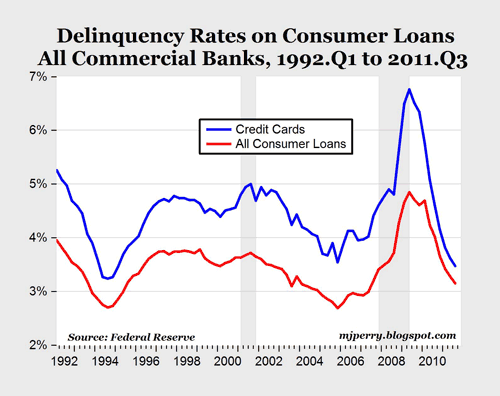

The Federal Reserve recently released data on delinquency and charge-off rates at U.S. commercial banks for the third quarter of 2011. For consumer credit cards, the delinquency rate fell for the 9th consecutive quarter to 3.47% during the July-September period this year, dropping to the lowest level since a 3.46% reading in the first quarter of 2005, more than 16 years ago (see blue line in chart). And before that cyclical low, you have to go all the way back to the first quarter of 1995 to find a lower credit card delinquency rate of 3.46%. Compared to the 4.3% quarterly average since 1992, the delinquency rate on credit cards is now about a full percentage point below the long-run average.

For all consumer loans, the third quarter delinquency dropped to 3.15%, the lowest rate since the 2.99% rate in the second quarter of 2007 before the recession started (see red line in chart). The second quarter delinquency rate is also below the 3.34% historical quarterly average since 1992.

The fact that consumer loan and credit card delinquency rates are back to pre-recession levels is part of the ongoing deleveraging of American households. It’s also more evidence that the worst is behind us. Now if we could just get the Beltway elite to show some of the same financial responsibility that American households have been demonstrating of late.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply