A construction rebound is coming, but it will be a soft rebound, leading to a mild recovery in wood products demand. Although somewhat better times are coming, businesses need to be prepared for the challenges that improved sales bring—it’s not all beer and skittles.

The rebound has to come because our recent level of construction has been unsustainably low. Our population is growing, albeit not as fast as when we attracted lots of foreign immigrants. The increased population triggers a demand for homes, stores, offices and other places to work.

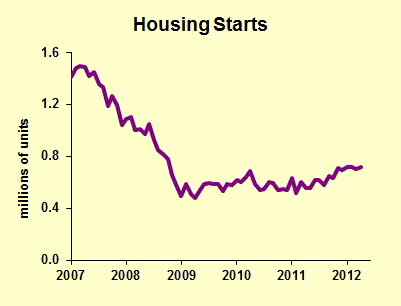

Don’t get too excited about the rebound, because we are not returning to the go-go days of 2005 when we built two million new housing units. However, we need a lot more than the 612,000 we built last year. Further softening the rebound is the steady decline in average square footage of new housing since 2007, down about five percent for single family houses and ten percent for multi-family.

Attitudes have also changed. People now think of a house as . . . a place to live! Young couples are not speeding to home ownership as fast as they can, preferring to rent for a while.

All things considered, construction and wood products demand will improve over the next two years, but not at a break-neck pace. Even the soft rebound, though, will present challenges to the wood products industry.

Sales: are your sales people ready to book more business? You may think so, but don’t be so sure. In slow times, sales representatives get discouraged and too often become order takers. When the rebound starts, the new business goes to young people too inexperienced to know that times are bad.

Staffing: if you’ll need more people when business improves, do you know where you’ll find them? Too many managers are embarrassed to stay in touch with people they laid off, yet those may be the best potential hires in the recovery. Suppose that a manager calls a previous employee and says, “We are not re-hiring quite yet, but we’d like to know if you’re available when we do.” That former worker is going to feel great, appreciated, respected. Even if he or she has found a new job and won’t return, the phone call is a very positive event. More importantly, you can determine ahead of time how much of a challenge you’ll have if you need to staff up.

Vendor Performance: You rely on other companies for materials, which could range from logs to maintenance, repair and operations supplies. Are your vendors ready to deliver? A little work assessing their ability to supply you can help avoid major headaches down the road.

Cash Flow: Orders come in, which is good news. Suppliers may need to be paid in 30 days, and employees definitely must be paid promptly. Are your customers going to wait 60 or 90 days to pay? If so, you’ll be making money on an accrual basis but hemorrhaging cash. Do some cash flow projections now under a moderate growth scenario to see if you’ll need more financing.

This is a great time to do economic contingency planning for stronger sales. Make sure you’re ready, even if the rebound will be soft.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply