Apple (AAPL) continues to be one of my favorite stocks to trade, especially after it has loosened up in the past couple of weeks. Action like today’s Red Dog Reversal get me excited to talk about the power of technicals, even though many people like to try to say they don’t work.

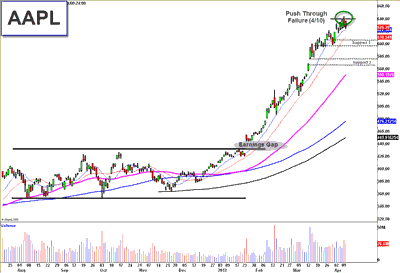

With AAPL reaching almost parabolic levels during Q1, it was hard to chase the stock to the long-side, and I chose to wait until the status quo got shaken up a little bit to trade it. The first chart I put out was a warning chart on April 11th. AAPL began diverging from the markets on that day, which was very unusual based on its tremendous leadership from Q1. That move took AAPL down into its upper floor, and made me think it was poised to break significantly lower.

On April 13th most traders covered into the $605 area as that was the measured move of the short term Bearish pattern.

(click to enlarge)

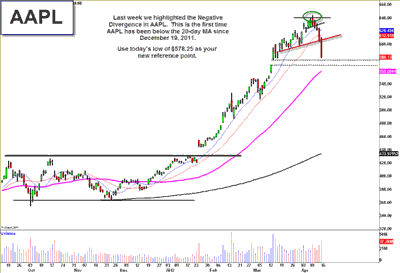

The April 16th chart we sent out outlined support areas to look for action. We trade those action areas based on the strength of the bounce (or lack thereof). I wasn’t in the office yesterday to trade (which may have been a blessing), but it traded down sharply and got little in the way of a bounce.

(click to enlarge)

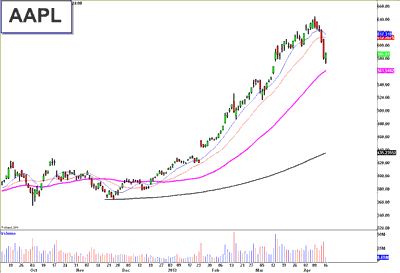

I came back in this morning looking for a buying opportunity for AAPL on a Red Dog Reversal, a trade I love so much I named it after myself!

(click to enlarge)

The pivot to trade against this morning was yesterday’s low of $578.25, and any remaining longs likely got stopped out through those levels and the early push down. Within the first 10 minutes we came back above that level (I was even more aggressive and got in prior to the break back above, still with my stops at the lows). I talked about it in very clear detail live on my Virtual Trading Floor (R) radio, where you could see when I initiated my position in real-time.

The stock right is trading around $596, almost $18 dollars higher than the technical Red Dog Reversal entry. Scalpers will take trades- swing traders might have caught a major inflection point for the stock and taken advantage of a big buying opportunity long-term. Everyone needs to use their own time frame.

Disclosure: Scott Redler is long AAPL, DNKN.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply