Jefferies & Co star retail analyst Randal Konik is making a potentially very significant call in Aeropostale (NYSE:ARO) upgrading the teen retailer to Buy from Hold with a $20 price target (prev. $12).

The call is titled ‘Upgrading to Buy: We’ve Seen This Movie Before & We Like the Ending’

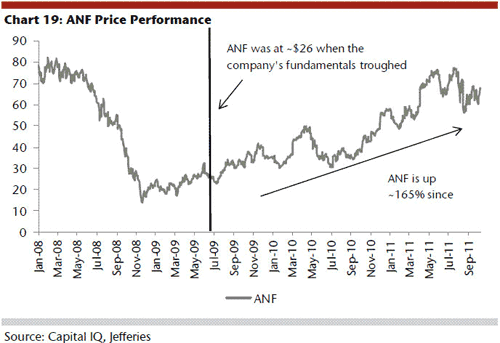

Konik highlights 5 reasons why investors should be buying ARO shares here. Most importantly he believes ARO is currently in a similar position to Abercrombie & Fitch (ANF, $67.98, Buy) when the stock reached trough fundamentals back in early 2009. ANF has since seen a turnaround in its business and its stock increase ~165% (vs. S&P up 35%).

THE DETAILS:

Fundamentals Should Improve. In 2011 ARO has seen slowing sales momentum, loss of market share and margin compression as the company lapped peak fundamentals and faced a tough competitive environment. However, we believe the company is now near trough fundamentals and will begin to see improvement in coming quarters as inventories come more in line with sales trends, ARO laps easier comps and some fashion issues are fixed.

We believe ARO margins are currently near trough levels at an estimated ~4% this year, and we expect margins will begin to improve in FY’13 for the following reasons:

1) ARO brings inventory more in line with sales.

2) Comps begin to improve as ARO cycles past easier compares.

3) ARO aims to correct some mistakes in the women’s business

through an improved color palette and fashion.

4) Sourcing cost inflation abates

This Company Is Not Going Away. We continue to believe that ARO’s business model is intact and that the company will again prove to be a key teen brand. Further the company’s balance sheet and cash flow remain strong despite the tough fundamentals today.

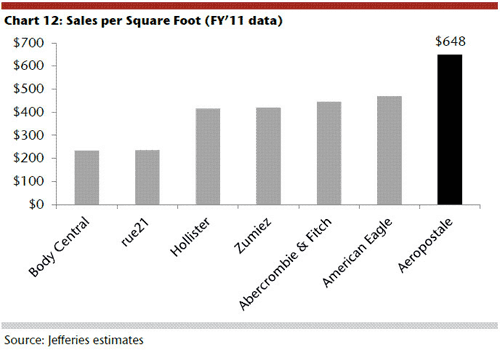

Aeropostale has some of the most productive stores in the specialty retail space. While the sales per square foot metric will be down this year vs. LY, we believe this very high level of productivity shows that the stores are in a cyclical slump, not a secular one.

Aeropostale currently has 5.2m fans on its Facebook page

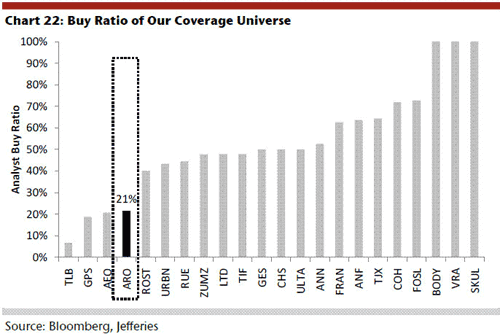

Sentiment is Already Very Negative. ARO has significantly reduced its earnings outlook this year and the stock is down over 50% YTD (vs. S&P down 5%). Further, sentiment is very negative with short interest near 20% of the float and very few buy ratings on the stock.

Back in early 2009, investor sentiment around ANF was particularly negative. This is illustrated by the high short interest and low number buy ratings among sell side analysts. ANF’s short interest as a percentage of the float peaked at ~19% in April 2009 as investors viewed the brand as largely dead and the company’s long term story broken. Analyst sentiment was also quite negative for ANF with less than 30% buy ratings, ~60% hold ratings and over 10% sell ratings.

What We Expect Will Happen at ARO

Investor sentiment around ARO has become increasingly negative this year following multiple downward earnings revisions and slowing fundamentals. We believe many investors view the ARO story as broken (much like they did for ANF in 2009).

This is evidenced by ARO’s short interest as a percentage of the float which has been increasing and is currently at 16%. Analyst sentiment is also negative for ARO with only 20% buy ratings, over 60% hold ratings and almost 15% sell ratings.

Among our coverage universe, ARO’s buy ratio (defined as the number of buy ratings as a percentage of total ratings) is one of the lowest at 21%. This compares to the average Buy ratio among our group of over 50%.

Risk/Reward Now Compelling to the Upside. With the stock one of the worst performing in our coverage universe, we now see little downside risk and meaningful upside in the coming months as margins and top line begin to recover. As such, we view risk/reward as very attractive at current levels.

Notablecalls: I’m calling this one Actionable Call Alert.

Here are my reasons:

1) Konik has done a very good job in ARO. He cut the name to Underperform on Jan 3 when the stock was trading around $25. Straight down. He kept pounding it all the way, ending with a $12 price target in August.

He upgraded ARO to a Hold on August 16 saying ARO had played out to his thesis with significant top-line and margin erosion YTD.

2) Konik compares ARO to ANF in 2009. A wild ride. But he was right. So right.

3) The call reads well and short interest stands at 18% of float. Sentiment is uber-negative so it won’t take much to light up the stock.

I don’t see this thing stopping before it hits $13 in the n-t. I suggest you don’t chase it too high in the pre market and watch for any pullbacks after open to buy.

Longer term? A potential double or more.

(PS: Posting this around open)

Leave a Reply