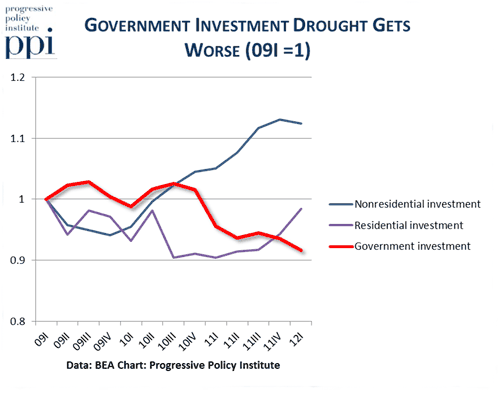

Sometimes things are not what we think they are. The conventional notion is that government has become more important under President Obama, while the private sector has stagnated. Yet in some ways the data tell a different story. Take a look at this chart.

The top (blue) line shows that private nonresidential investment has rebounded smartly since early 2009, when President Obama took office. Residential investment first dropped, and then mostly came back.

The real problem is government investment, which is down 8.3% since the first quarter of 2009, and still falling. In other words, government spending on infrastructure infrastructure, building, and equipment is declining, adjusted for prices changes.

This is just utterly bizarre. In a time when the economy is still sluggish, government investment should be the simplest thing to pump up. We need to modernize our infrastructure and bring government into the 21st century, and it’s just not happening.

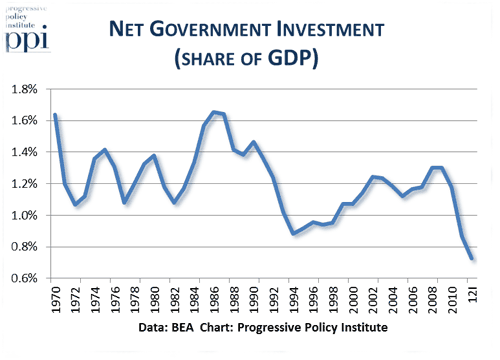

Here’s another angle. This chart shows net government investment as a share of GDP.

According to this chart, net government investment is the smallest share of GDP in more than 40 years, and dropping.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply