National Indemnity, a Berkshire Hathaway (NYSE:BRK-a) primary insurance group, sold 7.99 million shares of Moody’s Corporation (NYSE: MCO) this week, lowering its stake in credit ratings provider to 16.98% from 20.4%, according to a regulatory filing Wednesday.

National Indemnity, a Berkshire Hathaway (NYSE:BRK-a) primary insurance group, sold 7.99 million shares of Moody’s Corporation (NYSE: MCO) this week, lowering its stake in credit ratings provider to 16.98% from 20.4%, according to a regulatory filing Wednesday.

Indemnity sold the stock in the open market at prices ranging from $26.6425 to $28.7269, for gross proceeds of $217.6 million, the Form 4 SEC filing said. The sales of about 8 million shares reduced Berkshire’s stake in the New York-based Moody’s to about 40.01 million shares from 48 million. Berkshire paid $499 million for the larger stake.

National Indemnity still owns 24,294,300 mln Moody’s shares while Berkshire’s Geico auto insurance unit owns 15,719,400 mln shares of the outstanding common stock, 10.31% and 6.67% respectively.

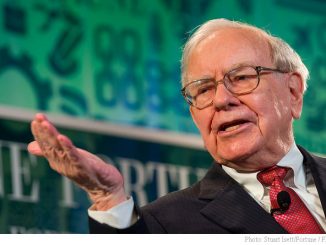

Berkshire’s stake reduction comes three months after Moody’s cut its rating on Warren Buffett’s holding company from triple-A, the top rating, to Aa2, the third-highest investment grade, saying a receding economy and investment losses at insurance operations of Buffett’s holding company have reduced its ability to support funding needs. Today’s SEC filing coincides also with July 21 Obama administration proposed new disclosure and conflict of interest rules for rating agencies. It is not clear yet however, why Buffett lowered his Moody’s holdings.

Many investors fault Moody’s and other top credit rating agencies for doing such an amateurish job on the debt and mortgage ratings game that later prompted the credit markets to freeze.

MCO shares slid $2.72, or 10.26%, to $26.52 in NYSE after-hours trading.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply