It takes some time to work through the minutes from the June FOMC meeting. They are, in the words of David Altig, “meaty.” Altig concentrated his remarks on the implications of the Fed’s balance sheet explosion. I found myself pulled to the various economic projections spread throughout the minutes. Do those projections pass the laugh test? Are they realistic? Are they optimistic? Or just plain delusional? I think a little of all those descriptions are accurate.

The staff’s projections comes first, and appear to be what Calculated Risk describes as an “immaculate recovery“:

In the forecast prepared for the June meeting, the staff revised upward its outlook for economic activity during the remainder of 2009 and for 2010…The staff projected that real GDP would decline at a substantially slower rate in the second quarter than it had in the first quarter and then increase in the second half of 2009, though less rapidly than potential output. The staff also revised up its projection for the increase in real GDP in 2010, to a pace above the growth rate of potential GDP. As a consequence, the staff projected that the unemployment rate would rise further in 2009 but would edge down in 2010. Meanwhile, the staff forecast for inflation was marked up. Recent readings on core consumer prices had come in a bit higher than expected; in addition, the rise in energy prices, less-favorable import prices, and the absence of any downward movement in inflation expectations led the staff to raise its medium-term inflation outlook. Nonetheless, the low level of resource utilization was projected to result in an appreciable deceleration in core consumer prices through 2010.

Looking ahead to 2011 and 2012, the staff anticipated that financial markets and institutions would continue to recuperate, monetary policy would remain stimulative, fiscal stimulus would be fading, and inflation expectations would be relatively well anchored. Under such conditions, the staff projected that real GDP would expand at a rate well above that of its potential, that the unemployment rate would decline significantly, and that overall and core personal consumption expenditures inflation would stay low.

Leaving aside inflation (which will stay low over the long term if you assume that expectations remain anchored), the staff upgraded the forecast for 2009, is expecting growth to rebound to potential next year (which, is now less than six months away) and then acce lerate further in subsequent years. Is such optimism justified? Yes and no.

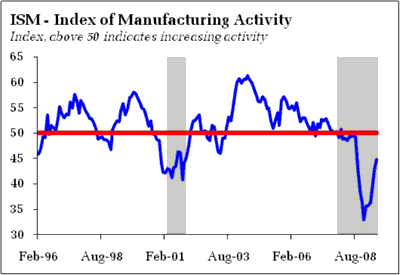

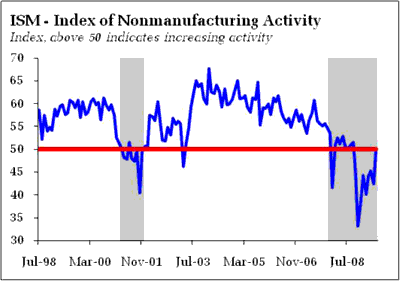

I think it is fair to say that mounting evidence points to the formation of a rather clear bottom in the most recent stage of this economic cycle. Hear I refer to the sharp contractions beginning in late 2008, not to the “official” start of the recession in December 2007. Indeed, I think one would have to be almost blind to not see the clear signals emerging in a wide range of data, such as the ISM data:

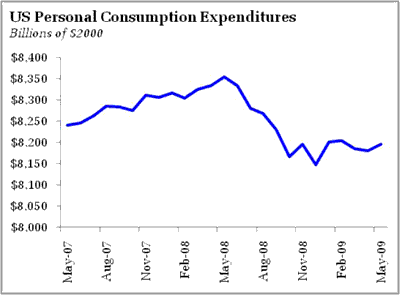

See also consumption data:

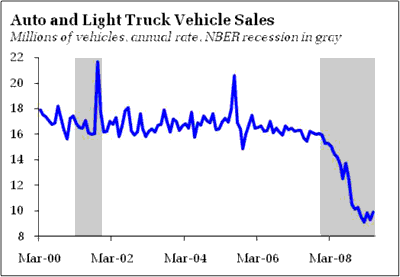

Not to mention to mention the initial claims data (see CR and his caveats). To be sure, one could worry that industrial production continues to fall, but note the rate of decline is slowing and capacity utilization looks to be stabilizing. Moreover, the recent stability in auto sales will lend support for manufacturing in the months ahead:

Notice that the vehicle sales increased 1.3% during the quarter, pointing to a gain in this component of GDP. As always, do not underestimate the data impact of moving from significant declines to just flattening out. With such clear evidence of bottoming out emerging, not only does the near term data get a boost, but downside risks fall – and both point to upward revisions of near term forecasts.

The more interesting parts of the staff’s forecast are in the 2010 and beyond range. The fact that they suggest immaculate recovery, I suspect, is largely a model driven outcome. Econometric models tend to force forecasts back to trend, and, in this case, are likely fighting with a large gap between actual and potential GDP. The only way to close that gap is through rapid growth which would in turn lead to “significant” declines in the unemployment rate.

How should we handicap this optimistic forecast? First off, I would remind readers that the bar has been lowered. The long run growth forecast from the FOMC participants are in the 2.5-2.7% range. While this is not a revision, I think commentators tend to forget how much the bar has been lowered since the late 1990s, when some foresaw potential growth as 4% or higher. Likewise, I believe evidence was building prior to the recession that the corresponding job growth rate is around 100k a month. In other words, 100k holds the unemployment rate roughly steady, rather than the 150k that is commonly suggested. In short, diminished expectations likely help the forecast clear the hurdle of reducing the unemployment rate in 2011 and beyond.

Moving toward the diminished expectation for potential output, I suspect, will not be terribly hard to accomplish. Stabilizing consumer spending itself will go a long way toward keeping GDP growth in positive territory as will just a lessening of the inventory drag. Moreover, fiscal stimulus will add positively over the next year, as will the external sector, especially if China can maintain its current dynamic and a weakened US consumer continues to weigh on import growth. And if consumer and export spending hold together, then investment spending will also cease to be a drag.

That said, positive territory for growth could easily be consistent with an economy limping along above recession but insufficient for any significant job growth, a scenario that remains my favorite. Given that 70% of the economy is driven by consumer spending, I find it hard to believe that you can supercharge growth well above potential without the active participation of households. We know, however, that households continue to struggle under heavy debt burdens which, combined with the now tighter underwriting conditions that are likely to be more permanent than temporary, suggest that spending growth is likely to be constrained sufficiently to prevent supercharged growth. I would imagine that to propel consumption growth to rates consistent with the staff’s forecast, the staff must be anticipating significant real wealth gains sufficient to drive savings rates back to zero. That, I believe imply a housing rebound…which I can’t see unless conditions revert back to the “let’s give everyone one with a pulse a loan” era.

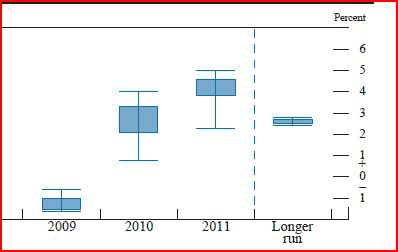

Could the Fed staff really believe that the stage is set for such a rebound? More importantly, could FOMC members? Perhaps some do, at least that is the impression from the growth projections:

The range of growth expectations is quite wide, as noted in this Bloomberg article. Some policymakers are expecting a solid V shaped recovery evolving in 2010, while the other side of the spectrum is looking for a more gradual acceleration to potential growth (the scenario I tend toward). The latter scenario suggests a jobless recovery, with growth insufficient to make much of a dent in unemployment. From a policy perspective, such a scenario points to additional pressure to ease further, complicated by the unknown impact of general balance sheet expansion. It certainly does not point to any rush to unwind the liquidity/credit support programs. The optimistic view implies the opposite, a concern that programs need to be unwound quickly, with a rapid move to normalize interest rates. Until the 2011 forecast comes more fully into view, sometime around the second quarter of 2010, policy will remain in a holding pattern. But note that the wide range of forecasts imply a wide range of Fedspeak, which will lend an irritating feature to the discourse: Seemingly opposite opinions nearly side by side in the press.

A final point: The range of forecasts, both high and low, can be used to argue against another stimulus package as the direction of growth is headed in the right direction. This is especially the case if unemployment stabilizes, even if at a relatively high level. Moreover, note that US Treasury Secretary Timothy Geithner is on something of a world tour, first China, now the Middle East, promising US fiscal restraint:

“Policies of the United States are designed to lay the conditions for a strong dollar,” Mr. Geithner said on Tuesday, adding: “We are very committed … to making sure that as we get through the crisis, we bring down fiscal deficits and we reverse these extraordinary interventions we’ve taken.”

I suspect conditions would need to deteriorate markedly in order to force the Administration to push a fresh round of stimulus. That is not the Fed’s projection.

Bottom Line: Clear signs of a bottom are an obvious reason to stabilize and boost near term forecasts. Still, the Fed staff’s projections appear overly optimistic, seeming to imply that future dynamics will be very similar to the past. I am skeptical. Remember to take forecasts relative of potential GDP in context of diminished expectations. The wide range of projections speaks to an interesting spectrum of Fedspeak in upcoming months. The game will be to track the data, being wary not to read to much into a short-lived bounce off the bottom. I side with the low end of the FOMC forecasts; call me a pessimist. Place your own bets, being prepared to adjust with the data.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply