The Shanghai stock market was up 4.5% in very nervous trading today but down 16.3% since its recent peak at 3478 on August 4, and still trading at more than 30 times earnings. All this turmoil is triggering all sorts of worried comments about the sustainability of the fiscal stimulus package and whether it has already reached the end of its effectiveness (it hasn’t – the government still has credit and fiscal firepower, and will use it if growth slows down significantly in the next few quarters). It also makes it harder, but probably more useful than ever, to focus on the bigger picture, and this entry is definitely big picture. It also turned out to be a very long piece, as these big-picture pieces tend to.

The topic is whether or not the global imbalances that have led to the current crisis were in any way “caused” by the Asian savings glut, and besides arguing why I think this may be the case, I want also to argue that getting this argument right is far more important than many seem to realize. Mohamed Ariff, executive director of the Malaysian Institute of Economic Research, indirectly suggests why in a good OpEd article in today’s New Strait Times:

China is seen as the beacon of hope in these days of gloom and doom. This has led some observers to think China will lead East Asian economic recovery and thereby spearhead a global economic turn-around. But this faith in China as saviour may be misplaced.China’s imports from the rest of East Asia consist mostly of raw materials, intermediate products and components and parts, the bulk of it turned into manufactures for exports. China’s imports of consumer products from the region account for no more than a small proportion.

China’s imports from its neighbours have plummeted in the wake of the slump in China’s own exports, although the Chinese economy is growing at seven to eight per cent, because China depends largely on domestic production for its own consumption, which does not spill over to the rest of the region through trade.

Therefore, China will import more only if it can export more. For this to happen, the demand for China’s exports in the US and European markets must first recover.

But our definition of a “recovery” in the US, and whether it will indeed happen in the way that Ariff requires for Asian growth to return, depends in an important way on whether or not the current imbalances were caused primarily by an original distortion in US consumption or in Asian savings.

I started writing this because while googling around looking for something else, I stumbled early this week upon a blog by LSE’s Danny Quah with the intriguing title “Where in the world is Asian Thrift and the Global Savings Glut?” I later found that like mine, his blog is carried by Nouriel Roubini’s RGE Monitor. I also subsequently discovered by a weird coincidence that on Saturday I am sharing a panel with him in a conference at the Guanghua School at Peking University, where we will be discussing the “Reconstruction of Global Finance”.

The whole “savings glut” debate is a controversial one because almost from the start it has degenerated into a fairly silly argument about who to blame for the global imbalances and the subsequent crisis – or more specifically and more excitingly, whether the predator was wholly the foolish American consumer or the beetling Chinese saver. Three months ago Brad Setser discussed all this in one of his blog entries that (inevitably) drew more comments than most, and as usual he provides a concise and enlightening discussion on the subject which you might want to read. He is a proponent of the hypothesis, but nonetheless pretty fair-minded.

Professor Quah weighs in on the other side of the savings glut debate although, unlike most others in the debate, he seems not terribly concerned about assigning full blame to any of the major parties. It is neither excess US consumption nor excess US savings that solely “caused” the imbalance, in other words, because necessarily both sides are required for it to exist.

Except for the possibility of trade with outer space, the US deficit has to be matched dollar-for-dollar by trade surpluses in the rest of the world. Correspondingly, therefore, the rest of the world has been saving—consuming less than it has been producing—and accumulating dollar claims against the US as a result.

In this description, however large the global imbalance, a savings glut—wherever or however it might arise on Earth—has no independent existence. It makes as much sense to say the world’s excess savings caused enthusiastic US consumers to flood into Walmart to buy $12 DVD players, as to say US consumer profligacy made hungry Chinese peasants abstain even more and instead plow their incomes into holdings of US Treasury bills.

When two variables have always-identical magnitudes, obviously neither can usefully be said to cause the other.

Who are the predators?

This is correct, but as an aside, the discussion about enthusiastic American consumers forcing the Chinese to save, or hungry Chinese savers forcing Americans to consume, typically uses colorful but totally inappropriate images to describe the dynamics of the this process. For example, I often hear opponents of the Asian savings glut hypothesis say, voices dripping with disbelief, that the savings glut hypothesis insists that the poor American consumer rushed out to buy another DVD player because terrible China forced him to borrow the money and buy the DVD player. How could that possibly happen?

Well, that’s not how it would have happened. In any large country, there are millions of households able and interested in increasing savings or in increasing borrowing. Specific policies or financial conditions will determine at any given time changes in the behavior of some of these individual households, so that at the macro level, and only at the macro level, the country will have seen an increase in savings or an increase in consumption.

It is not every household that rushes out to consume when consumption rises, and this never happen because predatory savers force an otherwise unwilling consumer to buy. So if it had indeed been rising Asian savings that drove the US consumption binge, policies aimed at constraining Asian consumption and boosting Asian production (which cause savings to rise) will have initially led to a rising Asian trade surplus and US trade deficit, as the tradable goods sector in Asia expands and the tradable goods sector in the US contracts.

This surplus would be recycled into the US via purchases of highly liquid securities. If the Fed failed to respond to this increase in liquidity by raising interest rates and contracting money (and contracting the tradable good sector), the financial system would have to accommodate the rising liquidity as it has always done throughout history – by growing financial balance sheets and taking on more risk. In that case the conditions for consumer borrowing will have been made increasingly easy, and those households who needed or were predisposed to borrow under easier lending conditions, and pressure on the parts of banks to extend credit, will do so.

As long as there are some households willing, however appropriately or foolishly, to increase consumption, the easier availability of consumer credit will cause them to increase consumption – this has happened many times and in many countries, and has nothing to do with a predisposition to excess consumption. Furthermore as recycled liquidity boosts household wealth by boosting the value of homes and investment portfolios, the rising wealth of each individual household will have an impact similar to rising income – and with it consumption will rise.

So the point is the not very controversial suggestion that a surge in domestic liquidity in the US can easily cause US consumption to rise. If that liquidity surge was “caused” by the recycling of a large and growing trade deficit, then it is easy to see how at the macro level US consumption would rise in response to a surge in Asian savings.

Similarly, the proponents of the Asian savings glut hypothesis wonder in disbelief how an American consumer deciding to buy a DVD player could have possibly “forced” poor Chinese peasants to cut their already minimal consumption and increase their savings. But there was no force. A sudden explosion in binge consumption in the US would divert production from China, and as China increased the share of its output dedicated to exports, total production would not immediately be matched by total domestic consumption (Americans bought some of it) and the Chinese savings rate would necessarily increase – whether at the household level or at the corporate or government level.

The interest rate argument

The point is that sarcastic comments about predatory American consumers forcing dim-witted Chinese households to save more and consume less, or predatory Chinese savers forcing helpless American households to borrow and consume, may be good debating tactics but they are misleading and explain nothing. At the macro level either event – higher Asian savings leading to higher American consumption, or higher American consumption leading to higher Asian savings, or even a combination of the two – is perfectly possible.

So why should we accept the Asian savings glut hypothesis? One argument that I first saw proposed by Brad Setser was that if the imbalances had been driven by US consumption, and therefore US borrowing needs, the consequence should have been an increase in US interest rates. Had they been driven by excess savings, US borrowing rates would have probably declined.

In fact during most of the relevant period US interest rates did decline, even leading to the US Fed several times complaining about its inability to control domestic long-term rates. So that pretty much settles it, right? But Professor Quah dismisses this argument:

Many other factors could, of course, have driven down short rates: US monetary policy responded to national economic downturns in 1991 and 2001. Through the 1990s inflation rates worldwide converged and fell, together with short-term interest rates set by central banks everywhere. The burst of the dot-com bubble in March 2000 saw the NASDAQ index decline 77% in the following 18 months, prompting action by the US Federal Reserve. Japan’s monetary policy during its decade-long recession drove nominal interest rates there to zero.

Although he is right, this is not a completely satisfying dismissal. The same savings glut that pushed down US interest rates could easily have pushed down global interest rates, especially in a world that was seeing rapidly rising capital flows that in many cases were aimed at “arbitraging” (absolutely the wrong word, of course, but one widely used in the markets at the time) interest rate differentials. After all it is often the case that, especially during periods of large international movements of capital, increases or reductions in US interest rates (or in British rates during the globalization period at the end of the 19th Century) are matched by changes in foreign interest rates.

Still, the fact is that his response does show that the interest rate argument is not final. There might be other perfectly good reasons that explain the decline in US interest rates.

The bilateral trade argument

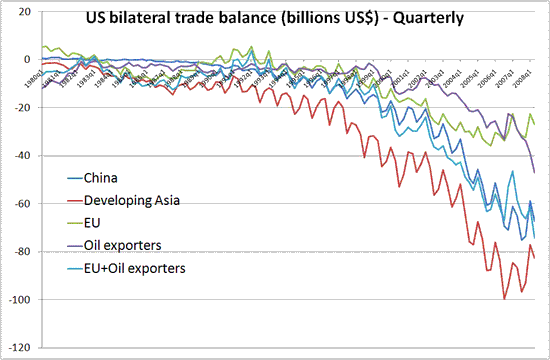

Quah’s main argument against the savings glut hypothesis, at least as far as his blog entry, seems to be that it could not have been a rise in Asian savings that drove the global imbalances because had it done so, much of the imbalance would have rested between Asia (or China, more specifically) and the US. The strongest piece of evidence he presents is a chart that shows the US bilateral trade balances between the US on one side and China, developing Asia, the EU, and oil exporters on the other. I have reproduced the graph below, but if you can’t see it well, just click on Quah’s blog (blocked in China, so China-based readers will need to use a proxy), and click on the graph itself for an enlargement (I wish I was clever enough to do things like that).

As the chart shows, the US trade deficit rose nearly as quickly, or even more so, with those other regions as it did with China and/or developing Asia. It wasn’t just a US-China phenomenon or a US-Asia phenomenon, it was a US-everybody phenomenon.

Quah’s argument seemed to be a powerful one at first, and I had to think about it for a while or else I would have to find myself deserting from the “savings glut” camp. In the end, however, I think his argument it turns out not to be very satisfying and I still think it runs against a timing story that better explains the imbalances. I’ll say more on that later, but it seems to me that in a “globalized” world, if the Asian savings glut hypothesis is true, not only would rising bilateral trade deficit between the US and other countries outside of developing Asia be possible, but they would even be almost necessary.

Why? Because we have to be careful about misreading bilateral trade numbers. It is the aggregates that usually matter. I don’t have the data in front of me, but I believe that Europe did not run significant and rapidly growing aggregate trade surpluses during this period. If that’s the case, then a growing bilateral surplus with the US is perfectly consistent with the savings glut hypothesis as long as you assume that trade is international and that any specific product can be produced and assembled in many countries – which is of course a pretty unremarkable assumption.

So, for example, if rising Asian net savings “caused” rising American net consumption (in the way described above – no sarcasm, please), it would mean that money recycled from Asia into the US caused the US trade deficit to rise as it was intermediated by the financial system into consumer financing, even as it caused Asian trade surpluses to rise.

It’s the aggregate balance that matters

But, and this is the important point, the trade did not need to occur only at the bilateral level. If rising Chinese savings was intermediated into rising US consumption and this bilateral relationship was resolved, to take a concrete example, by Chinese exporters producing shoes and American consumers buying shoes, the trade would not have had to occur directly between the two. When Americans shop for shoes, they don’t care which country saw net savings rise, and when Chinese sell shoes they don’t care whose economy saw an increase in net consumption. China could have produced shoes, sold them to a designer in Italy, where they would be packaged and branded, and then sold to American consumers.

In this simple case, Chinese excess savings would have “caused” Americans to borrow money and buy the shoes, and so China would run a trade surplus, the US would run a trade deficit, and Italy would be balanced. But Italy would nonetheless show a bilateral surplus with the US and a bilateral deficit with China.

Excess US consumption, in other words, would still have been “caused” by excess Chinese savings in this case, but global trading and processing networks would have the bilateral trade imbalances, and their countervailing obverses, spread out though the world. Many countries would run surpluses with the US and deficits with Asia, but at the aggregate level they would balance out at close to zero, and the US would be left with the sum of its bilateral deficits and Asia with the sum of its bilateral surpluses.

The point is that there is nothing in the Asian savings glut hypothesis that requires that all trade imbalances occur at a bilateral level and only between the participating countries – that the deficit/surplus imbalances occur between the US and Asia. It only requires that the US, as the equilibrator to rising Asian savings, have a large and growing trade deficit and Asia have a large and growing trade surplus. If other regions also have large and growing aggregate trade surpluses that fed into the US deficit at the same time, that would perhaps be the problem Quah says it is, and either would need to be explained or would create problems for the hypothesis. But they didn’t.

With one big exception, of course. Oil exporters did see not only rising bilateral trade surpluses with the US, but they also saw rising aggregate surpluses. Does this somehow weaken the savings glut hypothesis? Again no, because those surpluses reflect one thing only, rising oil prices, and in an environment of rapid US and Asian growth, we would expect oil (and other commodity) prices to rise. In fact the savings glut hypothesis would predict that as long as the recycling was occurring efficiently, both countries would grow quickly and high commodity prices would be not only possible, but in fact highly likely.

So as I see it, this is how the arguments and counterarguments stand:

1. The argument that declining US interest rates proves the correctness of the savings glut hypothesis is wrong. Declining US interest rates are suggestive but not final. Other things could have explained declining US interest rates during this period, and of course there is easily a possibility of feedback loops in which any initial decline in US interest rates could, by increasing household wealth (via rising asset values) increase consumption and the US trade deficit, leading to Asian recycling, and so on to more lower interest rates.

2. The argument that rising US bilateral deficits with many regions around the world disprove that the savings glut hypothesis is also wrong, and much less suggestive. On the contrary, if the hypothesis is correct and if trading is truly globalized, we would expect US bilateral deficits to be high with nearly everybody. At the aggregate level, however, we would not expect anyone except the high-saving Asian saving countries to run large trade surpluses.

3. There was also an argument that I associate with Morgan Stanley’s Stephen Roach – a very smart man who by the way disagrees strongly with the hypothesis – since he was the one who first made this argument to me, over a lunch at Peking University two years ago. According to Roach there has been no significant increase in global savings during the savings-glut-hypothesis period, which pretty much demolishes the idea of a saving glut.

I disagree because the hypothesis doesn’t imply in any way that global savings have increased. In a closed economic system, unless investment has increased commensurately, an increase in savings in one part of the system must necessarily come with a reduction in savings elsewhere, and this was exactly the point of ascribing the current trade imbalances to a forced rise in Asian savings. Rising Asian savings “forced” declining US savings by causing the US financial system to accommodate growing domestic liquidity by taking on risk (again, no sarcasm please – you might disagree but in itself this is not implausible).

Timing the flows

So where does that leave us? Before answering, I think there is another thing to think about here, as I wrote earlier in this entry, and that is the timing issue.

In a June 4, 2008 entry, much of which is reproduced here, I mentioned a very interesting paper by German economist Jorg Bibow of the Levy Economics Institute of Bard College (The International Monetary (Non-)Order and the “Global Capital Flows Paradox”). In it the author considers the “paradox” of high and rising capital flows from developing to developed countries during the past decade. This is a paradox because most economic theory (and history) suggests that developing countries are net recipients of investment, not net providers.

Bibow rejects the Asian savings glut hypothesis, but my understanding of his paper is that he agrees with much of what I understand the theory to be but rejects it on much narrower technical grounds – he claims that the saving glut hypothesis is based on the “fatally flawed” (his words) loanable funds theory. However his narrative (to be horribly post-modern for a moment) of events seems very close to my own.

What interests me most is the data he provides in his paper (and you can see the accompanying graphs by following the link to his paper). First off, Bibow discusses the evolution of the US current account deficit over the past fifty years.

Basically, according to the data quoted in Bibow’s paper, the US current account has been within a range of a surplus of 1% of GDP and a deficit of 1% of GDP for most of last fifty years with two exceptions. The first exception occurred in the mid-1980s when the US current account deficit rose to nearly 3.5% of GDP in 1986-87 before declining sharply and running into a small surplus in 1990. The second exception began technically in 1994, around the time of the Mexican crisis, when the US current account deficit climbed to around 1.6% of GDP, before it began to decline again, but it really took off in 1997-98, when it raced forward to peak at around 7% of GDP in 2007.

As an aside I should add that there was an acceleration of the growth rate of the deficit around 2004, if I remember, and I have a pretty strong suspicion that this had something to do with the financing of the Iraq war. As I have pointed out before, US asset markets and consumption often boom during unpopular wars, like the Vietnam War, which tend to be financed not with taxes but with money creation and debt, and often these two things lead to great markets – for a while.

If the US trade deficit was driven simply by an out-of-control US consumption binge, it is a little hard to see why it would have followed a pattern of general stability marked by two surges – a small one from 1984-88 and a very large one after 1997. If it was driven by Asian savings, this pattern becomes a little easier to understand – or at least, what amounts to the same thing, we can posit a more plausible story to explain it.

The narrative

I will ignore the 1980s surge because this post is already too long, but again one can tell a very plausible story based on Japanese trade policies and domestic savings. The post-1997 surge is much larger and more interesting. 1997 was, of course, the year in which several Asian countries, after years of tremendous growth and what seemed like invulnerable balance sheets, experienced terrifying financial crises and viciously sharp economic slowdowns, which profoundly impressed Asian policy-makers and has affected policy decisions to this day.

Since the main cause of the crisis seemed to be the sudden reversal in the early 1990s of current account surpluses into substantial deficits, along with highly unstable balance sheets in which large external obligations were mismatched with domestic assets and “hedged” with extremely low levels of foreign reserves, one of the main (if mistaken) lessons policy-makers learned was the need to run current account surpluses and to amass large foreign currency reserves to protect countries from a repeat of the disastrous crisis of 1997.

These countries, consequently, but into place “mercantilist” policies in order to achieve both goals – persistent trade surpluses and large amounts of foreign currency reserves. This (I think plausible) story is reinforced by another graph Bibow reproduces. The global capital flow “paradox” to which he refers in his title is the fact that developing countries are exporting capital to rich countries. According to his data, developing countries have almost always been net recipients of private capital flows – which is what one would have expected from most economic theory and history.

They have generally been net providers of official capital as far as foreign currency reserve accumulation goes, but for most of the last fifty years reserve accumulation on average was significantly less than net private inflows, so developing countries were net recipients of capital. (For much of the 1980s the balance on both was zero or close to zero, and I suspect that this reflects negative private flows to Latin American and others among the 32 defaulted or restructuring LDCs, as they were then called, netted against positive private flows to Asia.)

It is only in 1998 that reserve accumulation among developing countries begins to take off and by 1999 it exceeds net private capital flows to developing countries. This is when the “paradox” of net capital flows from developing to developed countries begins. Except for a small decline in 2001 net flows from developing countries surge almost in a straight line to around $700 billion annually (combining $1.2 trillion of reserve accumulation versus $0.5 trillion of net private flows).

I am sure there can be other competing explanations for the timing of these flows, but I am very impressed by the fact that Asian savings, as expressed in reserve accumulation, surge after 1997, as does the US trade deficit, although exacerbated by the second surge around 2004. Given the virulence of the 1997 crisis and the tremendous shock it provided to Asian policy-makers (and policy-makers in developing countries elsewhere), it seems to me that a very plausible argument can be made that it was the effect of 1997 that caused the shift in developing-country policies that led to the surge in savings and the corresponding increase both in trade surpluses and reserve accumulation.

The surge in the US trade deficit after 1997 is also more easily explained by a shift in Asian trade policies and currency regimes than by a shift in US consumer preferences. Of course that doesn’t mean that nothing relevant happened in the US. US monetary policy was clearly too accommodative, and especially in reaction to the Iraq war, so that it exacerbated the conditions created by the Asian savings glut. If anyone is still looking for which country to blame, my understanding of the creation of the imbalances suggests that you can blame almost anyone you like and there is a good chance that you’ll be at least partly right.

Why does this matter?

The issue of what drove what is not simply of academic interest. The consequences for the world of a system in which imbalances were driven by a sudden and self-perpetuating explosion in US consumption, which then forced higher savings onto Asian countries, are very different from a system in which imbalances were driven by a sudden and self-perpetuating increase in Asian savings, which then forced higher consumption onto Asian countries.

Deciding whether or not the savings glut hypothesis is correct is important not just because it allows us finally to decide which country really is the evil predator, the US or China. It matters for a very different reason.

If it was an explosion in US consumption which drove the global imbalances, then we are likely to see a fairly benign resolution to the crisis for everyone, except maybe the US. After all in that case the imbalances were driven by US consumption excesses, and since those excesses are, like it or not, going to be resolved by the need for US households to repair their badly-damaged balance sheets, the imbalances too will be resolved, and in a way that is mostly benign for everyone except recovering US households. This process may be postponed by current US fiscal policy, and especially by recent policies that subsidize consumption, but it will only be postponed, not derailed.

And just as Americans can no longer binge consume, their binge consumption will no longer force Asians to save such a high and rising portion of their income. Asian growth, and especially Chinese growth, will be much more balanced.

But if the global imbalances were driven by a surge in Asian savings, Asian and Chinese growth will still rebalance, but the rebalancing will be much more difficult. Why? Because too-high Asian savings, caused in large part by post 1997 policies that encouraged differential growth between consumption and production (as I discuss here, for example), have until now been matched by too-low US savings rates. As long as the two imbalances balanced, the world economy could continue functioning without too much distortion.

But now if we can expect net savings in the US (and perhaps in many other parts off the world) to rise, we need to see a rapid change in those policies that encouraged too-high Asian, and especially Chinese savings. In that light there was an interesting and worrying OpEd article in today’s Financial Times by the Peterson Institute’s Fred Bergsten and Arvind Subramanian:

The Obama administration is increasingly signalling that the US will not continue to be the world’s consumer and importer of last resort. The clearest statements came last month from Larry Summers , White House economics director, in a speech at the Peterson Institute for International Economics and in an interview with the Financial Times. The US, he said, must become an export-oriented rather than a consumption-based economy and must rely on real engineering rather than financial wizardry. Tim Geithner, the US Treasury secretary, and other top officials have spoken similarly of rebalancing US growth.

If the US really is serious about this shift towards higher savings, and if the primary source of the imbalance was the Asian savings glut, and not an original US consumption “glut”, this means that in the future US policies will be in direct conflict with still-current Asian policies, and unless the US is unable to accomplish these goals, Asian countries will need to force through an adjustment in their development policies as quickly as possibly. Asian and especially Chinese officials have acknowledged the need to increase consumption more quickly.

But for now this adjustment in policies that encouraged too-high Asian, and especially Chinese, savings does not seem to be happening. “The optimal choice is to expand household consumption,” PBoC governor Zhou Xiaochuan said in a speech last month. ”That is, however, easier said than done. While the current income structure cannot be dramatically changed in the short term, the second-best choice is to maintain and expand investments.” He is almost certainly right, at least except for his last statement.

In fact as I have argued many times (for example here, and here), I suspect that most of the Chinese fiscal stimulus is exacerbating the imbalances – both by boosting current and future production and by creating conditions that will constrain future consumption growth.

In that case there has been no significant rebalancing yet towards more rapid consumption growth taking a greater share of Chinese production – just a frenzied attempt to keep current growth rates high by boosting investment, which will almost certainly lead to capital misallocation and rising non-performing loans, and clearly unsustainable attempts by the Chinese government artificially (and unsustainably) to boost short-term consumption by subsidizing it heavily with government debt (something the US seems to have been doing too) which has the effective consequence of reclassifying fiscal expenditures as household consumption.

The end result? Planned increases in investment in China eventually become forced increases in investment – rising inventory – that ultimately must lead either to writing inventory off or closing down production facilities in the future. This is, by the way, just another way of stating the excess capacity problem.

Perhaps what we need is a real return to Confucian roots. I recently read this quote from Lao-Tzu: “The sage does not hoard. Having bestowed all he has on others, he has yet more. Having given all he has to others, he is richer still.”

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply