Data flow continues to support those who argue that if the recession is not already over as of July, it soon will be. The July jobs report – while not exactly cheery news for those still losing their jobs – is another clear indicator that the employment picture is turning. Still, excitement over the end of the recession aside, the data also reveal that the economy is recovering in fits and starts, with tell-tale signals that the consumer orgy of this decade is not likely to be repeated.

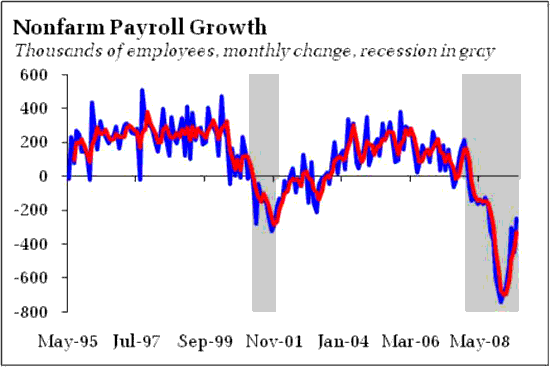

The July employment report in many ways spoke for itself. Possibly most important is the clear improvement in the pace of job losses:

This serves as confirmation of what we already knew from initial claims – the worst damage to the job market is in the rearview mirror. Other positive signs included a rise in manufacturing hours and stability in aggregate hours. To be sure, not all is perfect. The decline in the unemployment rate was driven by an exodus from the labor force – not exactly a sign of improving conditions. And a key leading indicator of employment, temporary help payrolls, continues to decline. If the recession did in fact end in June, and we see evidence of that end in the July industrial production report to be released this week, the decline in temporary help employment is clearly a disappointment. Indeed, coupled with rising production, it would simply reek of jobless recovery.

Other data supported the notion of weak recovery as well. While industrial activity may be close to turning a corner on the back of inventory reduction and the cash for clunkers program, not all is well in the service sector. The ISM read on nonmanufacturing activity actually edged downward for the month, with declines in not only the headline number, but also business activity, new orders, and employment. Better than the freefall of last year, but nothing to suggest that a V-shaped recovery is imminent.

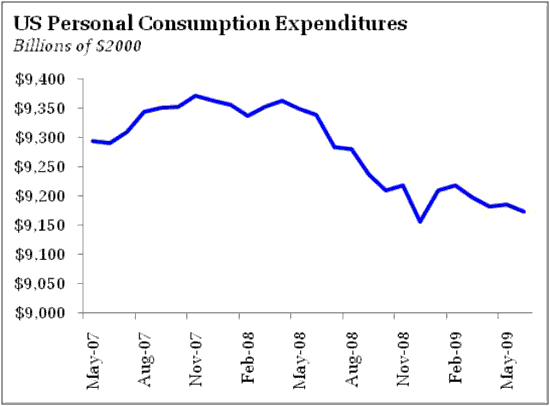

Perhaps the lack of enthusiasm in the service sector is a reflection of what is clearly a subdued consumer. The June personal income and outlays report reveals that consumer spending declined in for the month:

The impact of a weakened consumer is evident in a spate of stories and data during the week. For example, the first read on retail sales for July:

Retailers endured another tough month in July — the worst since January — as weaker consumer spending signaled a tough time for back-to-school sales, the second-biggest retail season after Christmas.

And note that where consumer activity is occurring, it tends to be at a lower price point:

Procter & Gamble Co., under assault by penny-pinching consumers, has quietly rolled out a version of Tide detergent that the company freely admits isn’t “new and improved.”

The product, Tide Basic, is currently for sale in about 100 stores throughout the South. It lacks some of the cleaning capabilities of the iconic brand — and costs about 20% less. Its very existence is one of the most telling signs to date of how the sour U.S. economy is forcing mass marketers to shift course. On Wednesday, the company reported an 18% plunge in fiscal fourth-quarter profits as sales of its premium-priced brands shrank amid tightened consumer budgets.

The decision to develop Tide Basic didn’t come easily. For decades, P&G had held fast to a strategy of promoting new features to convince shoppers to pay a premium for detergent, shampoo and other household staples. Then, as cheaper store brands gained traction in the aisles, P&G began offering lower-priced versions of some products — Charmin toilet paper, Bounty paper towels — to suit leaner budgets.

The trend is not limited to consumer stables. In what I think is an underreported story, the new housing market too is shifting toward the low end:

Frugal first-time buyers are driving the new-home market with purchases of low-priced houses with no frills. Sales of new homes costing less than $200,000 jumped to 47 percent of all transactions in June, up from 39 percent in May, U.S. Commerce Department data show. Homes under $200,000 accounted for almost half of the sales in the first six months of this year, the biggest share for a first half in five years.

It is often forgotten that the composition of new home construction is likely to change as builders shift to producing what people can actually afford, which is very different from what was being produced during the height of the housing bubble. The new housing will yield thinner profit margins for everyone in the supply chain, and will not generate as much wealth when the do appreciate at some point in the future. Moreover, a rebounding new home market for all housing types will place severe downward pressure on existing home prices, as builders will benefit from now lower land and construction costs. The point of which is that a recovery in new home sales is not a recovery for housing or the economy overall.

And if you had any residual doubt that household spending was still challenged, that doubt should be dispelled by the Federal Reserve read on consumer credit:

Consumer credit in the U.S. declined in June for a fifth straight month as banks maintained tough lending terms and households remained reluctant to borrow money for major purchases.

Consumer credit fell $10.3 billion, or 4.92 percent at an annual rate, to $2.5 trillion, according to a Federal Reserve report released today in Washington. Credit dropped by $5.38 billion in May, more than previously estimated. The series of declines is the longest since 1991.

To be sure, the pace of the decline should lessen in July as the impact of the cash of clunkers sales becomes more evident, but this would really be further evidence of consumer weakness – the only way to induce households to loosen the purse strings is to give them free money. Like the improvements seen in new home sales, an ongoing testament to the importance of government spending in keeping the economy afloat. It is not clear that all sectors realize that importance. An interesting local tidbit:

Production has resumed at Monaco RV, eight months after the plant was idled, a spokesman said Thursday.

About 400 workers are back at work at the Coburg factory, producing about seven recreational vehicles per day, said Roy Wiley, spokesman for Illinois-based Navistar International, the new parent company of Monaco RV. He said he wasn’t sure if workers were building towable RVs, motor coaches or a combination of both.

Even though there are no indications that the RV market has begun to recover, Navistar decided to resume production at the plant about two weeks ago because “you need inventory,” Wiley said.

Apparently, Navistar plans to increase inventory on the “if you build it they will buy it” philosophy. But like overpriced housing and luxury goods, RV sales are dependent on cheap credit and bad judgment. At least with a house you have hope of recovering your nominal losses if you hold on long enough; not so with RVs, which are only an exercise in depreciation tables.

The pattern of data and anecdotal evidence on the consumer is that the worst fears of a return to Depression-era spending patterns have not been realized, household have measurably changed their behavior, which coupled with what are likely permanently stricter underwriting conditions, point to a very real structural change in the evolution of economic activity going forward. It is simply increasingly difficult the we can return to a pattern of growth dependent on escalating importance of consumer spending in the mix of economic activity. Structural change is at hand, which will leave some dangerous economic waters to navigate.

Which leads us to the policy event of the week, the Federal Reserve meeting schedule for Tuesday and Wednesday. The subsequent statement will have to address the improving economic data without setting expectations that a rate hike is imminent, or even under consideration for early next year as some suspect. To be sure, there will be some V-shapers on the FOMC looking to role back policy accommodation at first hint of economic growth. But I have to imagine that Federal Reserve Chairman Ben Bernanke walked away with not one, but two basic rules from his studies on the Great Depression and Japan. The first is to respond forcefully at the first stages of a financial crisis. The second is to recognize the fragility of the subsequent recovery and NOT rush to normalize policy, thereby setting the stage for stop-start policy efforts. No one should be under the delusion that the current economic environment is the product of anything other than the massive efforts of federal authorities to keep the system afloat. Low interest rates, support of securitization markets, free money for cars are houses, fiscal stimulus, etc. Bernanke simply will not be inclined to rock the boat at such an early stage of the recovery.

What the Fed is likely to signal is that they do not intend to extend the Treasury purchase program at it expiration:

The Federal Reserve is set to halt its purchases of up to $300 billion in U.S. Treasuries in mid- September as scheduled, and will probably announce the decision next week, two former central bank governors said.

Still, I would not discount the possibility that the program could make a fresh appearance in the future; the future of monetary policy is dependent on the path of job growth. Six months of jobless recovery as the economy limps along could easily prompt the Fed into additional easing. Remember, that was the pattern in the wake of the 2001 recession, a recession that did not end for many until the housing bubble took hold. It is tough to see a fresh domestic bubble emerging, and thus tough to see how sustainable, organic growth develops. And thus tough to see a Fed not more inclined to offer additional gas rather than step on the brake.

Bottom Line: For those still fretting that the economy remains poised for the ultimate end-times collapse, you need to remember the following: In aggregate, nothing truly bad will happen as long as the Federal Reserve can print money and the US Treasury can spend it. We simply have not hit that wall yet (although one can see it coming, as the history of monetary policy for the last two decades is one of diminishing returns – it apparently takes more to accomplish less). At the same token, acceptance of the reality that the recession is set to end does not oblige one to adopt a V-shaped outlook. Far from it, as patterns of consumer spending and labor market activity, not to mention the undeniable impact of government support, all point to a tepid recovery characterized by a jobless recession. Such an outcome, however, will not be proven or denied by the end of the year at the earliest.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

My prediction: Whatever the fed does, it will only make the the economy worse. And if Obama & co. are really serious about restoring the economy, the first thing they must do is to get rid of the fed……the real cause of the New Depression.