Draghi blinks. After dropping the ball and holding rates steady at the last meeting, ECB President Mario Draghi is signalling he is ready to get back into the game. Via Reuters:

The euro zone economy faces serious risks and no inflation threat, European Central Bank President Mario Draghi said on Friday in comments that heightened expectations the ECB could cut interest rates or take other policy action soon.

Draghi also said the ECB stood ready to provide further liquidity to solvent banks, stressing that its provision of ultra-cheap 3-year funds, or LTROs, late in 2011 and early this year had averted a major credit crunch…

…There are serious downside risks here,” Draghi told the annual ECB Watchers conference in Frankfurt. “This risk has to do mostly with the heightened uncertainty.”

I am not so sure about this “heightened uncertainty” line. It seems pretty certain that Spain is in trouble if rates hold at these levels or head higher, and this is the immediate problem. Draghi might have in mind bringing down rates with another stab at the temporary solution the LTROs provided last year. Helpful, but still only temporary. It would be more helpful if he switched gears to outright quantitative easing via government bond purchases (oddly, though, the expectation is that the Federal Reserve will do more than Europe in response to a European problem).

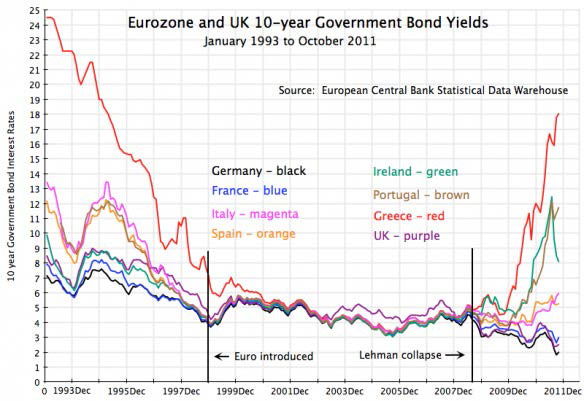

What would be most helpful is a clear signal that the ECB will not let the Eurozone collapse because default fears are driving unpleasant dynamics. Consider this helpful chart from Frances Woolley:

Woolley comments:

The convergence of bond yields after the Euro was introduced reveals that the pre-Euro yield differences were almost entirely based on inflation and exchange rate risk. No one ever seriously considered the possibility that an EU country might not be able to repay its debt. That’s what they were thinking…

Prior to the introduction of the Euro, the presence of independent central banks prepared to serve as a lender of last resort for the fiscal authorities meant that there was no serious default risk. There would, of course, be inflation (soft-default) and exchange rate risk, but no hard-default risk. You can’t really default when you can print the currency in which your debt is denominated. After Lehman, though, the possibility of default appears, and the ECB does nothing to dispel such fears. Moreover, the Greek debt restructurings dispelled any remaining doubts about European sovereign debt – the lack of a central bank backstops means serious default risk.

So now we can’t rule out a possibility of Spanish default, which drives interest rates higher, which in turn increases the probability of default. This of course then feeds into the dynamics for Italy, and then maybe France. The only entity that can break the cycle is the ECB, but they have been so far unwilling to do so, putting the pressure on fiscal authorities to break the cycle. Unfortunately, the job is simply too big and complicated for the fiscal authorities to complete in a timely fashion, especially when running Merkel’s race against the markets.

What we really need is a European Central Bank that can manage exchange rate and inflation risk while also addressing default risk. Without such a fully functional central bank, Europe will at best limp along under constant economic distress. Ultimately, Draghi will need to create such a central bank before the fiscal plumbing is in place if he wants to hold the Eurozone together. Which is why he will always blink first.

Or at least I hope he will.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply