As attested to by the large amount of coverage of the recent US-China Strategic and Economic Dialog [0] [1], [2], [3], [4],[5] China looms large in any discussion of the world economy. One of the most important contributors to the informed discussion on this subject was Brad Setser, at the Council on Foreign Affairs and before that at RGE Monitor. Unfortunately, Dr. Setser will be leaving the blogosphere, so his insights will be missed (although fortunately for us, he’ll be adding his input at the NEC, where we all wish him well).

So now, there’ll be even a greater need for reasoned analysis. One addition to the discussion is a Symposium on China’s impact on the global economy just published in Pacific Economic Review (August 2009). From my introductory chapter to the symposium:

Over the past decade, China’s presence in the global economy has grown increasingly large. Along many dimensions, China is, rightly or wrongly, perceived to have an enormous impact. In the trade arena, China is now widely considered to be the world’s workshop, displacing some traditional exporters of labour-intensive goods, even as its economy is ever more closely woven into the fabric of the increasingly fragmented chain of production….

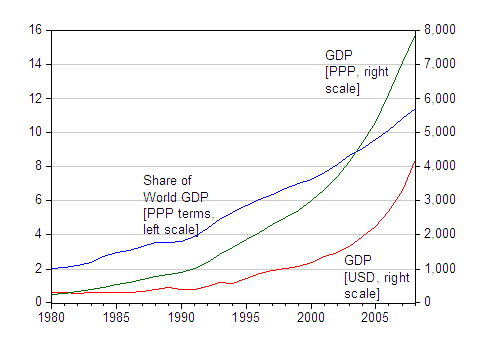

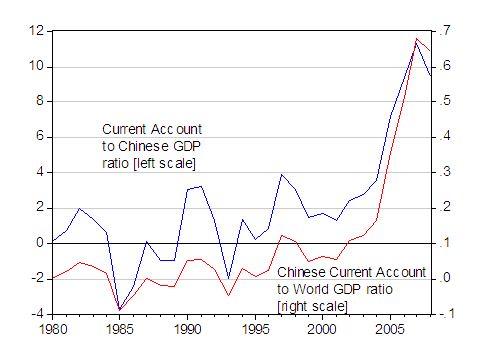

The development of trade linkages has been accompanied by such rapid economic growth that the resulting demand for inputs has driven up commodity prices: at least that is the popular view. China has also become a large net saver in the world economy, as its current account has expanded in recent years. Figures 1 and 2 highlight these trends.

Figure 1: Chinese share of world GDP, in PPP terms (solid line, left scale, in percentage points); Chinese GDP in billions of International dollars (long dashed lines, right scale) and Chinese GDP in billions of US dollars (short dashed lines, short dashed lines). Source: IMF, World Economic Outlook, October 2008. 2008 observations are forecasts.

Figure 2: Chinese current account to GDP ratio (solid line, left scale); Chinese current account to world GDP (short dashed lines, right scale), all in percentage points. Source: IMF, World Economic Outlook, October 2008. 2008 observations are forecasts.

In this volume, our contributors examine several aspects of China’s economic interactions with the world economy. In so doing, they cast some light on the Chinese economy’s prospects.

The contributors include Jeffrey A. Frankel (Harvard University); Steven Dunaway (Council on Foreign Relations), Lamin Leigh (IMF), Xiangming Li (IMF); Charles P. Thomas, Jaime Marquez, Sean Fahle (all Federal Reserve Board); Willem Thorbecke (George Mason University and RIETI), Hanjiang Zhang (University of Texas); Francois Lescaroux (GDF Suez), Valerie Mignon (University of Paris Ouest and CEPII); and Joshua Aizenman (UC Santa Cruz), Yothin Jinjarak (Nanyang Technological Institute). Also in the issue are two other China-related papers, by Michael Dooley (UC Santa Cruz), David Folkerts-Landau (Deutsche Bank), Peter Garber (Deutsche Bank); Yin-Wong Cheung (UC Santa Cruz), Xingwang Qian (SUNY Buffalo). Many of these contributors have had their research discussed on Econbrowser posts dealing with China.

The entire introduction is here, while the table of contents and articles are here. Below are the abstracts from the papers in the symposium.

New Estimation of China’s Exchange Rate Regime (p 346-360)

Jeffrey A. Frankel

The present paper updates the question: what precisely is the exchange rate regime that China has put into place since 2005, when it announced a move away from the US dollar peg? Is it a basket anchor with the possibility of cumulatable daily appreciations, as was announced at the time? We apply to this question a new approach of estimating countries’ de facto exchange rate regimes, a synthesis of two techniques. One is a technique that has been used in the past to estimate implicit de facto currency weights when the hypothesis is a basket peg with little flexibility. The second is a technique used to estimate the de facto degree of exchange rate flexibility when the hypothesis is an anchor to the US dollar or some other single major currency. Because the RMB and many other currencies today purportedly follow variants of band-basket-crawl, it is important to have available a technique that can cover both dimensions, inferring weights and inferring flexibility. The synthesis adds a variable representing ‘exchange market pressure’ to the currency basket equation, whereby the degree of flexibility is estimated at the same time as the currency weights. This approach reveals that by mid-2007, the RMB basket had switched a substantial part of the US dollar’s weight onto the euro. The implication is that the appreciation of the RMB against the US dollar during this period was due to the appreciation of the euro against the dollar, not to any upward trend in the RMB relative to its basket.

Since the paper was written (late-2008), Frankel has observed that the Chinese have essentially reverted to a dollar peg.

How Robust Are Estimates of Equilibrium Real Exchange Rates: The Case of China (p 361-375)

Steven Dunaway, Lamin Leigh, Xiangming Li

Assessments of a country’s real exchange rate relative to its ‘equilibrium’ value as suggested by ‘fundamental’ determinants have received increasing attention. Using China as an example, the present paper illustrates models commonly used to derive equilibrium real exchange rate estimates. The large variance in the estimates raises serious questions about the robustness of these results. The basic conclusion is that, at least for China, small changes in model specifications, explanatory variable definitions, and time periods used in estimation can lead to very substantial differences in equilibrium real exchange rate estimates. Therefore, such estimates should be treated with great caution.

In this article, the authors cover some of the same ground Cheung, Fujii and I surveyed, with largely the same conclusions, but different approaches.

Measures of International Relative Prices for China and the USA (p 376-397)

Charles P. Thomas, Jaime Marquez, Sean Fahle

In this paper we assemble a measure of international relative prices to gauge the average amount by which prices in China and the USA differ from the prices of their trading partners. Our estimated weighted average of relative prices for China and the USA are the first to use the significantly revised purchasing power parities embodied in the price data from the World Bank’s World Development Indicators. Our analysis reveals several findings of interest. First, interactions between the structure of trade and the levels of relative prices are sufficiently important to induce divergences between the weighted average of relative prices and conventional real effective exchange-rate indexes. Second, revisions embodied in World Development Indicators price data generally lower the estimate of US international relative prices. Third, net exports are inversely related to the estimate of US international relative price, but, for China, the correlation is positive. Estimating this correlation for other countries reveals no systematic pattern related to the level of development alone. Fourth, unlike previous work, using our price measures we find that an increase in US prices relative to Chinese prices raises the share of China’s exports to the USA. Finally, there is a distinct possibility of eliminating the long-standing differential in income elasticities of US trade in empirical applications.

The Effect of Exchange Rate Changes on China’s Labour-intenstive manufacturing exports (p 398-409)

Willem Thorbecke, Hanjiang Zhang

Chinese policy-makers fear that an RMB appreciation will reduce low technology exports. We investigate this issue using data on China’s exports to 30 countries. We find that an appreciation of the RMB would substantially reduce China’s exports of clothing, furniture and footwear. We also find that an increase in foreign income, an increase in the Chinese capital stock, and an appreciation among China’s competitors would raise China’s exports. Because Europe is the second leading exporter of labour-intensive manufactures behind China, these results indicate that the appreciation of the euro relative to the RMB since 2001 has crowded out European exports.

These two articles provide different perspectives on the issue of how exchange rate changes impact Chinese trade flows. For recent discussion of this subject, see [7].

Measuring the Effects of Oil Prices on China’s Economy: A Factor-Augmented Vector Autoregressive Approach (p 410-425)

Francois Lescaroux, Valerie Mignon

The aim of this paper is to investigate the impacts of oil prices on the Chinese economy. To this end, we rely on the factor-augmented vector autoregressive methodology, which allows us to evaluate the response of various macroeconomic variables to an oil price shock. Our results suggest that an oil price shock leads to: (i) a contemporaneous increase in consumer and producer price indexes, inducing a rise in interest rates; (ii) a delayed negative impact on GDP, investment and consumption; and (iii) a postponed increase in coal and power prices.

The USA As the ‘Demander of Last Resort’ and the Implications for China’s Current Account(p 426-442)

Joshua Aizenman, Yothin Jinjarak

The present paper evaluates the current account patterns of 69 countries during 1981-2006. We identify an asymmetric effect of the USA as the ‘demander of last resort’: a 1% increase in the lagged US imports/GDP is associated with a 0.3% increase in current account surpluses of countries running surpluses, but results in insignificant changes in the current accounts of countries running deficits. The impact of US demand variables is larger on the current accounts of developing countries than that of OECD countries. We also contemplate China’s current account over the next 6 years, and project a large drop in its current account/GDP surpluses.

Also related are the two other papers in the issue. The first is an update on the Bretton Woods II argument, by my former colleague, Mike Dooley and his coauthors:

Bretton Woods II Still Defines the International Monetary System (p 297-311)

Michael Dooley, David Folkerts-Landau, Peter Garber

In this paper we argue that net capital inflows to the USA did not cause the financial crisis that now engulfs the world economy. A crisis caused by such flows has been widely predicted but that crisis has not occurred. Indeed, the international monetary system still operates in the way described by the Bretton Woods II framework and is likely to continue to do so. Failure to properly identify the causes of the current crisis risks a rise in protectionism that could intensify and prolong the decline in economic activity around the world.

They focus, rightly, on “catastrophic failure of risk management”, on the part of both private and public (my emphasis) sector agents. In other words, they are quite skeptical of what I called the “Blame it on Beijing” meme favored by the previous Administration (see Economic Report of the President, 2009) and many other observers.

The second is by another former colleague, Yin-Wong Cheung and his coauthor:

Empirics of China’s Outward Direct Investment (p 312-341)

Yin-Wong Cheung, Xingwang Qian

We investigate the empirical determinants of China’s outward direct investment (ODI). It is found that China’s investments in developed and developing countries are driven by different sets of factors. Subject to the differences between developed and developing countries, there is evidence that: (i) both market-seeking and resource-seeking motives drive China’s ODI; (ii) Chinese exports to developing countries induce China’s ODI; (iii) China’s international reserves promote its ODI; and (iv) Chinese capital tends to agglomerate among developed economies but diversify among developing economies. Similar results are obtained using alternative ODI data. We do not find substantial evidence that China invests in African and oil-producing countries mainly for their natural resources.

Chinese outward FDI must be a hot topic. Another study, by a former colleague of mine from EOP days, Dan Rosen, has just published China’s Changing Outbound Foreign Direct Investment Profile PB09-14 (with Thilo Hanemann).

By the way, a slightly older but still very relevant, compendium is the volume entitled China’s Growing Role in World Trade, edited by Rob Feenstra and Shang-Jin Wei.

China’s Impact on the Global Economy: A Symposium

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply