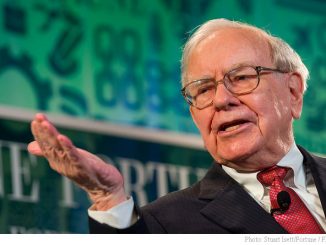

At this year’s Berkshire Hathaway annual meeting, Warren Buffett, the billionaire CEO and the world’s 2nd richest man defended his call for higher taxes: “When Charlie [Munger, billionaire Vice-Chairman of Berkshire Hathaway] and I took this job, we did not decide to put our citizenship in a blind trust.” No, indeed. They put their assets in trusts, so they can forever avoid taxes while preserving their own tax preferred status. Paying taxes is for suckers. But all that changed at this year’s annual meeting. Buffett insists that even billionaires should pay a minimum tax. If necessary–and in his case it is–the tax should be retroactive.

Buffett and Munger have avoided paying taxes by keeping much of their wealth tied up in unsold Berkshire Hathaway shares that have risen in value and made them wealthy men. Their controlling interest in Berkshire Hathaway has allowed them to accumulate a massive cash pile, while they refuse to pay dividends to shareholders, even though they concede that Berkshire’s massive size now hampers its ability to generate more than low single-digit annual growth rates. The reason, of course, is that dividends are taxable, and as shareholders they would receive taxable dividends.

Buffett has further sheltered himself from estate taxes by gifting shares to the Gates Foundation and charitable organizations run by his children.

Retroactive Tax on Billionaires

The multi-billionaire pointed out that he’s avoided tax for decades. Meanwhile he’s accumulated massive wealth that he kept out of reach of the IRS. Buffett insists that as a matter of fairness he should be made to pay more taxes too.

Buffett feels the only way to achieve this is through a one-time wealth tax on the assets of billionaires, even those assets currently sheltered in charitable trusts and offshore vehicles. Compounding tax-sheltered wealth for decades allowed him to amass around $44 billion, and Buffett notes that the 90% wealth tax will still leave him with more than $4 billion. On an ongoing basis, a tax on increases in wealth, including unrealized capital gains, would solve the problem of tax avoiders like him benefiting at the expense of the country as a whole.

Saving Shareholders from Cash and Gold

In other news, Buffett admonished shareholders that cash is the riskiest asset they can hold over time. That’s why he’s accumulated more than $20 billion of it, a record amount of cash on Berkshire Hathaway’s balance sheet. Rather than pay that cash to shareholders as dividends, he’s helping them to avoid both potential taxes and the risk of having this cash in their own hands. Never mind that Berkshire’s future potential for return on assets is hampered by its size, his shareholders must be protected from their own incompetence.

Meanwhile, Charlie Munger told CNBC that “civilized people don’t buy gold.” As supporting evidence Munger highlighted recent gold purchases by Central Bankers.

____

End Note: In response to this emailed question by a reader: “Wait is the whole piece satire or did Buffett actually call for a ‘wealth tax’?” To the best of my knowledge Warren Buffett did not call for a wealth tax, at least not on his own tax sheltered wealth.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply