In response to Obama’s proposal (pdf) to let the Bush tax cuts expire for high-income households as one of the ways to close the budget deficit in future years, I’ve heard and seen a number of commenters assert that there simply aren’t enough people at high levels of income for that particular idea to make much difference to the federal budget deficit. Are they right?

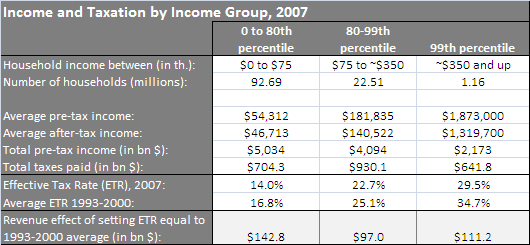

Here’s a table that I constructed using data from the CBO on income and taxes paid by income group. (The data goes up through 2007.) I divide US households into three categories. The first includes all households making under approximately $75,000 per year — that’s the bottom 80% of the income distribution, and includes about 93 million households. The second category includes all households that make between approximately $75,000 and $350,000 — that’s the 80th to the 99th percentile of the income distribution, and includes about 22 million households. The final category is the top 1% of the income distribution — those households earning over about $350,000 per year.

To get an idea of whether there’s enough income at the very top of the income distribution to make a serious dent in the US’s long-run budget problems (note that I firmly believe that the US does not need to worry about its budget deficit in the short run — we have much more pressing problems to deal with first), I estimate what would happen if effective tax rates (ETRs) for each group reverted to the average of the period 1993-2000. I selected that timeframe as the point of comparison simply because that was the only brief period in recent history when the US had clearly beaten its chronic budget deficit problem.

If all tax rates went back to their 1993-2000 averages, approximately $350 billion in additional taxes would have been collected in 2007.* Of this total, roughly one-third would come from each of the three categories delineated above. So the 1.2 million households in the top 1% of the income distribution can certainly not close the budget deficit by themselves. But they could get the US about one-third of the way there.

Put another way, if the US is only willing to raise taxes on the very top of the income distribution, the US’s medium-term budget problems can not be solved through additional revenue alone. However, tax increases that are limited to just the very top of the income distribution, while not sufficient by themselves, would actually probably get us about one-third of the way toward fixing the US’s medium-term deficit problems. So while not a cure, it would make a significant dent in the problem.

Leave a Reply