In the previous post I sketched out the origins of the eurozone crisis, and argued that powerful systemic forces, not irresponsible behavior, pushed the periphery countries toward crisis – and may well have done so no matter what the peripheral EZ countries had done. The common currency encouraged (in fact, was designed to encourage) large-scale capital flows from the EZ core to periphery. We know from experience that such “capital flow bonanzas” are susceptible to sudden changes in investor sentiment, and very often come to a sudden stop. The sudden stop in this case happened in 2009 (exploring the specific reasons for that stop is interesting, but will have to wait for another day), made it difficult for the periphery countries to roll over their debt, and thus caused a crisis.

But note that other aspects of the common currency meant that the odds were stacked even more heavily against the peripheral EZ countries. Euro-adoption not only set the stage for the crisis by encouraging a capital flow bonanza to the EZ periphery; it also made it impossible for the periphery countries to deal with the sudden stop to those capital flows if and when it came. In his excellent recent paper (pdf), Paul De Grauwe has pointed out that the adoption of the euro by Europe’s periphery effectively caused them to be “downgraded to the status of emerging countries”, in the sense that they could no longer issue sovereign debt in their own currency. This made those countries peculiarly vulnerable to changes in investor sentiment. As Paul Krugman recently put it, thanks to the common currency, the periphery countries lacked the tools to manage their balance of payments.

Given that, the heavy firepower for dealing with the crisis necessarily had to come from the rest of the EZ, i.e. the core (by which I generally mean Germany, France, Benelux, Austria, and maybe Finland). But does this understanding of the origins of the crisis tell us anything else about proper policy responses?

Immediate Implications

1. Being judgmental is not helpful.

One of the objections raised by some who oppose support from the EZ core to the periphery is that such a bailout of the periphery countries may just encourage future irresponsible behavior. The periphery behaved badly, according to that argument, must pay the price, and clean up its own mess.

But if the very structure of the common currency area contained the essential ingredients for this crisis, and if the easy answer (namely, that the crisis is due to the irresponsible behavior of the periphery countries) is not the right answer, then such an argument no longer works. Since the crisis was largely the result of forces outside the control of the EZ periphery countries, it’s not appropriate to try to punish those countries through the bitter medicine of insufficient assistance. In other words, this crisis should not be turned into a morality story.

2. Austerity is not helpful.

Severe fiscal austerity by the periphery EZ countries has been the condition attached to assistance from the core EZ. But that austerity requirement brings with it several problems.

First, it is largely counterproductive with respect to reducing annual deficits; a simple textbook example illustrates how fiscal contraction during a recession will typically fail to meet deficit reduction goals, because the austerity itself makes the recession worse. That’s exactly why Greece keeps missing its deficit reduction goals – not because they aren’t trying hard enough, but because it’s inherently almost impossible to balance a budget through austerity during a recession.

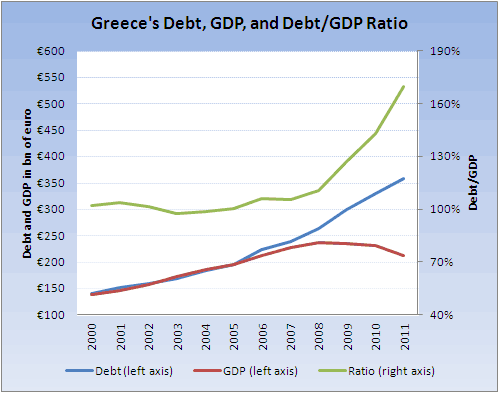

Second, austerity is completely counterproductive with respect to reducing debt burdens. As the economy shrinks thanks to austerity, the debt burden skyrockets relative to the country’s income. Just look at the debt, GDP, and debt-to-GDP ratios for Greece to see how that works. It’s no wonder that it has recently become crystal clear that Greece will never have enough income to repay this level of debt. (Note: data from Eurostat; 2011 figures are forecast.)

But finally, and most importantly in the context of this analysis, austerity shifts most of the burden of dealing with the crisis onto the EZ periphery countries. And that means that citizens of the core EZ countries like Germany, France, and Benelux are essentially getting a free ride.

All of the members of the EZ have enjoyed the benefits of the common currency; that’s apparent simply from the fact that they have worked so hard to construct and maintain it (recent evidence notwithstanding). Many of those benefits are political, but some are baldly financial as well: the large capital flows from the EZ core to the periphery during the years 1999-2007 are evidence that investors in the core EZ countries enjoyed and took full advantage of the high returns they could get on new investment opportunities in the periphery. Furthermore, the capital outflows from the core meant that the core EZ countries had to run current account surpluses; they have been able to enjoy significantly stronger exports for the past 10 years thanks to the euro.

But there is a fundamental asymmetry that goes along with international capital flows: the country on the receiving end risks a serious financial crisis when that flow stops, while the country that is the source of the capital bears no similar risk. In other words, the periphery of the EZ bore the bulk of the systemic risks inherent to the common currency area, while the benefits were shared by both the core and the periphery. In a sense, the periphery countries “took one for the team” when they allowed themselves to be placed at risk for the greater good of the entire eurozone. Given that, it doesn’t seem appropriate that the burden of solving the crisis should be placed so overwhelmingly on the periphery countries that had such little control over the crisis to begin with. Trying to solve the crisis primarily through austerity is thus just plain unfair. (I’ll have more details about the relative cost of the crisis to the core and periphery EZ countries in an upcoming post.)

3. Shared responsibility is very helpful.

The opposite of trying to solve the crisis through austerity – which places the burden of escaping from the crisis on the periphery countries themselves – is for the core EZ countries to substantially share the cost of getting out of this mess. Once it is clear that the systemic risk of crisis that came along with the creation of the euro was borne disproportionately by the EZ periphery, while the benefits of the common currency were enjoyed by both core and periphery, the calculus of how to respond to the crisis changes. In that context, substantial assistance from the core to the periphery in response to the crisis is not only helpful, but can in fact be viewed as the responsibility of the core EZ countries. The degree to which they choose to accept that responsibility – and pay for it – will determine how the crisis is resolved.

And let’s not kid ourselves about something: policy-makers in Europe know exactly how the crisis can be solved. It’s not a mystery that if the core EZ countries contribute sufficient funds to finance Greece’s debts for the foreseeable future, accept a substantial write-down on the amount owed by Greece, and provide funds to recapitalize banks in Greece and elsewhere in the EZ, then the crisis will be over. So the question is simply whether the core EZ countries are willing to pay that required price. If they are, then the EZ will remain intact. If not, it will not. The current debate going on among European policy-makers is simply the unpretty process of figuring out the answer to that question.

After the Crisis

Suppose that at some point the EZ emerges from this crisis. And let’s be as hopeful as possible, and further suppose that the EZ emerges more-or-less intact, i.e. with most or all of its member countries still exclusively using the euro. What then?

The problem is that the logic that led to this crisis will not have changed. At some point, if financial integration and convergence between the core and periphery is to resume, there will once again be capital flows from the EZ core to the periphery. It might take 10 or 15 years, but investors at some point will regain confidence and once more try to seek out the higher returns that are available in the periphery countries. And the recipients of the resulting capital flows will once again be vulnerable to a sudden stop. And they will once again lack any policy tools to deal with it when it happens. So can anything be done to fundamentally make the eurozone system more stable?

A few thoughts come to mind.

1. Impose policies to reduce capital flows.

Every financial crisis seems to generate renewed suggestions from economists that it might make sense to use policy to slow down international capital mobility, and this one should do the same. The most famous incarnation of this idea is the Tobin Tax, the suggestion put forward by Nobel prize-winning economist James Tobin in the early 1970s that each international transaction (in his case he was specifically talking about currency transactions) be subject to a small transaction tax. This would make investors think more carefully and move more slowly both into and out of international capital markets.

2. Make explicit institutional changes to explicitly support the EZ periphery countries ahead of time.

One of the reasons that this crisis has gotten so bad is that the EZ periphery countries lacked any tools to deal with it, largely because in a common currency area they have no central bank to fall back on in the event of a liquidity crunch. This problem can be solved, however, through a number of steps. For example, if the ECB promises to provide unlimited liquidity to any EZ country that needs it. Yes, the Maastricht treaty would probably have to be amended. And yes, such a policy could potentially be expensive for the core EZ countries. But crucially, it would be a mechanism for the EZ core to carry its share of the burdens that come with the currency union. Paul De Grauwe’s paper suggests other institutional changes that would help. But details aside, the point is basically quite simple: one way or another, if the eurozone is going to survive in the long run, there needs to be a recognition that since all members benefit from the common currency, all will have to pay the price of dealing with its vulnerabilities when they arise.

3. Restrict the eurozone to the core.

If the core EZ countries are simply not willing to accept the burden of substantially footing the bill to clean up the mess left by a capital markets crisis, then the only real remaining solution will be to make sure that all of the countries using the euro are similar enough that there won’t be any large-scale capital flows from one to another. If there are no significant and systematic capital flows within the EZ, then the likelihood of crisis goes away. The remaining eurozone would probably be half of its current size; but it would be stable.

The basic choice that policy-makers face is therefore fundamentally the same in both the short-run and the long-run: the core EZ countries need to be willing to pay a substantial portion of the cost of fixing the current mess, and they need to be willing to remain on the hook for any similar future events. In return, they will be able to continue enjoying the substantial political and economic benefits that the euro has brought them. If they decide that it’s not worth the price, then the eurozone will not continue to exist in its current form for much longer.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply