It’s been noted by many that the USA is eerily following the path of Japan. The similarities are there. A mature economy, aging population, huge debt to GDP, massive unfunded liabilities and a stagnant economy. Both countries have chosen to address their structural problems with more and more debt and cheap money monetary policies.

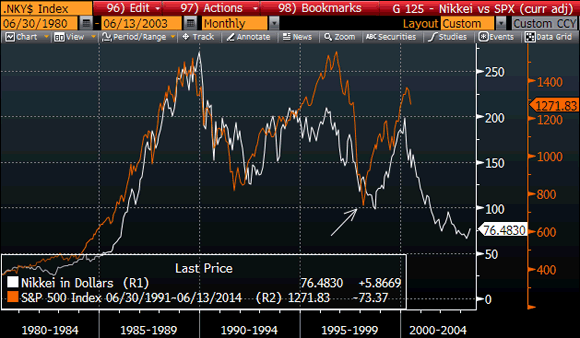

A friend sent me the following chart that looks at the Japanese stock market and the S&P. Two important adjustments have been made to the data. (1) There is an eleven-year lag on the Japanese Nikki. (2) The data is currency adjusted. I think this is a pretty scary stuff:

These lines do not match up perfectly over the measured period. But what is striking is the correlation of the “Turning Points” in the markets. Look at how it lines up in the most recent period. The S&P appears to be rolling over the past six weeks. Exactly as the Nikki did eleven years ago. But look at the results. In the eleven years that followed, Japanese stocks fell from the index level of 200 to the current value of 76. That is a 60+% drop!

There are differences between the US and Japan. So this chart may not be our future. But if it is even remotely close then the US will not make it another eleven years. Something will blowup in a spectacular way.

I found this chart fascinating, so I looked a bit deeper to see what Japan has done and why. Guess who played a big hand in determining the monetary policy of Japan? I’m sure you guessed this one right. It was none other than Ben Bernanke. He gave a major speech way back in 2003 on what Japan should do. If you’re a Fed watcher read the whole thing. My take on it was that Ben was lecturing to the Japanese Central Bank. If you found the above chart a sign of what is in our future Ben’s words eight years ago will give you the Willies.

The Intro:

My remarks today will be focused on opportunities for monetary policy innovation in Japan, including specifically the possibility of more-active monetary-fiscal cooperation to end deflation.

BK: If you took out “Japan” and inserted “America” this would be the same speech that Bernanke would use today. He has taken the same attitude in all of his speeches since 2008.

The “Ben” plan

I will discuss the option of asking the Bank of Japan to announce a quantitative objective for prices, as well as how such an objective might best be structured.

I would like to consider an important institutional issue, which is the relationship between the condition of the Bank of Japan’s balance sheet and its ability to undertake more aggressive monetary policies.

BK: Bernanke has pushed for a Fed policy that targets inflation. He has brought us QE that has added to the Fed balance sheet. Ben’s plan for Japan is what we have in the USA today.

Ben’s philosophy

In principle, balance-sheet considerations should not seriously constrain central bank policies.

BK: They shouldn’t be “seriously” considered?? OMG!

The Bank of Japan should consider increasing still further its purchases of government debt, preferably in explicit conjunction with a program of tax cuts or other fiscal stimulus.

BK: That is exactly what happened in 2009. We got ZIRP, QE1 and HERA (tax cuts and stimulus).These things have had no lasting impact.

From the point of view of conventional private-sector accounting–which, as I will discuss, is not necessarily the correct standard in this case.

BK: Ben thinks Central Banks are above the “rules”. We certainly have that status today.

On the issue of Monetiziation

A tax cut for households and businesses that is explicitly coupled with incremental BOJ purchases of government debt–so that the tax cut is in effect financed by money creation.

BK: Note the “financed by money creation” part of this. Ben swears he is not creating money today. But that is exactly what he proposed for Japan AND that is exactly what he is doing in the US today.

On the “Goodness” of more debt

Ben asks:

Isn’t it irresponsible to recommend a tax cut, given the poor state of Japanese public finances?

And answers:

To the contrary, from a fiscal perspective, the policy would almost certainly be stabilizing.

BK: NO! The consequence is destabilizing. The real consequence is that people (markets) lose confidence when money is cheap and governments are running printing presses.

Ben admits to a downside

Of course, one can never get something for nothing; from a public finance perspective, increased monetization of government debt simply amounts to replacing other forms of taxes with an inflation tax.

BK: This drives me nuts. Bernanke has been pounding the table that his monetary policy does not cause inflation in the US and the rest of the world. But Eight years ago he saw the connection perfectly. Today he is in denial. Either Ben’s lying to us, or he has his head in the sand.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply