The summer rumbles on with the risk-on orgy intact. After a brief wobble earlier in the day, the SPX closed on its highs of the years, and a welter of bullish strategists send missives with 4-digit price targets and dreams of a sustained V-shaped recovery.

Now, Macro Man is surfing the risk-on wave, especially after jettisoning the non-performing player yesterday who had harshed his smooth since late last week. In the short run, a steady flow of funds into equities and other risky assets will drive prices higher, assuming such flow materializes.

The problem that some so-called perma-bears have is is recognizing the temporary importance of such asset flow, and how far it can push asset prices. By the same token, the problem that some of the flow-of-funds, risk-on crowd have is is failing to recognize that buying something just because other people do is nothing more than an exercise in greater fool theory. And while the market may well be a voting machine in the short run, as Benjamin Graham observed it is a weighing machine in the long run.

Macro Man was debating the long-run outlook for stocks with an FX-only punter yesterday who asked him what he thought “fair value” was. This raises on of the critical issues that a macro punter like your author has with equity markets. It’s gotten to the point that the stock market is so rife with misrepresentation and lies that it’s very, very dificult to get a firm idea of what’s priced in.

Now, the high-lighting the fact that the stock market is full of misrepresentation is hardly breaking new ground, even for this space. But Macro Man does wonder….when Barrry and Gordon take a break from fingering your wallet to try and build a better (financial) mousetrap, why they don’t do anything to address the web of lies, sweet little lies, that surface every reporting season.

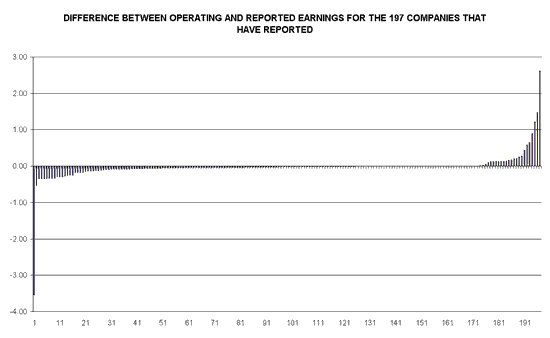

Misrepresentation in corporate earnings statements is rife; according to S&P, of the 197 SPX companies to report this quarter, only a quarter have actually earned the number reported in the headlines. Fully 63.5% stuffed “one-off” or “extraordinary” items in their income statements, while only 24 of the 197 had reported earnings that were higher than headline operating earnings. Interestingly, some of the latter were quite sizeable, courtesy of some of the worst performers of the whole crisis: Z-list financials, Ford, etc. The dispersion graph is shown below.

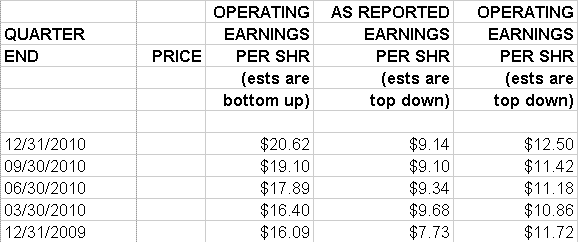

So in valuing equities moving forward, what concept of earnings should we use? Pick a number, any number. Looking at 2010 earnings estimates yield an incredibly broad range of forecasts. If you believe the crack-smoking bottom-up guys who strip out everything that could be construed as a “loss”, you get a resounding $74 pr share. Not bad!

Taking the same approach (stripping out the quarterly “one offs”), but from a top-down framework, yields a substantially less rosy result: earnings of just $46 per share. And actually counting all the turds for what they are on a top-down basis yields 2010 EPS of just $37 per share.

Source: S&P

Remarkable! On this basis, equities are either pretty darned cheap or bum-clenchingly expensive based on 2010 earnings. Gee, thanks. Now obviously, trusting analysts’ forecasts is a treacherous endeavour at the best of times, but it’s small wonder that you have some people screaming “buy buy buy buy buy!!!!” whole others mutter “you guys are frickin’ morons” under their breath (or not, as the case may be.)

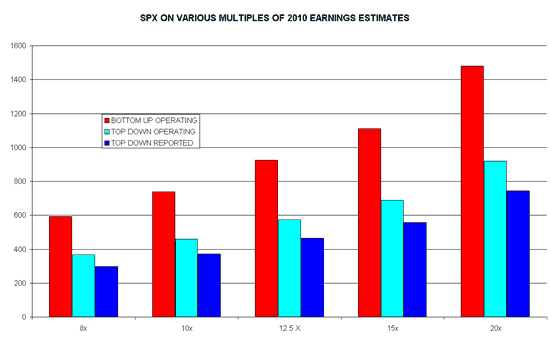

The chart below shows the appropriate valuation for the SPX based on a) the 3 sets of earnings estimates listed above and b) a range of multiples, none of which is completely unbelievable.

This little exercise yields a range of values for the SPX from 300 to 1480. So regardless of where you fit on the bull/bear continuum, there’s probably a forecast here that fits your view. (Macro Man cannot help but observe, however, that all of the top-down valuations are well below current levels.) It’s also a pretty good indication that if someone tells you that they “know” what fair value is for the SPX or equities generally, they’re almost certainly lying.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply