The August employment report certainly reminded me that forecasting monthly changes in nonfarm payrolls is a dangerous game. A game I will certainly play again, but dangerous nonetheless. I think there is little doubt that this report is not in the “substantial and sustainable” category, which thus points to additional Fed action next month.

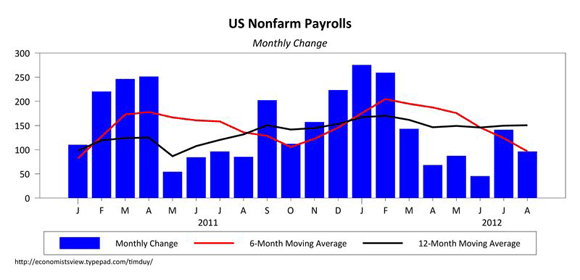

Nonfarm payrolls posted a 96k gain for the month, well below consensus expectations and the low-end of my 110k-290k range (198k midpoint). The numbers for the previous two months were revised downwards. And while the 12-month trend remained virtually unchanged, the 6-month trend is weaker than last summer:

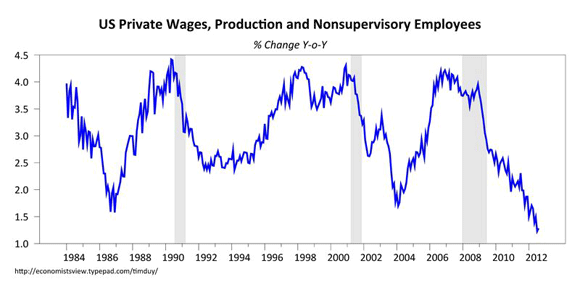

And while I am sure it will not dissuade fears that inflation is just around the corner, hourly wages actually slipped a penny for both all employees and production/non-supervisory workers. The latter category, for which we have a longer time series, continues to plumb the depths of wage growth:

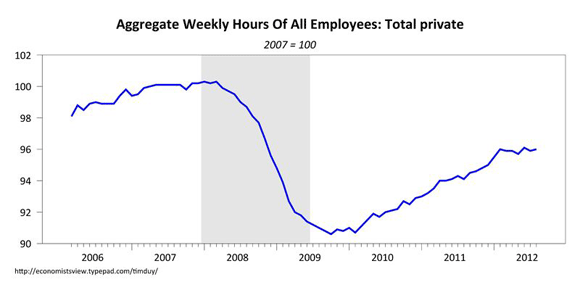

Also note that the index of aggregate weekly hours has largely leveled off this year, in contrast with steady growth in 2011:

Roughly half the net job growth was attributable to health care and social services, manufacturing and government both dragged down the headline, while professional services gained 28k despite a disconcerting loss of 4.9k temp workers. In short, more of the same general lackluster numbers that on average have typified the labor market “recovery.”

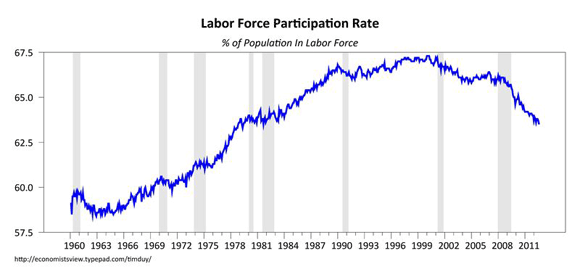

The population survey was also hardly inspiring. The unemployment rate managed to edge down on the back of an exodus of 348k workers from the labor force. Consequently, the participation rate ticked back down:

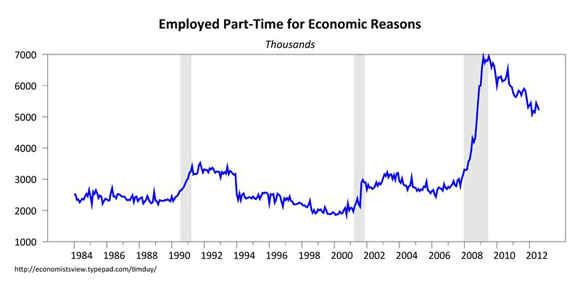

The ranks of both the employed and unemployed fell. Employed part-time for economic reasons fell only marginally, basically steady since the beginning of this year:

Long-term unemployment, an issue specifically noted by Federal Reserve Chairman Ben Bernanke, fell as a proportion of total unemployment, yet still remains very, very high:

Improvements in the long-term unemployment situation have been hard to come by, to say the least.

Bottom Line: Where does this leave us for next week’s FOMC meeting? Given Bernanke’s description of the labor market situation as “grave” and the complete lack of improvement in the most recent report, given Bernanke’s meager defense of the potential costs of balance sheet operations (see Joe Gagnon), given the ongoing European saga (Europe still headed for a deeper recession as more austerity will likely occur in both Spain and Italy despite the ECB) and its impacts on US manufacturing (see Intel today), given the uncertain situation in China, given the increasingly vocal support of Fed doves and marginalization of Fed hawks, given that time is running out for Bernanke with the nontrivial possibility of a Romney win, and given that recent positive data is largely limited to consumer spending, it is hard to come to any conclusion other than to expect additional easing next week. Quantitative easing and/or enhanced verbal guidance, although at this point I imagine they need to go hand-in-hand. In fact, if they don’t ease this time, I think we will need to conduct a fundamental reassessment about what exactly is happening on Constitution Ave.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply