It’s hard to be optimistic about the economy, and my own economic forecast is fairly conservative. I look for optimists, but can’t find any. The closest thing I’ve found is three contributors to The Wall Street Journal’s survey who expect GDP growth of four percent or a little better. Given our current gap between actual and potential GDP of over eight percentage points, a four percent growth rate isn’t much.

Even though I’m not optimistic, I think the economy does have upside potential. There’s enough of a possibility of a stronger economy that companies should engage in economic contingency planning for such a scenario.

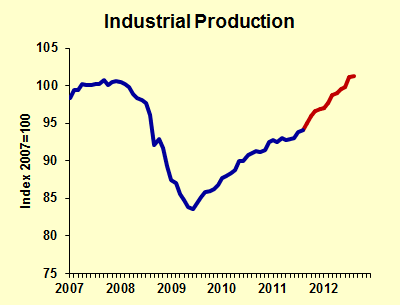

Here’s how we tell an upside story for manufacturers and industrial distributors. Industrial production peaked in December 2007, then in the recession dropped 17 percent. Since the bottom, production has recovered ten percentage points of the drop.

How do we get an optimistic story from this? We had decent growth of industrial production from June 2009 through June 2010. If we could return to the growth rate of that 12-month period, we’d blast through our old peak level of output in July 2012, less than a year from now. Businesses would find that they lacked capacity for all that activity, and they would order more equipment, computers and buildings. In fact, once we were on a trajectory to regain the old peak level of output, companies would anticipate capacity shortages and start buying new equipment. We don’t even need 12 months of solid growth, just six months or so.

In the chart, the period of moderate growth comes right after the trough. I call this moderate growth rather than strong growth because the rate of gain is smaller in absolute value than the rate of decline during the recession. The future period is shown in red, and tracks exactly the month-to-month percent changes from the period of moderate growth.

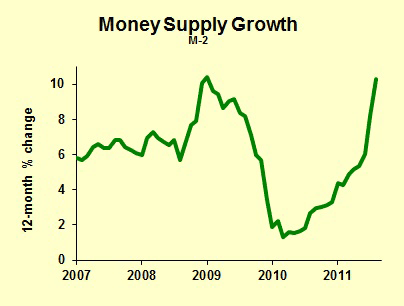

OK, so we need six months of moderate growth, rather than the crummy growth we’ve actually been getting. What could trigger stronger growth? The best candidate is the rapid growth of the money supply that we’ve been getting.

The strong growth in industrial production began about seven months after the strong growth in the money supply that the Federal Reserve engineered during the financial crisis. Monetary policy normally works with a substantial time lag. We are now in another period of rapid money supply growth, which could well give us strong production growth in three to nine months. (As a number of commentators have said, some of the money supply growth may be hot funds leaving European banks for the safety of the United States. Some of it may also be U.S. corporate funds that would have been swept into other overnight non-bank assets, but are not now due to regulatory changes allowing payment of interest on demand deposits. I have not heard a credible estimate of the magnitude of this effect.)

I’m not at all convinced that the optimistic scenario I’ve sketched out will come to be, but I am absolutely convinced that it’s possible and warrants some consideration in corporate planning discussions.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply