“The U.S. Government doesn’t have a revenue problem, it has a spending problem.”

That is a talking point you hear a lot lately. Let’s take a look at what the facts actually have to say about the matter.

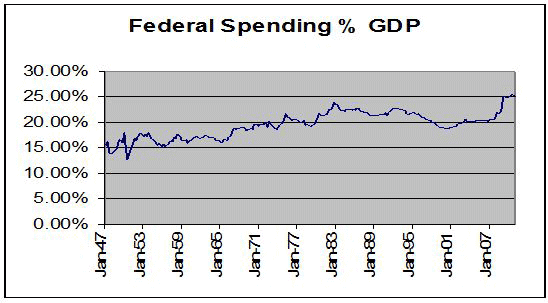

Here is what those who point to spending as the source of the problem are talking about. Federal spending is at a post-WWII high as a share of GDP. Since Federal spending is a nominal amount, I have used nominal GDP in this analysis. Note that federal spending as a share of GDP over the last 30 years was lowest when Bill Clinton was in office, with federal spending as a share of the economy falling from 23.68% of GDP down to 18.81% in the fourth quarter of 2000.

However, it is important to keep in mind that any ratio is determined by both the numerator (Spending) and the denominator (GDP). The Great Recession was very unusual in that we saw an actual decline in nominal GDP. Normally when the economy goes into a slump, we still have a bit of inflation, and thus while real GDP falls, nominal GDP continues to rise. Indeed the cause of many recessions is a determination by the Fed that inflation has gotten out of hand, so they tighten up on monetary policy to deliberately slow the economy and bring inflation down.

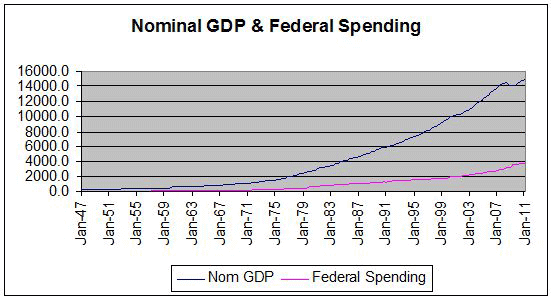

Here is the path of both GDP and Federal Spending since 1947. Before the Great Recession, you don’t see a lot of times when the blue line actually turns south. While nominal GDP has returned to a new high, in the first quarter it was running at an annual rate of $15.018 Trillion, up 3.69% from its pre-recession high (3Q08, $14.484 Trillion), and up 7.81% from the low (2Q09, $14.034 Trillion), that still meant that nominal GDP was down by 3.11% at its low point.

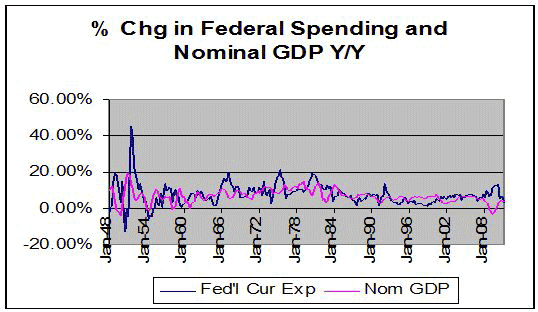

Federal Spending in nominal terms has not been increasing at any sort of unprecedented rate, but it did not fall along with nominal GDP. The next graph shows the year over year growth rate for both spending and GDP. There was a bit of a bulge in spending between the second quarter of 2009, and the first quarter of 2010, when spending growth hit the low double digits on a year over year basis. Yet, the peak was 13.06% in the fourth quarter of 2009, which is hardly unprecedented. Since the late 1940’s spending growth has averaged 7.71%. Nominal GDP growth has averaged 6.76%. However, spending growth has been above the Great Recession peak in 34 quarters since 1948, or 14.5% of the time.

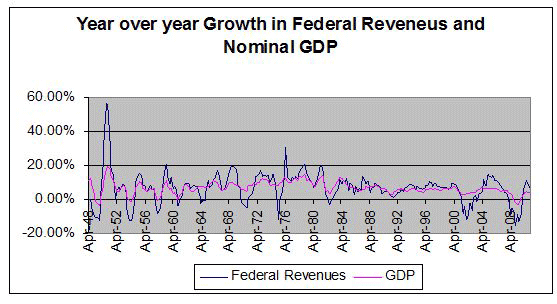

The concern should be about the level of the deficit, and the growth of the federal debt that it causes (just to make clear the difference, the debt is the accumulation of the deficits over time) but deficit is the difference between federal revenues and federal spending, and both play a role. Federal revenues tend to be sensitive to the overall health of the economy. When times are good, they tend to rise faster than nominal GDP, and when times are bad, they tend to fall, even in nominal terms. This is sometimes due to policy changes, say tax cuts to help spur the economy when it is soft, but it it will also happen without any policy changes. The biggest source of federal revenues is the income tax, and when people have less income, they pay less taxes. The other big source is the payroll tax, and when people are unemployed, that tax is not being paid either.

The next chart looks at the year over year change in federal revenues and the change in nominal GDP. Lower revenues than 12 months earlier is a much more common occurrence than either falling nominal GDP or falling federal spending, happening 40 times, or 16.7% of the time. Nominal GDP has fallen only 12 times, or in 5.0% of the quarters. With the exception of the Great Recession, it has not happened sine the 1950’s. Every instance where nominal GDP fell, tax revenues also fell. Spending has only been below year ago levels in 10 quarters, or 4.2% of the time, and the last instance was in 1955.

While Federal receipts have recovered somewhat from the depths of the recession, the downturn in revenues was unusually deep and long. It lasted for 8 straight quarters, and at its worst point (1Q 2009) they were down 15.78%. The only real rivals for the title of the biggest declines in revenues were during the early George W. Bush era, when revenues declined for six straight quarters and were down 11.51% at their worst point (1Q 2002), and the downturn of the late 1940’s which lead to five quarters of declining year over year revenues and being down 12.56% at the worst point (4Q 1949).

The declines in the early part of this century were more due to policy changes (the Bush Tax Cuts) than they were due to severe economic weakness. It is worth noting here that when the TARP funds went out to the banks late in 2008 and early 2009, it was counted as spending, and when the funds were repaid, they were counted as revenues. Thus the spending increases of late 2009 and early 2010 are a bit overstated, as are the revenue increases over the last year or so.

As a result, revenues have recovered a bit as a share of GDP, but mostly because of the repayment of TARP funds, not due to surging recurring revenues. Revenues as a share of GDP fell from 19.17% in the first quarter of 2007 and hit a low of 15.42% in the third quarter of 2009, a decline of 19.6%. They have since recovered to 16.44%. That puts them 6.6% above the low as a share of GDP, but still 14.2% below the Great Recession high. In absolute terms, revenues hit a peak of $2.6661 Trillion in the fourth quarter of 2007. The low was in the third quarter of 2009 at $2.1763 trillion, a decline of 18.4%. By the first quarter of this year they had recovered to $2.4696 Trillion, 15.5% off the low, but still 7.4% below the pre recession high. The long term average is for revenues to be 18.02% of GDP and spending averages 19.56% of GDP.

Over the medium to long term, we need to get the deficit under control, but it seems pretty clear to me that we have to address the problem from both sides: lower spending as a share of the economy, and higher revenues as a share of the economy. Addressing the problem too quickly by either dramatically raising taxes or slashing spending in the short term would probably be counter productive.

As we have seen, tax revenues tend to fall when GDP growth is weak, and by a greater amount than GDP, thus forcing down revenues as a share of GDP and thus making the problem worse, not better. Note that from the percent change in revenues and GDP graph above, even a lower, but still positive rate of change in nominal GDP tends to be associated with an absolute decline in revenues. We are already feeling the effects of austerity on the economy.

We can also look abroad to see the effects. Many countries in Europe have gone down the austerity path of late (Greece, Ireland, Latvia, Spain, Portugal, and the U.K. for example) and none of those economies is exactly what you would call robust. Historically, here in the U.S. Hoover responded to the downturn by cutting spending and raising taxes (mostly cutting spending, but a tariff is a tax on imported goods, and the Smoot Hawley tariff exacerbated the Great Depression). The result was a disaster, not only for this country but for the whole world.

While this article has focused on federal spending and revenues, it really is total government spending and revenues that count, and State and Local Governments have also been plagued by falling revenues. Since for the most part they are not allowed to run operating deficits, they have had to respond by cutting spending (and to a lesser extent raising taxes) and this has resulted in massive layoffs of people at the state and local levels – 305,000 over the last year alone.

While Federal spending has risen over the last few years, it has hardly done so at unprecedented rates. What has been unprecedented is the decline in nominal GDP and the fall off in revenues. Yes, we have a problem, but it is not just a spending problem.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply