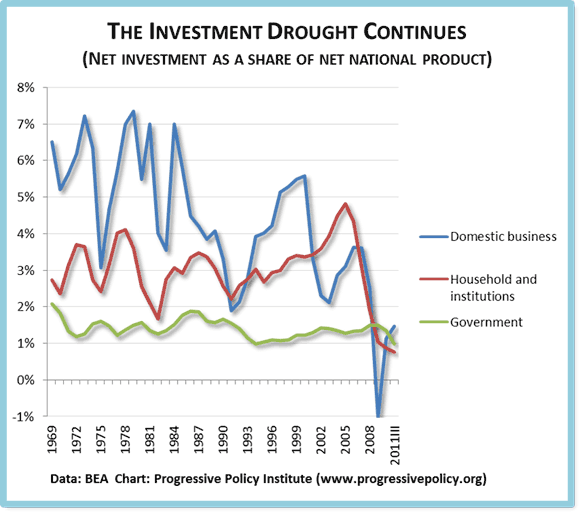

I’m sorry, every time I hear about the need to boost consumer spending I have to stop myself from pounding the table. As we round into 2012, the real weakness in the economy lies on the investment side, not the consumption side. Take a look at the following graph of net domestic investment as a share of net national product (‘net’ means depreciation is subtracted). I consider this graph, which expands on one I gave to the Atlantic, to be my ‘chart of the year’.

This chart, which runs through the third quarter of 2011, displays several disturbing patterns:

- Despite rebounding from its recession valley, net business investment as a share of net national product is still far below historical levels.

- Household and institutional net investment as a share of net national product is at a 40-year low.

- And perhaps most disturbing, government net investment is only 1% of net national product, a 40-year low.

Let me repeat that: Government net investment as a share of net national product is at a 40-year low. I had to check this last one a couple of times to make sure it was really true. This is a true failure of national economic policy. Government is punking out, just at the time when a public investment surge is needed to make up for the private investment drought. As a country, we should be investing more, not less.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply