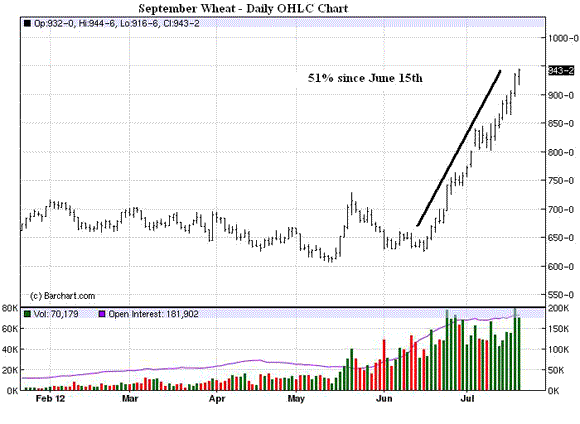

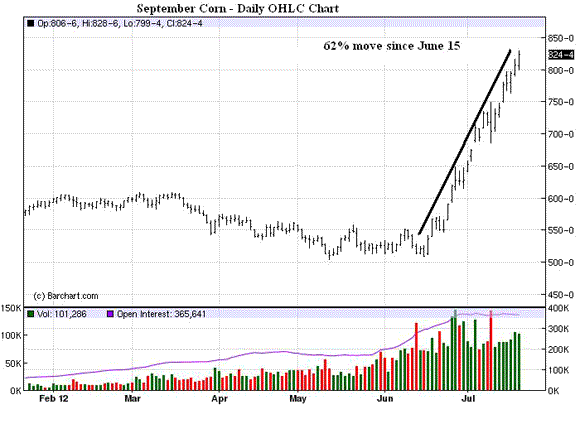

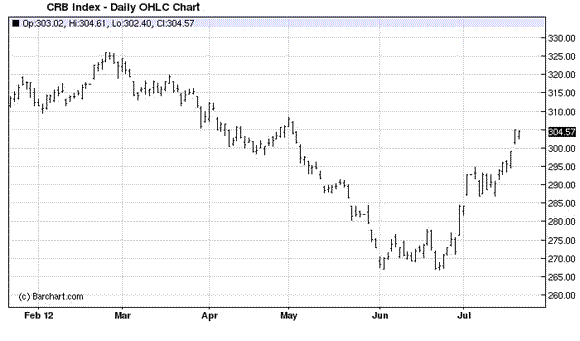

The Fed finds itself extremely unlucky once again as it talks up quantitative easing while food prices, mainly wheat and corn, are making a parabolic and historic move as crops suffer from extreme drought. You can’t prove causation with correlation (or a counterfactual) so is there any doubt the hard money crowd — which, we, by the way, have a favorable bias — will try and make a connection? Note the CRB made its low in June.

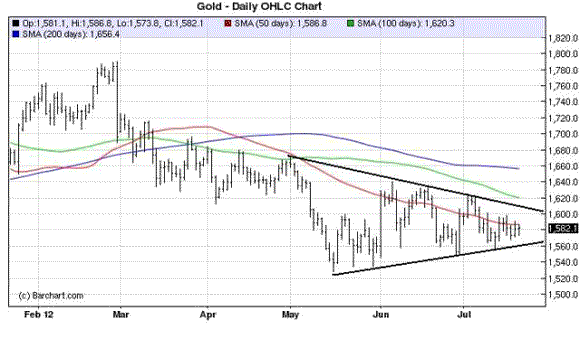

The gold chart merits attention as a big break out of the symmetrical triangle seems likely. The direction? We suspect higher with further QE but it has yet to catch the printing press fever and enthusiasm that has infected equities. If gold can’t move up on another round of Fed balance sheet expansion, the yellow metal could be headed for big trouble, in our opinion.

Stay flexible and stay tuned!

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply