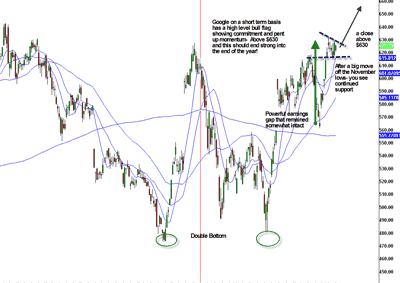

Google is a stock we have talked about all year, and especially since strong earnings in mid-October. While the market has been in a manic state over the last few months, Google (GOOG) held in strong. The stock has looked poised to break out to 52-week highs, and today we are seeing this upper level flag pattern come to fruition.

I think this could be just the beginning for Google. This stock looks ready to explode in 2012. It has become the leader among the high-beta tech names, especially with the weakening of former leaders Amazon.com (AMZN) and Apple (AAPL). Google is much more than search, and continues to take a strong hold on emerging industries like mobile and cloud computing.

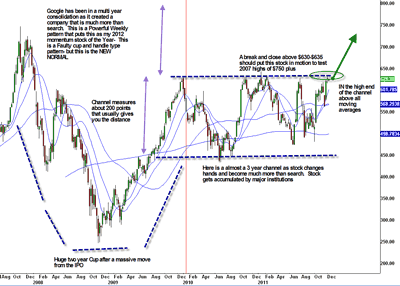

The stock has been in a three-year consolidation with a more short-term upper level flag pattern. Perhaps the reason for the long-term consolidation is the sheer size of the company and anti-trust centered regulatory concerns.

Short-term, there is a bull flag that can give a short-term cash flow above $630. Longer term I see a cup and handle pattern that forecasts a move to 2007 highs of $750.

Disclosures: No relevant position

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply