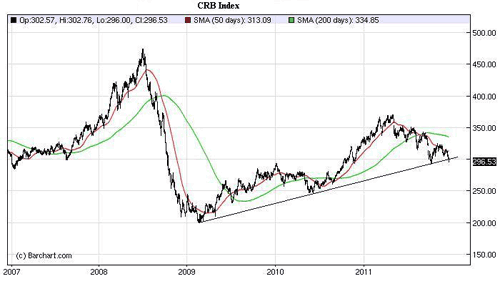

Gold and other commodities got hammered. It hasn’t been two weeks since we thought gold could move to new highs on the back of the announcement of coordinated global central bank support for Europe, which we believed would be followed by the unleashing of the big liquidity bazooka at the EU Summit.

We were so wrong and now it appears the markets believe a full blown liquidity/credit contraction is on the way and are fleeing risk assets. Money is flying out of the emerging markets and as their central banks try and ease the currency pressure they sell their international reserves, which is a big factor in the directional move of gold, in our opinion.

Furthermore, unsterilized currency intervention is a monetary contraction, just the opposite problem of earlier in the year. How the currency wars have reversed.

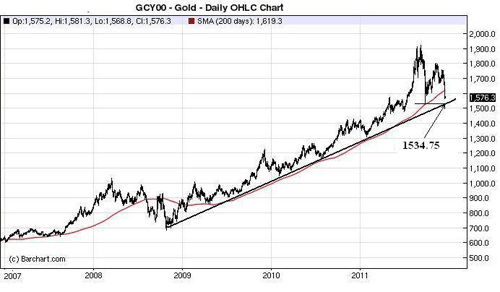

Today’s move puts gold below its 200-day for the first time since early 2009. That makes 1534.74 the next must hold level of support, which is the three year trend line and September low. We’re in no rush to buy anything here.

The macro swans are back in a big way and 2012 is looking pretty gloomy unless, of course, the EU policymakers can somehow reign in their debt crisis and China embarks on another massive stimulus. That hopium, however, has made trading an expensive December.

We have a short bias, in full preservation of capital mode, and basically done for the year.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply