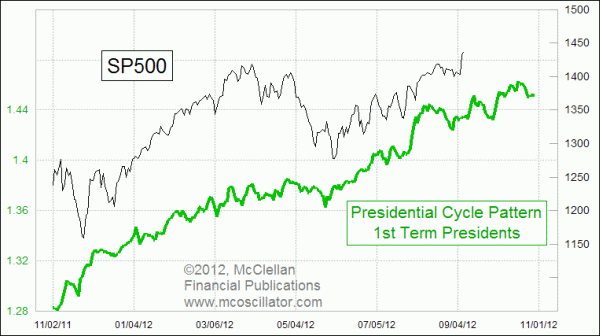

I have been following the election year pattern and it remains on track, with a 2 – 3 day lag (see chart, courtesy PragCap). There is an interesting twist this election, but first a discussion of the general situation. The prognosis, per PragCap:

Looking ahead, this version of the Presidential Cycle Pattern says that we should expect to see a choppy uptrend continuing toward election day, perhaps with some significant “texture” along the way. The strong correlation up until now suggests that this pattern is working reliably. Once we see how the election turns out, we can then figure out which pattern to follow starting in November.

What is interesting is that this version of the chart has taken out the 2d terms and only focused on first term Presidents, a more true comparison to this election. The generic chart that we showed in the prior post combines first and second terms and the behavior is different in each term. Per PragCap:

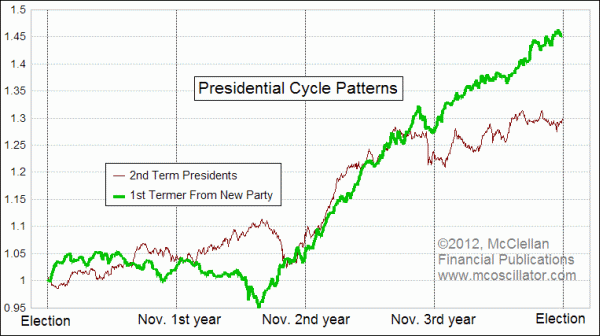

As a rule, [new Presidents] all typically spend the first year in office “discovering” that conditions are even worse than we were told during the campaign, and that the “only solution” is some urgent package of tax changes, spending, regulations, etc. …

When a first term president wins reelection to a second term, then he typically does not spend much time in the first year telling us all about what a lousy job his predecessor did. That lack of a persistent negative message seems to work out to bring slightly better market performance right after a reelection.

But with a new president from a different party, investors tend to get discouraged hearing that things are worse than expected, and so the market’s performance during the first few months with a new party president is on average slightly worse than if an incumbent wins reelection. Over time, though, it tends to average out to be just about the same.

This chart shows the comparison of first term vs second term Presidents:

What is different this time is the pattern has not worked well in the last three elections, perhaps because we hit a secular bull market peak in 1999 and have been in a secular bear through the past three elections. The pattern broke in 2000 and 2008 when we had market crashes; it also didn’t hold in 2004.

This time there is a lot of can-kicking going on to push the problems to after the US election. A lot of commentary over the past week out of Eruope thinks the latest ECB moves can buy 3 months, and of course the fiscal cliff doesnt rear until after the lection. The one stinker is that we may hit the debt ceiling limit faster than expected, before the election.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply