Philadelphia Federal Reserve President Charles Plosser spoke yesterday, reiterating his opposition to QE and his expectation that it will have no impact on growth. I don’t think any of that should have been a surprise. What caught my attention was this:

Once the recovery takes off, long rates will begin to rise and banks will begin lending the large volume of excess reserves sitting in their accounts at the Fed. This loan growth can be quite rapid, as was true after the banking crisis in the 1930s, and there is some risk that the Fed will need to withdraw accommodation very aggressively in order to contain inflation.

I am somewhat concerned that a Federal Reserve official would use loan growth in the 1930s as an example of what could go wrong with quantitative easing. It should be seen as an example of what could go right.

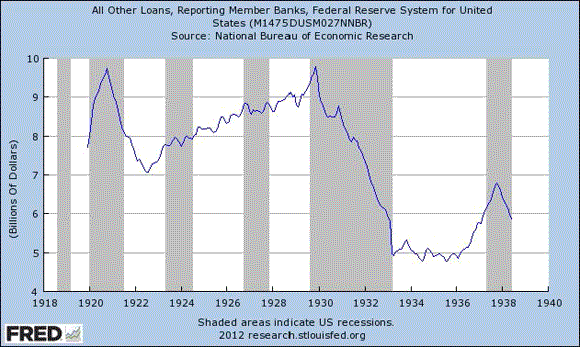

Presumably, Plosser is talking about something like this graph:

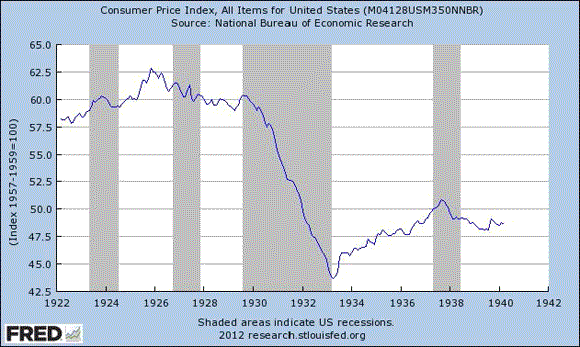

This is a problem because…why? The inflation, that’s right:

Yes, there was inflation after 1933. And no, this wasn’t a bad thing. The inflation, as well as the loan growth were part of the recovery. They were features, not bugs, of easier policy. And even by 1937, both the price level and loans were below pre-recession peaks. Yet, policy turned prematurely tighter, tipping the US economy back into recession and deflation.

Bottom Line: Fed hawks obsess with the issue of having to unwind quantitative easing when the economy improves. We should be so lucky. Shouldn’t we wait until we see some hope that rates can sustain themselves above at least 3% before we worry about this? Somehow the hawks fail to understand that policy is always reversed in the next phase of the business cycle. Simply put, if we need to unwind quantitative easing, the policy was indeed effective. Plosser takes the wrong lesson away from rapid loan growth in the 1930s. The lesson is not that we should fear recovery. The real lesson was to avoid premature tightening of policy.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply