If you haven’t paid much attention to global markets this week, here’s what you missed…fears that the global economy is dangerously close to a recession due to the financial crisis in the eurozone and flatlining growth in the U.S. sent assets of all shapes and sizes into a tailspin.

Among the E7 and G7 countries, only two markets increased for the week—Pakistan (up 2.2 percent) and Japan (up 0.5 percent). Russia (down 12.2 percent) and Indonesia (down 10.7 percent) were the leaders in the opposite direction. The average return for the 14 countries was a 5.7 percent decline.

Many investors have used gold and other commodities as a haven from recent volatility, buoying prices while equities sunk, but even those investments weren’t immune to the wave of selling. Silver was hit the hardest, falling nearly 24 percent, with copper (down 16.5 percent) and platinum (down 11.2 percent) not far behind. Gold and oil were down roughly 9 percent and the yellow metal was down more than $100 during intraday trading on Friday.

The U.S. dollar, in contrast, was up 2.2 percent. Much of the dollar’s rally came after the Federal Reserve announced the creatively named “Operation Twist” on Wednesday. The Fed will sell $400 billion of short-term securities and buy an equal amount of long-term debt. The goal is to push down long-term interest rates, which would spur economic activity.

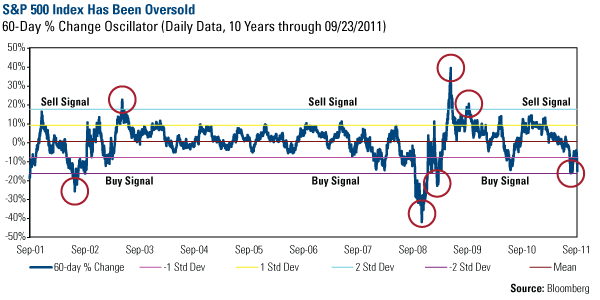

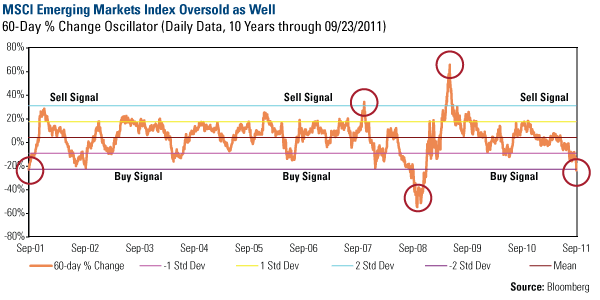

As a result of this week’s actions, the S&P 500 Index is just slightly below two standard deviations from its mean over the past 60 trading days. The MSCI Emerging Markets Index is at a similar position, just greater than two standard deviations from its mean over the same time period.

The two charts above illustrate how rare two standard deviation events are for these markets. Over the past ten years, 60-day percentage changes to the downside of this magnitude have only occurred just over 5.4 percent of the time for the S&P 500 and 4.8 percent of the time for MSCI Emerging Markets.

This rare territory is often called “oversold” by traders and portfolio managers. That simply means too many investors have sold their holdings in a condensed timeframe, driving the price down more than its historical average.

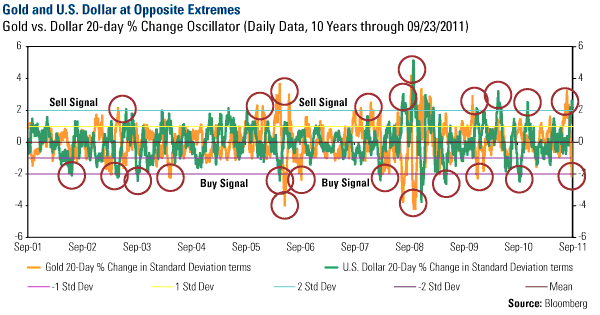

Take a look at the gold/U.S. dollar relationship, for example. Over the past 20 trading days, gold has dropped 8.7 percent while the U.S. dollar appreciated by 6 percent.

This week’s moves are even rarer for gold and the U.S. dollar. The U.S. dollar has experienced similar upward moves only 3.5 percent of the time over the past decade, while similar declines in the price of gold have happened roughly 4 percent of the time.

I point this out because markets have historically reverted back to their mean after crossing into extreme territory, creating a “buy” or “sell” signal for the asset. This gauge has proven a reliable indicator for our investment team as it seeks to limit downside risk and take profits when assets have experienced a big run.

Since mid summer, our investment team has sought to limit exposure to downside risks by raising cash levels, selling mid-caps to buy large-cap companies and downsizing positions in cyclical areas such as industrials while increasing those in more stable areas such as consumer staples. This week’s market volatility provides an opportunity to selectively invest cash and redeploy capital.

The market’s reaction to the Fed announcement is indicative of how little confidence investors have in policymakers in controlling what appears to be an escalating situation. More than half of investors and analysts surveyed believe a global recession is imminent.

While we certainly recognize the current downside risks for the global economy, we think it’s worth noting that investor sentiment and emotions can be significant market drivers, but the math of the market indicates we are probably at an extreme and a price reversal is likely.

One of these is the Conference Board Index of Leading Economic Indicators (LEI), which our director of research John Derrick highlighted for you in last week’s alert. The LEI, has historically been a good predictor of economic growth as it measures peaks and troughs in the business cycle. Despite it being one of the most volatile months for equity markets in recent memory, the LEI increased more than expected during August. In addition, initial July figures were revised upward. ISI Group said in a report on Thursday that “the LEI is not flashing any sign of an impending recession.” In addition, the firm also expects a modest gain for the September jobs report. ISI calls America’s jobs outlook “capital market’s most important economic statistic.”

These are positive developments, but we’re not out of the woods yet. The U.S. economy will continue to inch its way forward over the next one to two years and U.S. companies and consumers must adjust to this low-growth environment. It’s critical investors identify the companies that will successfully compete in this environment.

We believe America is up to the challenge.

John Derrick, director of research, contributed to this commentary.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply