Macro Man has returned to the coal-face of global finance this morning after two days of following the mayhem from afar. It’s really getting to the point where he will need to start a premium subscription service that will notify customers in advance of when he will be away from the market. Going long vol during his absences from the market has been close to an infinite Sharpe ratio strategy over the past few years, so those institutions that are left standing after this year should be more than happy to pony up.

In any event, Macro Man is engaged with the market but off the desk for the entirety of this week. This is because a) it is half-term school holidays and is a chance to spend some time with the kids, and b) the British rail authorities have finally decided to upgrade their infrastructure from 19th to early 20th century standards. As such, the engineering works will render it close to impossible for Macro Man to get to and from the office in anything approaching an acceptable time frame this week, so he’s had to opt for telecommuting from his home office.

In any event, markets appear to be wondering if today will be the newest entry in the pantheon on “black” market days. Market liquidity is execrable, to say the least, and fear is running high- though SPX futures and European markets are “only” down about 5% or so. That, however, may be down to the latest horrible squeeze in Volkswagen, where Porsche is turning the screws a number of hedge fund shorts in VW stock (many of whom, ironically, probably drive Porsches….for now.)

Still, an out-of-the blue G7 statement on currencies has caught the eye, suggesting that the authorities are getting worried. The RBA was reported buying AUD/USD both Friday and today, and you know the Japanese aren’t afraid of a little FX intervention every now and again.

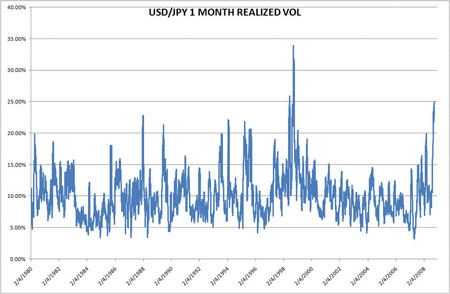

USD/JPY realized vol has risen dramatically, exceeding that observed during the descent to all-time lows in the spring of 1995. However, it’s still got a ways to go to breach the highs seen in the wake of the Russia/LTCM crisis in 1998. It would be a truly remarkable feat to do so, given that the likes of Soros and Tiger aren’t sitting on tens of billions of long USD/JPY positions like they were a decade ago.

So why bother? Just because authorities are concerned about something doesn’t mean that they can do a whole lot about it- just ask Ben and Hank! Still, Macro Man supposes they have to at least make a gesture- the downdraft has been impressive- see if you can find this month on the chart below.

Elsewhere, oil seems to have confirmed the thesis that its parabolic rise was a bubble, given that its descent has been equally parabolic. While peak oil may or may not be a reality, oil’s trajectory this year is an object lesson that the fundamentals don’t justify any price.

So Macro Man has found himself in a spot where he has emerged from last week’s conference more bearish than ever but with relatively little risk on. Sure he’s got a few bets on that (knock on wood) are working OK, but he has slashed his nominal position size to the bone. This opens up a philosophical question of how to trade these markets. Massive volatility brings massive opportunity…but also carries substantial risk.

So do you maintain a relatively normal position size, live with the volatility, and try and hit a home run? Clearly the magnitude of the moves we have observed offer the opportunity to potentially make one’s year in a single month. Yet given what we’ve already seen and where implied vols are, adding fresh risk at current levels doesn’t appear to offer tremendous risk/reward. And so any position that could make your year, even a long option position, could cost you a lot of dough if it doesn’t work.

Or should one slash nominal risk to reflect the inexorable rise in realized vol and play with tiny positions, trying to maintain a relatively steady portfolio volatility and locking in a “very good” month while falling short of “epic”?

Macro Man has generally opted for the latter and is, broadly speaking, satisfied with the results. He has kept some skin in the game, allowing him to participate, but has mitigated portfolio risk to the extent that he hasn’t had too much trouble sleeping-and in this market, a well-rested, alert mind is imperative. Yet after chatting last week with a couple of very successful managers, he’s wondering if he’s erred too far on the side of caution and not made enough hay while the sun shines (at least in terms of calling the market correctly.)

There isn’t necessarily a right answer to this question- ultimately, we all need to do what works for us. At the end of the day, the name of the game is to remain in the black….regardless of what colour the day may be.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply