Today Eurostat released its official tally of the budget deficits recorded by the EU and eurozone countries during 2011:

In 2011, the government deficit of both the euro area2 (EA17) and the EU27 decreased in absolute terms compared with 2010, while the government debt rose in both zones. In the euro area the government deficit to GDP ratio decreased from 6.2% in 20103 to 4.1% in 2011, and in the EU27 from 6.5% to 4.5%. In the euro area the government debt to GDP ratio increased from 85.3% at the end of 2010 to 87.2% at the end of 2011, and in the EU27 from 80.0% to 82.5%.

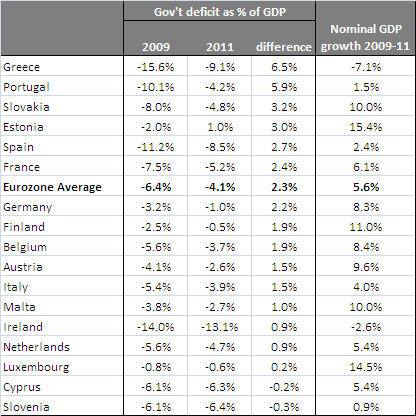

During 2011 the borrowing requirements of the eurozone’s governments fell by about €180bn, of which nearly 60% was accounted for by the two largest economies, France and Germany. But expressed as percent of GDP, it was the countries that have been forced to implement tough austerity measures that were at the top of the deficit reduction list between 2009 and 2011. The following table illustrates.

Greece, Portugal, and Spain have substantially reduced their deficits over the past two years, despite the fact that their economies were stagnant or contracting. And of course, their terrible economic performance can be attributed in large part precisely to those very same austerity measures, as contractionary fiscal policy in each country has depressed their economies. Yet eurozone politicians’ obsession with deficit reduction continues — and continues to have new repercussions every day on the eurozone’s economies and governments.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply