As noted by David Kotok’s CA firm, today marks the one-year anniversary of Meredith Whitney‘s appearance on “60 Minutes,” when she predicted the apocalypse in the muni market.

Last fall, Ms. Whitney, the analyst who rose to prominence by calling Citi’s (C) 2008 dividend cut, predicted “between 50 and 100 ’significant’ municipal bond defaults in 2011, totaling ‘hundreds of billions’ of dollars.” Whitney told everybody to sell munis right away. Her comments fueled a wave of selling in the $2.9 trillion muni market, prompting investors to withdraw money from municipal bond funds for 25 consecutive weeks.

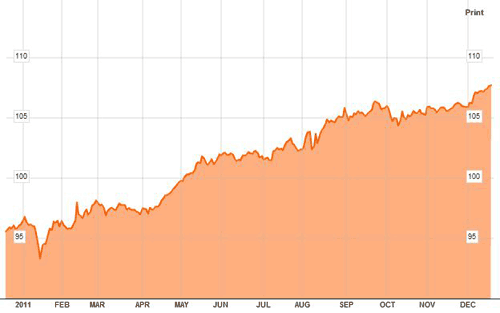

Well, so far, Whitney’s call — particularly for the small-time investors who bailed out of the muni market and then watched it gain — has been spectacularly wrong. As you can see the benchmark iShares S&P National Municipal Bond Fund, with a $2.47 billion market cap, has had a total return of 12.13% YTD (52-wk range 107.74 – 95.85) since Whitney’s “60 Minutes” appearance.

1 year Bloomberg (MUB:US) Chart

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

those defaults are a comin, her timeline was just a little off. but no denying the numbers, with virtually every state insolvent u can only play both ends against the middle for so long

Federal and state government can push the liabilities and the day of reckoning down and thats why the defaults will occur at the county & city levels.