Apple (AAPL) stock today is up more than 2%, at a new all-time high, after winning a $1B settlement against Samsung in its patent-infringement lawsuit. AAPL sued Samsung on grounds that the touch screen technology in many of its smartphones and tablets violates the company’s patents, and the judge’s ruling in favor of the Cupertino-based company sets a precedent that is much more significant than the sizable monetary reward.

Samsung and other device makers now have to go back to the drawing board to examine whether their designs infringe on AAPL patents, leaving AAPL is a strong position heading into the release of its iPhone 5. The new Apple phone was already expected to see extremely high demand, but now, with some of its biggest competitors scrambling to re-make many of its signature devices, the phone should wrestle back an even bigger piece of smartphone market share heading into the all-important Holiday season.

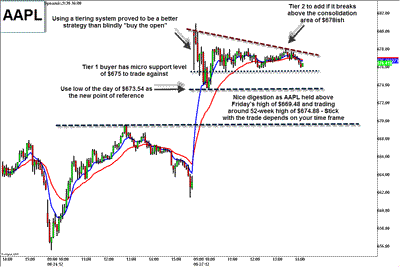

AAPL has been a tremendous trading vehicle for me my entire career, and a great investment vehicle for investors with a long-term strategy. In the past I have written about how to trade Apple in the long and short-term. Last week, I made trades both long and then short in AAPL, first as it broke out to new highs, and then as it displayed relative weakness and exhaustion on Tuesday. Given how well it responded on Wednesday and held up through the end of the week, I bought back into AAPL Friday.

(click to enlarge)

While intraday AAPL is not trading on its highs, it has held and digested the gap well, perhaps readying for a run even higher as investors digest the truly far-reaching implications of the Samsung ruling. Watch the high of the intraday range, and then the opening price, for a break that could trigger further momentum.

Disclosure: Scott Redler is long AAPL, GLD.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply