A bit of a mixed bag of economic numbers and a somewhat surprising take on second quarter GDP highlight the economic news today.

First, consumer sentiment took a dive. It went from 70.8 in June to 64.6 this month. The expectation had been that it would drop to 70.5 which once again stands as a testament to the ability of the economics profession to forecast anything. It would seem that the people actually out living in the economy and feeling the pain have a slightly different view of things than do the computers.

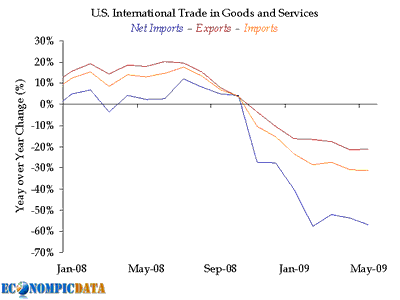

Second, though it might not be that surprising, the trade deficit declined. Exports were up by 1.6% and imports down 0.6% from last month. That resulted in a decline in the deficit of $2.8 billion as it decreased from $28.8 to $26 billion. Now while a decline in the trade deficit is always a welcome development some economists are reading a lot into this number. This is from the WSJ Real Time Economics blog:

Was the better-than-expected May trade report enough to finally push GDP into the black? Macroeconomic Advisers thinks so.

Prior to Friday’s data (which showed a surprising narrowing in the trade gap to $25.96 billion in May) Macroeconomic Advisers expected a 1.6% GDP decline in the second quarter, at an annual rate.

Now, the firm sees second-quarter GDP up 0.2%, a 1.8 percentage point upward revision. That would be the first positive GDP result since the second quarter of 2008.

RDQ Economics also noted the potential for a positive GDP number. “At a minimum, this suggests that the decline in real GDP should be less than current forecasts (we think that a drop of 0.5% rather than 1.5% in the second quarter is now a central forecast for GDP) and there is a significant possibility that real GDP could actually grow slightly in the second quarter, which would further add to our view that the recession ended last quarter,” economists said.

Other economists didn’t see as large an effect. Morgan Stanley revised its forecast to a 1.1% contraction from a previous forecast of a negative 1.5% print.

Goldman Sachs said the report means their forecast for a 3% GDP contraction is likely too negative. Nigel Gault of IHS Global Insight also didn’t offer an exact figure, but said the trade data indicate that any second-quarter GDP contraction will be under 2%.

I’m not sure I buy into their arguments but it’s always nice to see some positive opinion. As this chart from EconomPicData shows the declines might be leveling off but there isn’t any obvious growth.

More second derivative type of stuff.

Graph: Econompicdata

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply