Sigh, redux. For all the sturm und drang surrrounding the GS earnings release yesterday, the banner report was met with a collective yawn. It looks as if the whisper number of nearly a fiver per share really was in the price, courtesy of Monday’s squeeze-a-thon.

No, the real surprise came via the fact that every other company reporting yesterday, including heavyweights like J&J and Intel, beat expectations. Thus far, 10 of 13 firms have exceeded estimates, a slightly higher ration than usual (albeit in a tiny sample size.) Thus far, Macro Man’s expectation of a disappointing non-bank earnings season has been wrrrooonnnggggggg.

Fortunately, his portfolio management style involves buying cheap hedges in the event that his base case falls through. (Years as a professional forecaster taught him how difficult it actually is.) So while he had his largest short equity delta of the year on Friday, he now finds himself modestly long. Bizarrre.

In any event, anyone who waited to sell the head and shoulders neckline breaks in just about any market going is now offside. This, combined with the earnings beats and looming option expiry on Friday, could potentially engineer a nasty squeeze into the end of the week. If not, Macro Man will have to decide what to do about his theta bill.

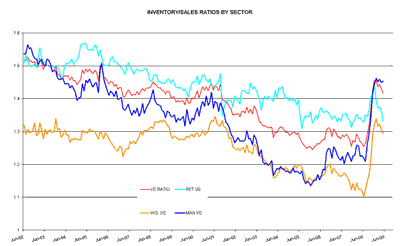

In any event, there was an interesting nugget in yesterday’s business investories that Macro Man would like to throw open to discussion. A record level of inventory unwinding has finally put a cap on inventory/sales ratios, sending them lower across the supply chain rom their early-year peak. An H2 inventory build is close to inevitable, though Macro Man continues to believe that that is a pretty flimsy foundation for a sustainable recovery in an economy as consumer-dependent as the US.

In any event, if we break I/S ratios down, we find that the further up you go in the supply chain, the less of a correction there has been. Retail ratios, seen in the aquamarine line below, have corrected quite a bit and are now within hailing distance of their pre-crisis lows. Wholesale inventories have also nudged lower, yet remain close to their highs. And the manufacturing inventory/sales has barely budged. Might this mean that re-stocking entails less actual production than envisaged? Inquiring minds want to know…

In any event, other than the little post-Intel pop in Spoos, the last 24 hours have felt very summery indeed (at least market-wise; it’s raining like the middle of November here in London.) Market lethargy is epitomized by EUR/USD, which, depending on which source you use, has traded on a 1.39 handle on 25 of the last 26 trading days. Ugh…..just ugh.

Among the culprits for EUR/USD’s inability to move is reportedly your author’s old chum Voldemort, who, after ramping EUR in May and June, is now content to trade (or, depending on your perspective, define) the range.

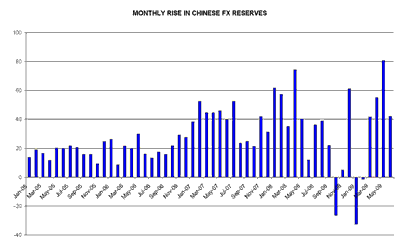

Sadly, these turkeys have once again become a fact of life in G10 FX after FX reserve accumulation started to tick up again. Indeed, Merrill’s Steven Pearson reckons that Voldy and co. sold $28 billion against stuff that moves last month. Yowsah!

As you can see, Voldemort has not quit taking the piss: far from it. In fact, China’s FX reserves rose by a record $80 billion in May, though that fell to “just” $40 billion last month. To be sure, some of that rise represents valuation effects, but those pale in comparison to the extent of the actual USD/RMB purchases required to keep the yuan woefully undervalued.

And given the famous difficulties that the MOF and PBOC have had recently in flogging paper at uneconomic levels, you can be damned sure that a fair amount of this intervention has gone unsterilized. This, combined with the “lend or else” diktat from on high, has helped spur China’s M2 growth to 28.5% y/y, the highest in nearly 20 years (which ended…poorly.)

Unfortunately, in an act reminiscent of Gordon Brown Stalin, the early 90’s data has been wiped from the historical record. A cynic might suggest that this is because China’s leadership doesn’t want to remind people that one upon a time, money growth was this high and it didn’t end well. Judge for yourselves.

In any event, it’s looking increasingly like the “miraculous” recovery in Chinese growth and equities is simply the result of cranking the ol’ printing presses 24/7. While this seems highly likely to end in a banking crisis, hey- at least Voldy has plenty of FX reserves with which to recapitalize the banking system.

In the meantime, Macro Man is left pondering; given the complaints from the Chinese and others about economic management in the US and elsewhere, where are the moans about the true world champion of money-printing, Helicopter Wen?

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply