Crude oil prices surged last spring following disruptions in oil production from Libya, and had been drifting down during the summer and fall. But since the beginning of October, the price of West Texas Intermediate and Brent crude oil have both risen by over 30%, putting them back up near where they had been last spring. What’s changed in the world since the beginning of October?

Price of West Texas Intermediate, dollars per barrel, weekly Jan 7, 2011 to Feb 24, 2012. Data source: Webstract.

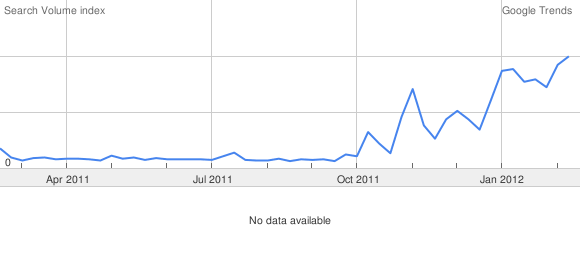

Although conditions in Libya may have stabilized, the possibility of military conflict in Iran has been increasingly discussed, an event which would be hugely important for oil markets. Here for example is a measure of the volume of Google searches for “Iran War”.

Google searches for “Iran war”. Source: Google Trends

The Wall Street Journal suggested that U.S. monetary policy could also be a factor in recent price movements:

Oil staged its last price surge along with other commodity prices when the Fed revved up its second burst of “quantitative easing” in 2010-2011. Prices stabilized when QE2 ended. But in recent months the Fed has again signaled its commitment to near-zero interest rates first through 2013, and recently through 2014. Commodity prices, including oil, have since begun another surge, and hedge funds have begun to bet on commodity plays again. John Paulson says he’s betting on gold, the ultimate hedge against a falling dollar.

Below I’ve graphed the price of oil along with 9 other commodities that I could find quickly on Webstract. Oil increased 22% in the last 3 months of 2011; the next biggest gainer over this period was copper, which was up less than 4%, and most were actually down over those 3 months. Since the start of this year, the metals have climbed, though their gain is still typically less than half that of oil. Most agricultural commodities are still below their levels of the start of October.

Selected cash commodity prices, weekly Jan 7, 2011 to Feb 24, 2012, normalized at Sep 30, 2010 = 100. Data source: Webstract.

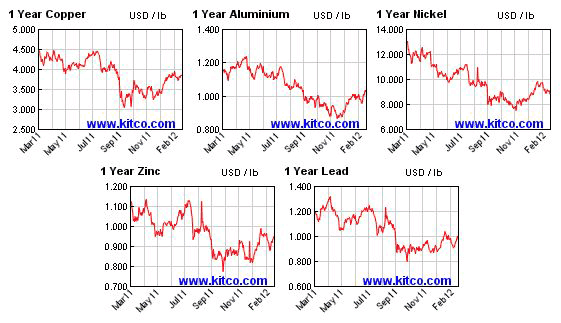

Here are some other metals prices from Kitco, again showing gains since October, but significantly less than those for oil.

Are there factors other than U.S. monetary policy that could have contributed to a modest increase in broader commodity prices since the start of the year? U.S. economic conditions have been improving, and worries about a financial crisis emanating from European sovereign debt problems seem to be weighing less on financial markets. An improving outlook for real economic activity (particularly in Asia, which has been driving global commodity demand) could have made a modest contribution to the price of oil and some other commodities over the last few months.

Yield on 10-year Italian government bonds. Source: Bloomberg

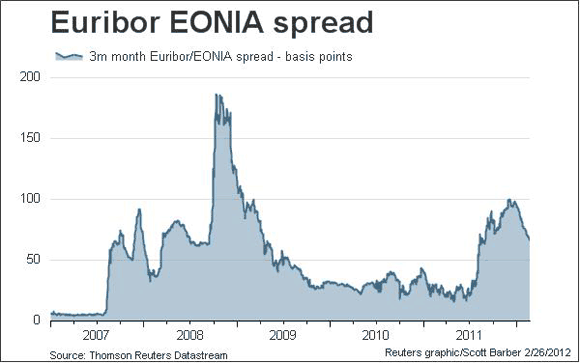

Source: Thomson Reuters

In general, I agree that the Fed needs to keep a watchful eye on commodity prices as one potential indicator that their efforts to stimulate the U.S. economy are having undesirable side effects. But based on the evidence so far, I think the Wall Street Journal is crying wolf a little too early.

Factors in the recent oil price increases

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply