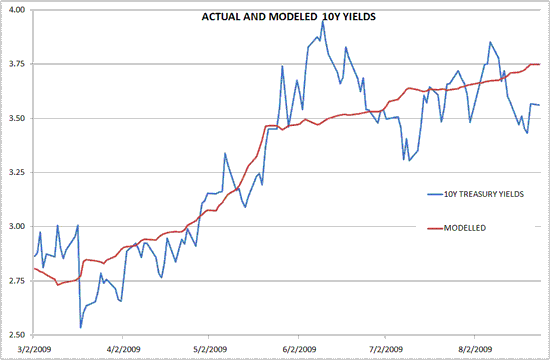

Running a simple two-factor model of equity prices and LIBOR suggests that bond yields should not, after all, be north of 4%…though the model admittedly is at its high setting for the year.

Still, it suggests that fair value for US 10 year yields is well north of current levels. Macro Man wouldn’t be surprised to see us there sooner rather than later, and prefers to concentrate his long fixed income bets at the shorter end of the curve.

Oh, and as for equities: perhaps it’s time to revive this playbook for valuing and trading equities? Sure feels like it…

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply