Following a substantial 90 percent increase since the financial crisis, platinum prices have been sluggish. During the first six months of 2011, the metal gained only a few basis points. Platinum has significantly lagged silver (up 15.72 percent) and gold (up 7.72 percent), but has outpaced palladium, its closest relative.

Following a substantial 90 percent increase since the financial crisis, platinum prices have been sluggish. During the first six months of 2011, the metal gained only a few basis points. Platinum has significantly lagged silver (up 15.72 percent) and gold (up 7.72 percent), but has outpaced palladium, its closest relative.

In recent days, the market has discounted the metal because of weaker car sales in the U.S. According to the Wall Street Journal, Japan’s earthquake shut down car production, and higher vehicle prices and continued bad news about the U.S. economy prevented consumers from purchasing cars.

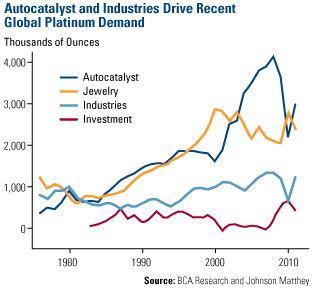

While this is a short-term setback, the case for higher platinum prices over the long-term starts with demand, which jumped 16 percent around the globe in 2010. Roughly 40 percent of this demand came from the automobile industry. Platinum is a key component in an automobile’s autocatalyst, which controls the amount of car exhaust fumes that are released into the air, including carbon monoxide, oxides of nitrogen that contribute to acid rain, hydrocarbons and carcinogens. Platinum’s important job is to convert more than 90 percent of these noxious fumes to less harmful carbon dioxide, nitrogen and water vapor.

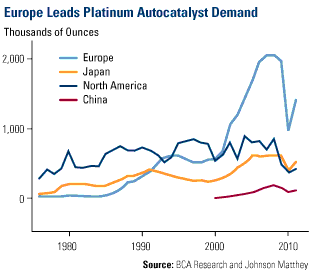

According to BCA Research, the more stringent the emission standards are in a country, the more platinum is required. In the global automotive sector, Europe had the largest increase in platinum demand, driven by light-duty diesel vehicle production.

With standards on auto emissions increasingly becoming stricter in many countries, including China, we believe the use of autocatalysts will increase, and continue to drive platinum demand.

With standards on auto emissions increasingly becoming stricter in many countries, including China, we believe the use of autocatalysts will increase, and continue to drive platinum demand.

As the first chart above shows, industrial demand for platinum rose 48 percent in 2010, facilitated by the global recovery. Platinum’s unique attributes have been applied in a wide variety of industries. Platinum is used in hard disks of computers to store large amounts of information and the metal’s high melting point is critical in the production of a variety of glasses. Medical researchers have even applied platinum’s special properties to help treat cancer.

While demand remains strong, platinum supply has declined over the past five years. The world primarily relies on South Africa to supply its platinum needs. The country’s production accounted for roughly 76 percent of the world’s platinum in 2010, but supply has been decreasing since 2006. Johnson Matthey, a metals group company, cites strikes and stoppages as short-term issues impeding the expansion of platinum mines, while longer-term issues include the strong South African rand, inflation and availability of electricity. South Africa has the potential to increase output by as much as 5 percent in 2011, but Johnson Matthey doubts the country can shake off the production issues it’s experienced in recent years.

Based on these supply challenges, BCA Research says things are unlikely to turn around unless platinum price levels stay above $2,000 an ounce for an extended period of time. Currently, they’re around $1,750 an ounce but BCA forecasts prices will hit $2,000 by the end of the year. Likewise, BCA expects platinum stocks, which have underperformed due to the strong rand, to move in tandem with the price of platinum.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply