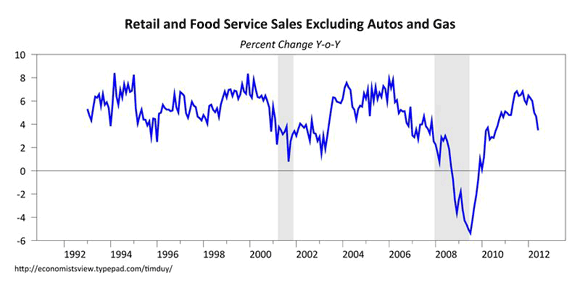

The retail sales number should be a slap in the face for any FOMC members sitting on the fence. Stripping out autos and gas gives us this picture:

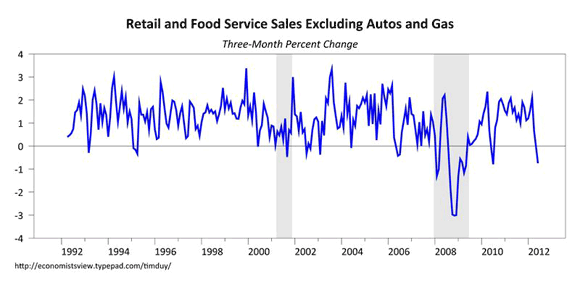

Clearly, sales growth has rolled over. But what is more startling is the pace of the deceleration. The three-month change:

The three-month change is severe, to say the least, and since 1992 unseen in the absence of recession with the exception of the deceleration in June and July of 2010. The deceleration also lends credence to the theory that the jobs slowdown this summer is not entirely an artifact of seasonal variation but also reflects a general softness in economic activity. The rapid downgrades of Q2GDP estimates reflects that softness.

Note, however, that the 2010 slowdown in sales did not foreshadow a recession. But it did foreshadow the Jackson Hole speech and QE2. With that in mind, I would expect Federal Reserve Chairman Ben Bernanke to acknowledge the deceleration of activity when he marches up to Capitol Hill this week. And such acknowledgement would be a signal that more easing is on its way. Moreover, given the pace of deterioration in the data, the Fed may not have time to find any new tricks, and thus be forced to deliver that easing in the form of additional balance sheet action.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply